Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

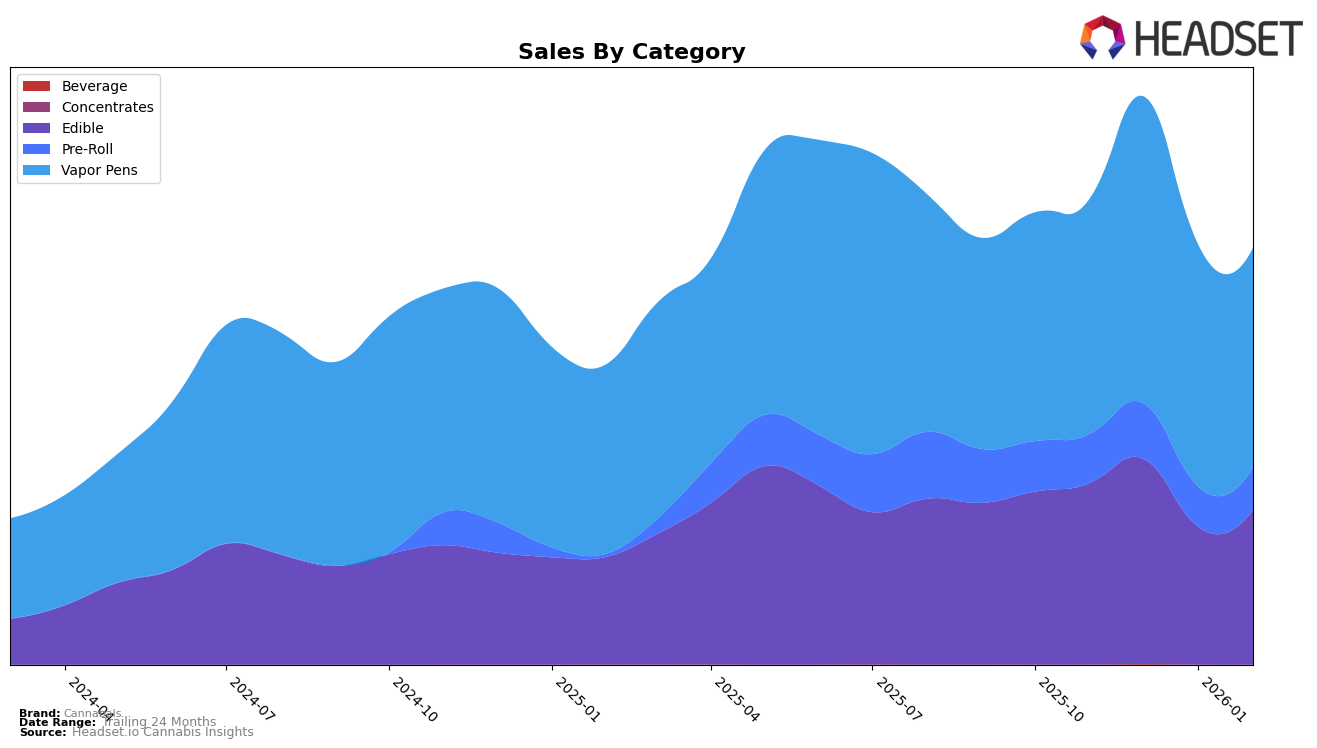

Cannabals has demonstrated varied performance across different product categories in New York. In the Edible category, the brand consistently maintained a top 10 position towards the end of 2025, but experienced a slight drop to 12th place in January 2026 before recovering to 10th in February. This fluctuation suggests some volatility, yet the brand remains a strong contender in this category. In contrast, Cannabals' performance in the Vapor Pens category shows a slight decline from a peak ranking of 10th in December to 14th by February. Despite this, the brand's position in the top 15 indicates a solid market presence. Notably, Cannabals did not make it into the top 30 for Pre-Rolls, which could be a point of concern or an area for potential growth.

Analyzing sales trends, Cannabals' Edible sales in New York saw a significant peak in December 2025, which could be attributed to seasonal demand or effective marketing strategies during the holiday season. However, the subsequent decline in January suggests a possible normalization post-holidays. Vapor Pens displayed a similar pattern with a December peak, though the drop in sales by February might require strategic adjustments to maintain consumer interest. The Pre-Roll category, while not making it into the top 30, still showed incremental sales growth over the months, indicating a potential area for Cannabals to explore further market penetration or product development to enhance their standing in this segment.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Cannabals has shown a dynamic performance over recent months. Despite a slight dip in rank from 10th in December 2025 to 14th by February 2026, Cannabals remains a strong contender with sales figures consistently surpassing those of Heavy Hitters and Select. Notably, Holiday has been a close competitor, maintaining a rank just above Cannabals in most months, although Cannabals did outpace Holiday in December 2025. Meanwhile, New York Honey (NY Honey) has been climbing the ranks steadily, moving from outside the top 20 in November 2025 to 15th by February 2026, indicating a potential emerging threat. These shifts highlight the competitive volatility in the New York vapor pen market, where Cannabals must strategize to maintain and improve its market position amidst fluctuating ranks and emerging competitors.

Notable Products

In February 2026, Cannabals' top-performing product was the Brick - Strawberry Lemonade Live Resin Gummies 10-Pack (100mg), maintaining its top rank from January with sales of 2,699 units. Dragonfruit Lemonade Live Resin Gummies 10-Pack (100mg) secured the second position, rising from an unranked position in January and achieving notable sales. Super Lemon Haze Distillate Disposable (1g) climbed to third place, improving from its fifth rank in January, indicating a growing preference for vapor pens. Milk Chocolate Waffle Cones 10-Pack (100mg) entered the rankings at fourth place, suggesting a new interest in this edible. Lastly, Strawberry Kush Distillate Disposable (1g) rounded out the top five, dropping one spot from its previous fourth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.