Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

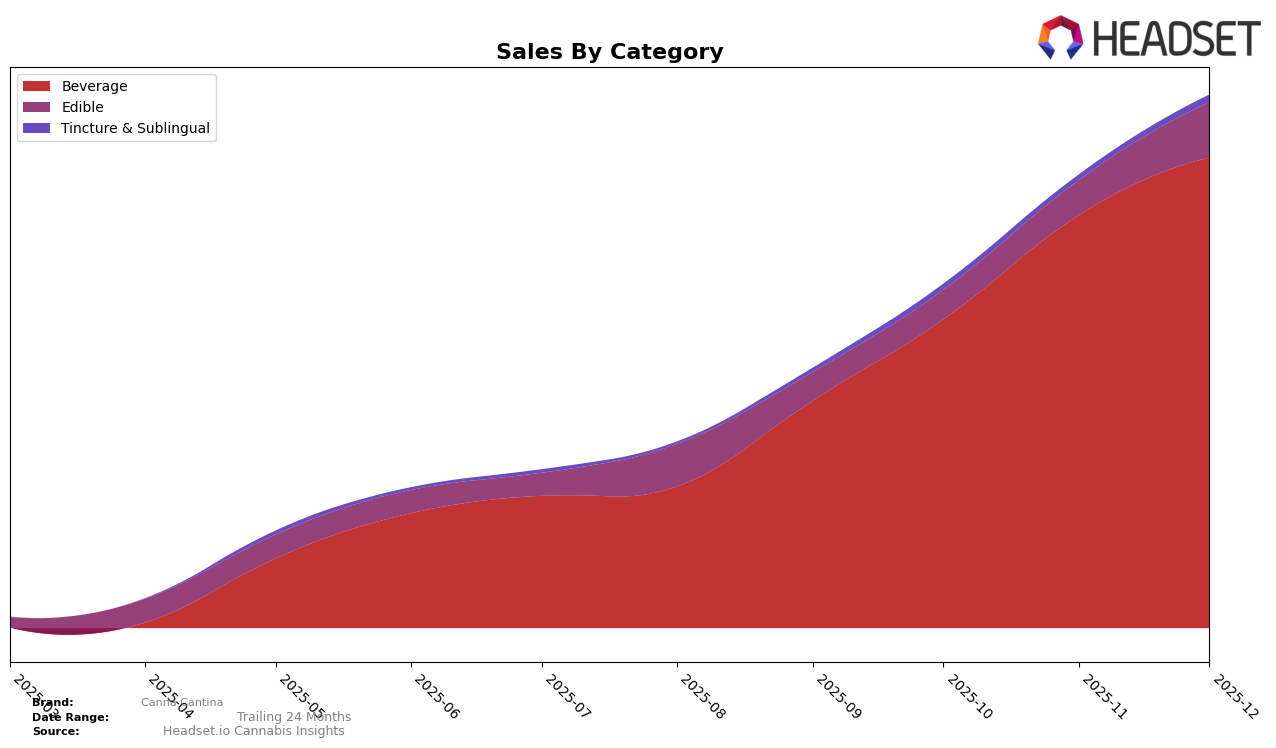

Canna Cantina has shown significant progress in the Beverage category across different states, with notable performance in Missouri. In Missouri, the brand's ranking climbed from seventh in September 2025 to an impressive second place by November and December 2025, indicating a strong upward trajectory in consumer preference. This rise is reflected in their sales, which nearly tripled from September to December. Meanwhile, in Washington, Canna Cantina maintained a consistent presence in the Beverage category, holding steady at 14th place until a slight improvement to 13th in December. This consistency in Washington suggests a stable market foothold, though there's room for growth compared to their performance in Missouri.

In Washington's Edible category, Canna Cantina's presence is less pronounced, as they were not ranked in the top 30 until appearing at 44th place in November and improving slightly to 40th in December 2025. This late entry into the rankings highlights a potential area for growth, as they are beginning to gain some traction. While their sales figures in this category are modest compared to their beverage sales, the upward movement in rankings suggests that Canna Cantina is starting to capture more of the market's attention in Washington's Edible category. This could be an area to watch for future development and expansion.

Competitive Landscape

In the competitive landscape of the beverage category in Missouri, Canna Cantina has demonstrated a remarkable upward trajectory in brand ranking and sales over the last few months of 2025. Starting from a rank of 7th in September, Canna Cantina surged to 4th in October, and impressively climbed to 2nd place by November, maintaining this position through December. This ascent highlights a significant growth in consumer preference and market presence, as evidenced by the increasing sales figures. In contrast, Keef Cola consistently held the top spot, indicating a strong market dominance, while Major and High Five (MO) experienced more fluctuations in their rankings. Major moved from 5th to 3rd in October but slipped back to 5th by December, and High Five (MO) saw a dip to 7th in November before recovering to 4th in December. Canna Cantina's rapid rise suggests a successful strategy in capturing market share and consumer interest, positioning it as a formidable competitor in the Missouri cannabis beverage market.

Notable Products

In December 2025, Canna Cantina's top-performing product was the Mango Shot (100mg THC, 2oz) in the Beverage category, maintaining its first-place ranking for the fourth consecutive month with sales of 3344 units. The Fruit Punch Shot (100mg THC, 2oz) held steady in second place, consistent with its ranking from November. The Mandarin Shot (100mg THC, 2oz) remained in third place, showing a slight sales increase from the previous month. The Dankchata Shot (100mg THC, 2oz) improved its rank from fifth in September and October to fourth in November and December. Meanwhile, the Lime Shot (100mg THC, 2oz) dropped from third place in September to fifth by December, indicating a decline in its sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.