Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

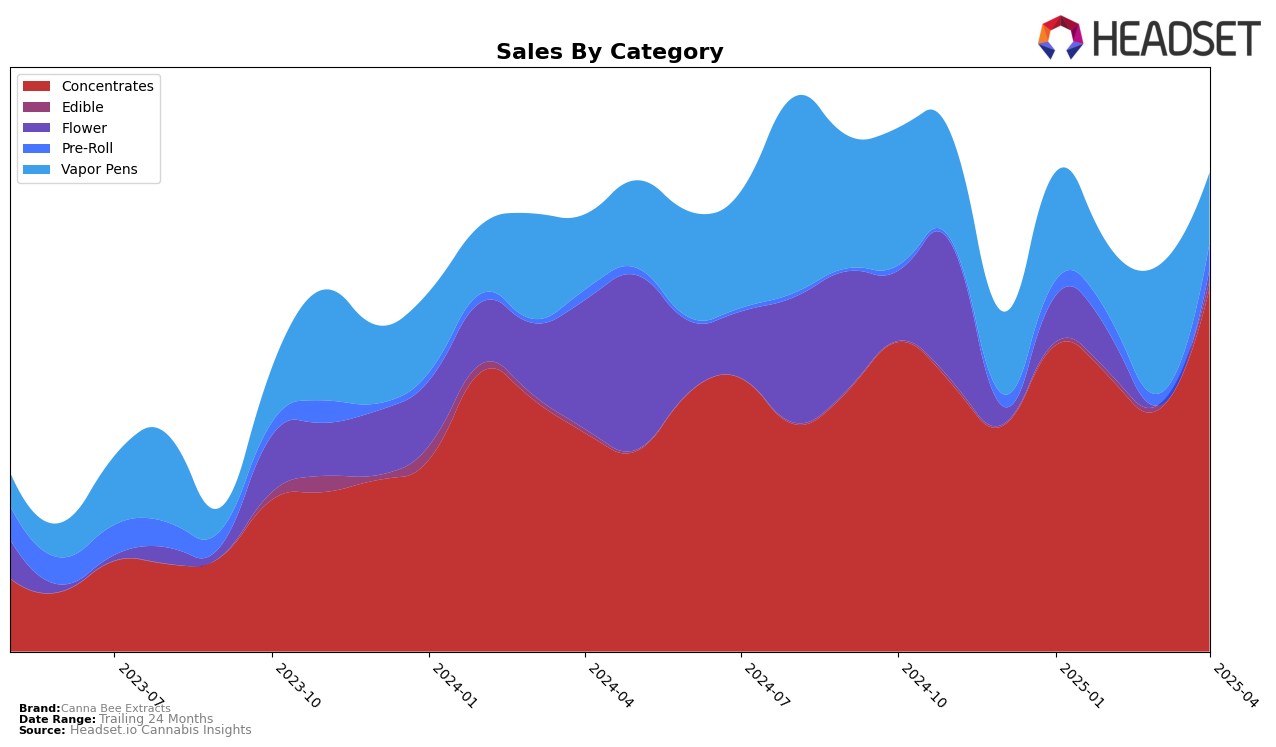

Canna Bee Extracts has shown varying performance across categories and states, with notable activity in the Michigan market. In the Concentrates category, the brand has exhibited resilience, bouncing back to the 22nd rank in April 2025 after a dip to 29th in March. This recovery aligns with a significant increase in sales, suggesting a successful strategy or product launch that resonated well with consumers. However, the Vapor Pens category tells a different story, as the brand struggled to maintain a consistent position within the top 100, peaking at 77th in March before falling to 92nd in April. This inconsistency might indicate challenges in brand positioning or market competition in this particular segment.

Despite the fluctuations in rankings, Canna Bee Extracts has maintained a presence in the competitive Michigan market, particularly in the Concentrates category. The absence of a top 30 ranking in the Vapor Pens category highlights a potential area for growth and improvement, as the brand was unable to secure a stable position within the leading brands. This disparity between categories suggests that while Canna Bee Extracts has a strong foothold in Concentrates, there may be untapped potential in Vapor Pens that could be explored further. It will be interesting to see if the brand can leverage its strengths to enhance its performance across all categories in the coming months.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Canna Bee Extracts has experienced fluctuating rankings over the first four months of 2025, indicating a dynamic market position. Starting at 22nd place in January, Canna Bee Extracts dropped to 25th in February and further to 29th in March, before rebounding to 22nd in April. This volatility contrasts with brands like Fresh Coast, which maintained a stronger presence, peaking at 11th in February, and Old School Hash Co., which remained consistently within the top 20. Meanwhile, Redemption and Bamn also demonstrated competitive volatility, with Bamn making a notable leap from 81st in January to 15th in February. Canna Bee Extracts' sales trajectory, with a notable increase in April, suggests potential for recovery and growth, but the brand faces stiff competition from these more consistently ranked competitors, highlighting the need for strategic marketing and product differentiation to improve its market standing.

Notable Products

In April 2025, Canna Bee Extracts x Frosted Farms - Jokers Wild Live Resin Moon Rocks (1g) maintained its top position in the Concentrates category, achieving a sales figure of 1591 units, marking a significant increase from previous months. Aunt Gemima's Live Resin Terp Badder (1g) climbed to second place in Concentrates, improving its rank from fifth in March. Cannabee x MI Loud - Guava Juice Cured Resin (1g) made a notable entry, securing the second position in its debut month. Cannabee x Kinship - Lemon Oasis Live Resin Terp Badder (1g) also debuted in April, ranking third in Concentrates. In the Vapor Pens category, Cannabee Extracts x Frosted Farms - Frosted Strawberry Cake Live Resin Disposable (1g) slightly dropped to fourth place, despite a slight increase in sales compared to March.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.