Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

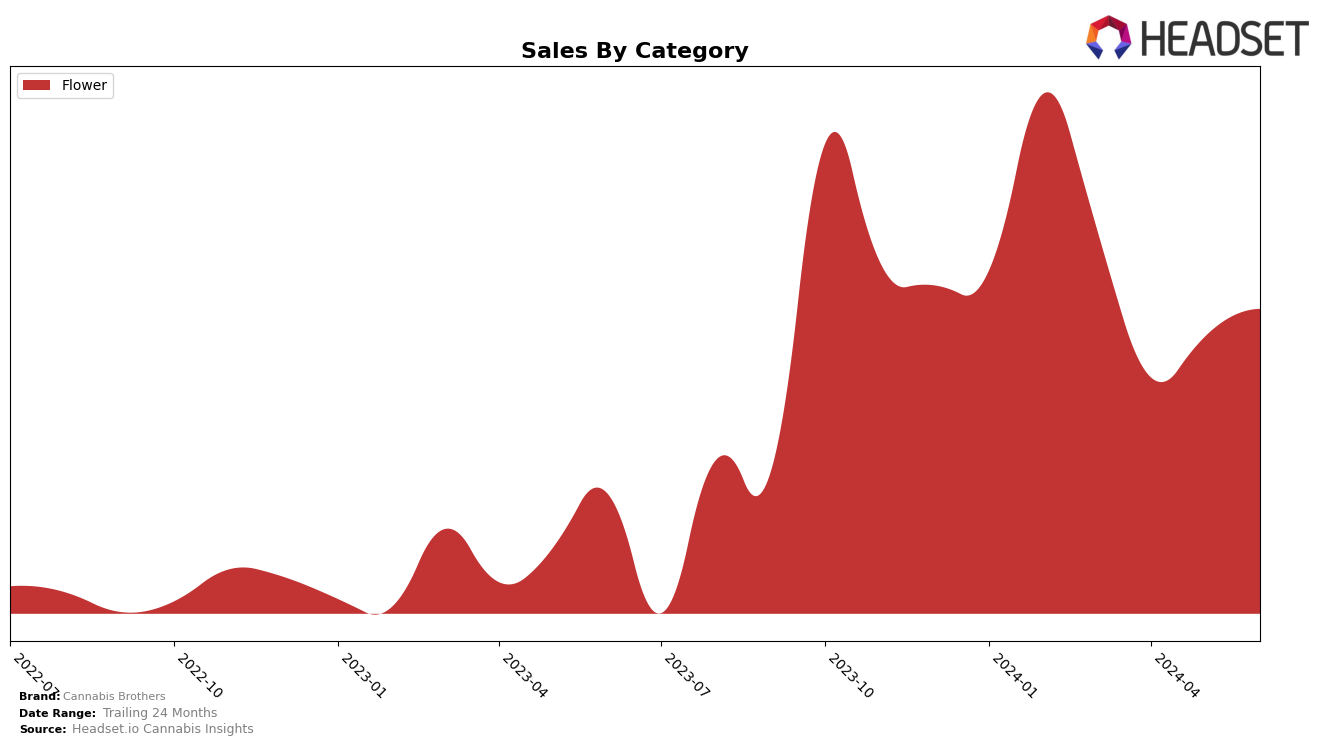

Cannabis Brothers has shown fluctuating performance in the Colorado market, specifically within the Flower category. Over the past few months, their ranking has seen some ups and downs, starting at 36th in March 2024 and dropping to 41st in April 2024. However, they managed to improve slightly to 40th in May 2024 and made a significant jump to break into the top 30 in June 2024. This movement indicates a potential upward trend, although the brand has yet to consistently maintain a top-tier position. The sales figures also reflect this volatility, with a notable decrease in April followed by a gradual recovery in subsequent months.

Despite these fluctuations, Cannabis Brothers' ability to reach the 30th position in June 2024 is a positive sign, suggesting that their strategies might be starting to pay off. However, the fact that they were not in the top 30 for the preceding months indicates challenges in achieving a stable market presence. This inconsistency highlights the competitive nature of the Flower category in Colorado. Observers should keep an eye on whether Cannabis Brothers can sustain their recent progress or if they will face further volatility in the coming months.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Cannabis Brothers has shown a notable fluctuation in its ranking over the past few months, moving from 36th in March 2024 to 30th in June 2024. This upward trend indicates a positive shift in market presence, although it still trails behind competitors such as Indico, which maintained a relatively stable position around the 28th rank, and Host, which improved from 31st to 29th during the same period. The sales performance of Cannabis Brothers also reflects this competitive dynamic, with a significant increase from April to June, suggesting effective marketing or product improvements. However, the brand still faces stiff competition from Super Farm and Sunshine Extracts, both of which have shown resilience in their rankings and sales. For Cannabis Brothers to continue its upward trajectory, it will need to sustain its current momentum and possibly innovate further to close the gap with higher-ranking brands.

Notable Products

In June 2024, the top-performing product for Cannabis Brothers was Red Velvet x Gary P (7g) in the Flower category, achieving the highest sales figure of 943 units. Polaris Purp (7g), also in the Flower category, secured the second spot with a notable increase from its first-place rank in May. Key Lime Pie (Bulk) ranked third, making its debut in the top five. Sour Spritzer #3 (7g) moved up from fifth place in April to fourth in June, showing consistent improvement. Trop Cherries (7g) maintained its position at fifth place, having also been a top contender in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.