Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

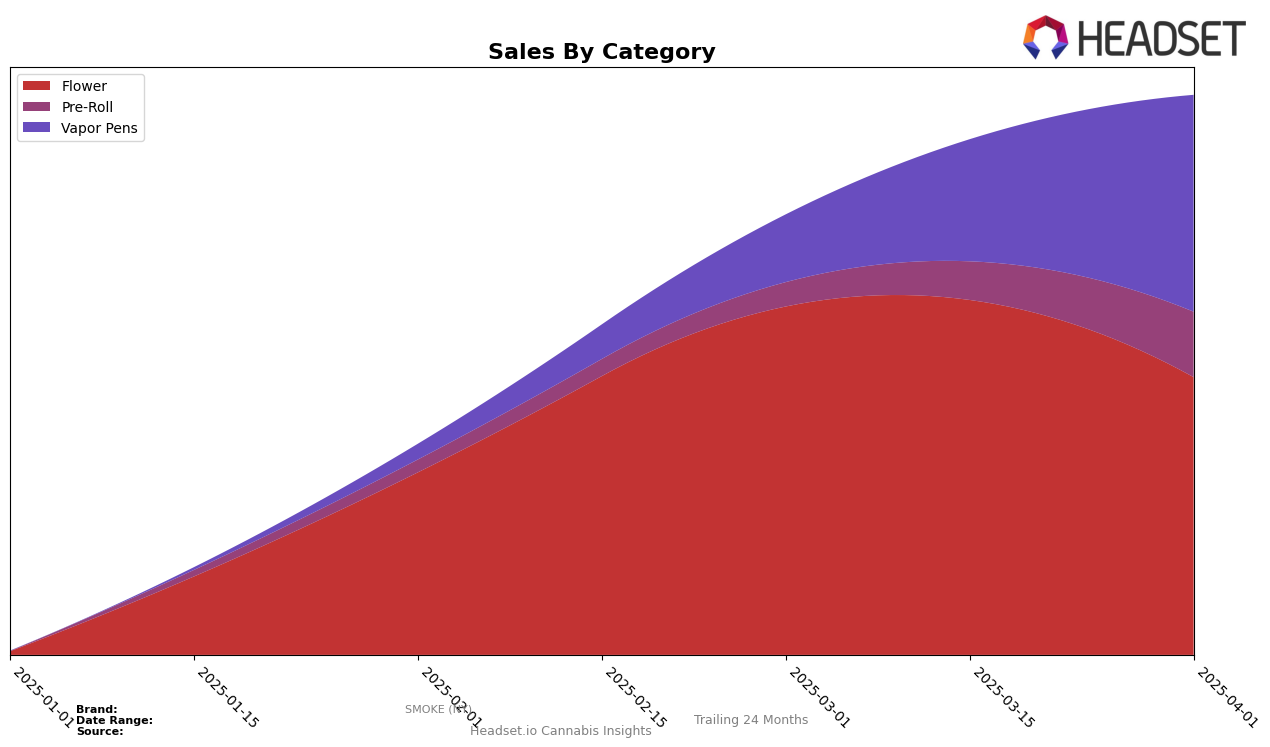

SMOKE (NY) has shown a noteworthy performance in the New York market, particularly within the Flower category. After not ranking in the top 30 brands in January 2025, SMOKE (NY) made a significant leap to 19th place in February and further improved to 10th in March. However, the brand experienced a slight decline, dropping to 13th place in April. This fluctuation suggests a dynamic competitive landscape in the Flower category, where SMOKE (NY) is striving to establish a more consistent foothold. The sales figures reflect this movement, with a peak in March before slightly tapering off in April, indicating the brand's potential to capture and maintain consumer interest.

In the Pre-Roll category, SMOKE (NY) started outside the top 30 in January but demonstrated a strong upward trajectory, reaching 24th place by April. This consistent improvement suggests a growing acceptance and demand for their products. Similarly, in the Vapor Pens category, SMOKE (NY) climbed from 54th in February to a commendable 12th place by April, showcasing a rapid increase in popularity. This rise in rankings highlights the brand's successful penetration in the New York market, particularly in the Vapor Pens category, which could be attributed to effective product offerings or strategic marketing initiatives. While the exact sales figures are not fully disclosed, the trend indicates a positive reception and expanding market presence for SMOKE (NY) across these product categories.

Competitive Landscape

In the competitive landscape of the New York flower category, SMOKE (NY) has demonstrated a dynamic shift in its market position from February to April 2025. Initially absent from the top 20 in January, SMOKE (NY) made a significant leap to rank 19th in February, reaching its peak at 10th in March before settling at 13th in April. This upward trajectory indicates a robust growth in sales, particularly notable when compared to competitors like The Botanist and Florist Farms, both of which experienced a more gradual climb within the rankings. Meanwhile, Leal and Nanticoke maintained relatively stable positions, consistently outperforming SMOKE (NY) in terms of sales volume. The rapid ascent of SMOKE (NY) suggests effective marketing strategies and product offerings that resonate with consumers, positioning it as a formidable player in the New York flower market.

Notable Products

In April 2025, the top-performing product for SMOKE (NY) was Tropic Thunder Infused Pre-Roll (1g) in the Pre-Roll category, which rose to the number one spot with sales of 2825 units. Island Jack Live Resin Liquid Diamond Disposable (1g) in the Vapor Pens category made a notable entry at rank two. Bomb Pop Infused Pre-Roll (1g) maintained a steady presence, ranking third, while NYC Diesel Infused Pre-Roll (1g) slipped to fourth. Gary Payton (3.5g) in the Flower category experienced a significant drop from the first position in March to fifth in April. These shifts highlight a dynamic change in consumer preferences, particularly the rise in popularity of infused pre-rolls over traditional flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.