Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

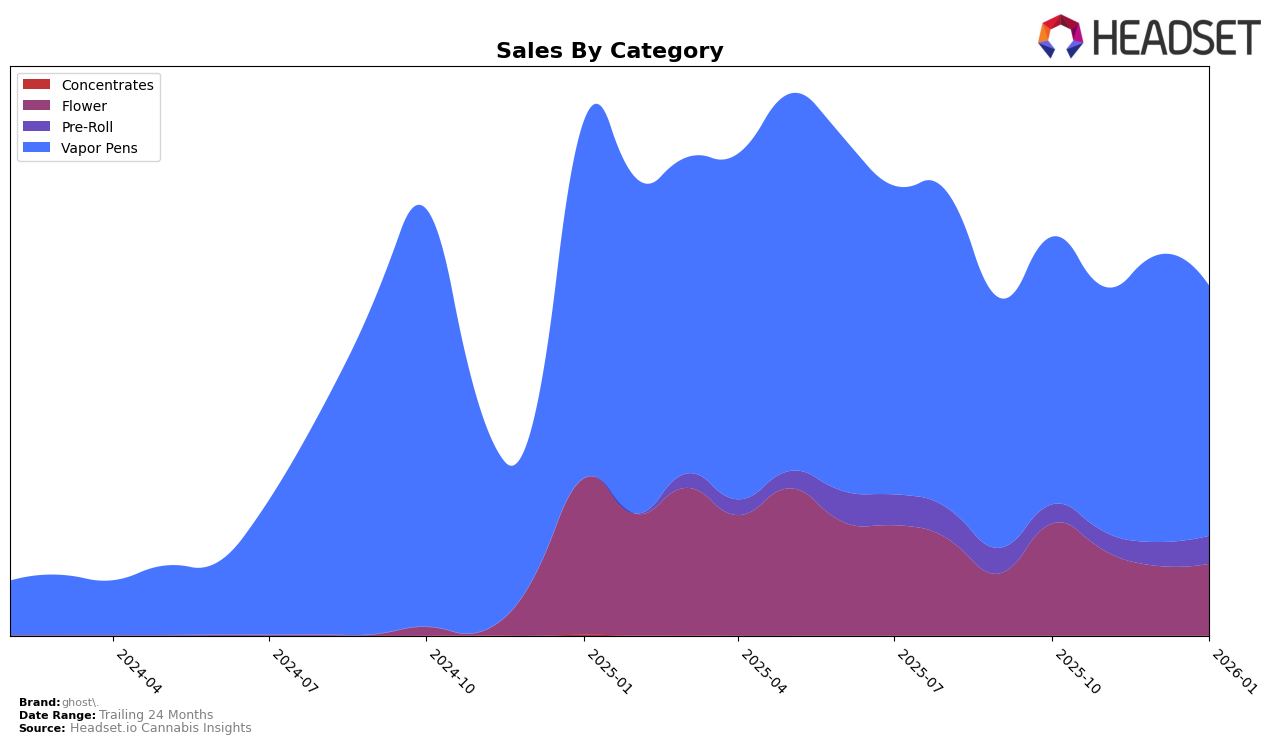

In the state of New York, ghost. has shown varied performance across different product categories. In the Flower category, the brand has not made it into the top 30 rankings from October 2025 through January 2026, with its rank peaking at 46 in October 2025. This suggests that ghost. is struggling to gain a foothold in this highly competitive market segment. Conversely, their performance in the Vapor Pens category is more promising, maintaining a strong presence with a rank of 19 in October and November 2025, slightly improving to 18 in December before dropping to 21 in January 2026. This indicates a relatively stable position in the Vapor Pens category, hinting at a consistent consumer base and possibly effective product offerings.

The Pre-Roll category presents an interesting trajectory for ghost. in New York. While the brand did not make it into the top 30 rankings, there is a noticeable upward trend in sales, especially from November 2025 to January 2026. The ranking improved from 98 in October 2025 to 80 in January 2026, suggesting a growing consumer interest and potential for future growth in this segment. This upward movement in rankings, despite not being in the top 30, could indicate strategic adjustments by the brand or changing consumer preferences that ghost. is successfully tapping into. Such insights could be crucial for stakeholders looking to understand the brand's market dynamics and potential areas for investment or improvement.

Competitive Landscape

In the competitive landscape of vapor pens in New York, ghost. has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. Notably, ghost. maintained a consistent rank of 19th in October and November 2025, improved to 18th in December 2025, but then slightly declined to 21st in January 2026. This suggests a competitive challenge, particularly from brands like Sapphire Farms, which, despite a downward trend, remained ahead of ghost. in January 2026. Meanwhile, Bloom showed a significant improvement, climbing to 19th position in January 2026, surpassing ghost. for the first time in this period. The consistent performance of Dime Industries also highlights the competitive pressure in this category. These shifts underscore the importance for ghost. to innovate and adapt its strategies to maintain and improve its market position amidst strong competition.

Notable Products

In January 2026, the top-performing product for ghost was the Black Mamba Distillate Disposable (2g) in the Vapor Pens category, climbing to the first rank with sales of 1272 units. The Ghost Train Haze Distillate Disposable (2g) slipped to the second position after holding the top spot in December 2025. Blueberry Dream Distillate Disposable (2g) maintained its position at third, showing consistent performance despite a drop in sales. New entrants, Apple Jacks Live Resin Cartridge (2g) and Cereal Milk Distillate Disposable (2g), debuted at fourth and fifth positions respectively, indicating a positive reception. These shifts highlight a dynamic market where Black Mamba gained significant traction over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.