Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

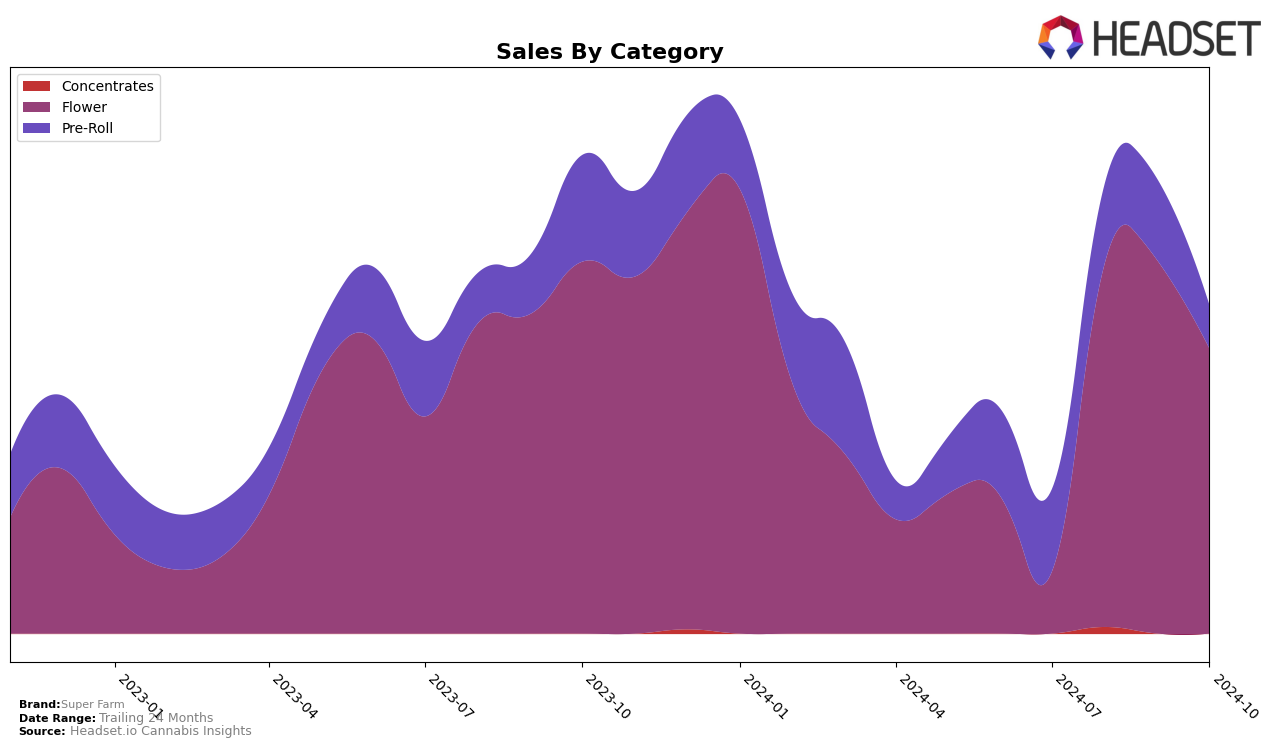

Super Farm has demonstrated notable performance shifts across different categories and states, particularly in the Colorado market. In the Flower category, Super Farm made a significant leap from being ranked 68th in July 2024 to 17th in August, maintaining this position in September and October. This upward movement indicates a strong market presence and growing consumer preference. However, in the Pre-Roll category, the brand's ranking fluctuated, starting at 28th in July and dropping to 38th by October. This decline suggests potential challenges in maintaining their market share in Pre-Rolls, despite a consistent sales performance earlier in the year.

The sales data reveals an intriguing trend in Colorado for Super Farm. The brand saw a remarkable increase in Flower sales from July to August, coinciding with its improved ranking. However, despite maintaining a strong position in the Flower category, sales slightly dipped in October compared to September. This indicates that while the brand has solidified its standing, there might be seasonal or market dynamics impacting sales volumes. In contrast, the Pre-Roll category saw a consistent sales pattern until a notable drop in October, reflecting the brand's challenges in retaining its ranking. The absence from the top 30 in some months for Pre-Rolls highlights areas for potential improvement or strategic shifts.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Super Farm has demonstrated a remarkable improvement in its market position over the past few months. Initially ranked at 68th in July 2024, Super Farm made a significant leap to 17th in August, maintaining a similar position in September before slightly dropping to 17th again in October. This upward trajectory highlights a strong performance compared to competitors like 710 Labs, which saw a decline from 11th to 18th place over the same period, and Bonsai Cultivation, which fluctuated but ended at 16th in October. Meanwhile, Hummingbird showed a positive trend, rising from 34th to 15th, surpassing Super Farm in the latest ranking. The sales performance of Super Farm, although peaking in September, saw a decline in October, indicating potential challenges in maintaining its competitive edge against brands like Host, which showed consistent improvement in rank and sales. These dynamics suggest a competitive environment where Super Farm must strategize to sustain its market presence and capitalize on its earlier gains.

Notable Products

In October 2024, Super Farm's top-performing product was Blueberry Slushie Pre-Roll (1g) in the Pre-Roll category, ranking first with sales of 2,418 units. This product improved from its second-place position in September. Pink Certz (Bulk) in the Flower category rose to second place, marking its first appearance in the rankings. Chiesel Pre-Roll (1g) dropped from first place in September to third in October. Helium (3.5g) and Island Mist (3.5g), both in the Flower category, maintained their fourth and fifth positions respectively, showing stable performance since their introduction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.