Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

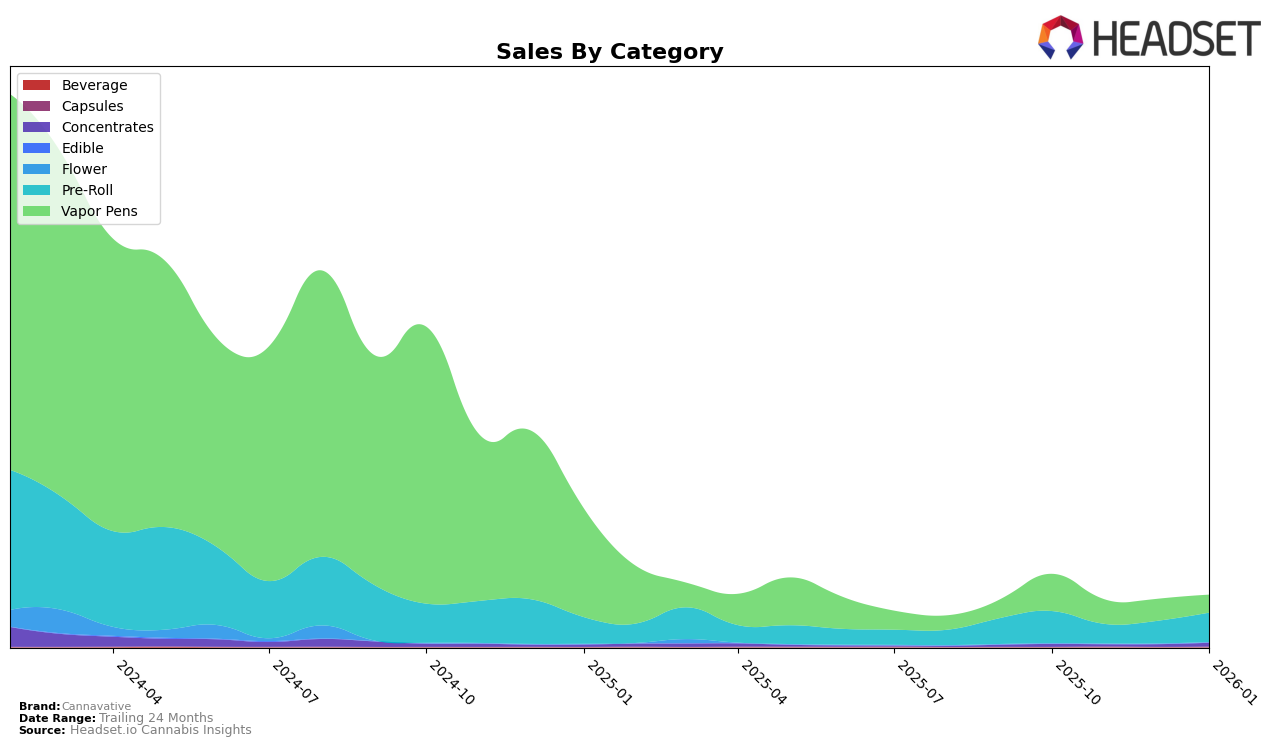

In the Nevada market, Cannavative's performance across various categories has shown both resilience and areas for improvement. In the Pre-Roll category, Cannavative has maintained a presence in the top 30, with rankings fluctuating from 23rd in October 2025 to 26th by January 2026. This slight improvement in rank, despite a dip in November, indicates a positive trend towards regaining a stronger foothold. However, the Vapor Pens category tells a different story, where Cannavative's rank has slipped from 27th in October to 38th by January, falling out of the top 30 in November and December. This decline suggests challenges in maintaining market share in Vapor Pens, which could be attributed to increased competition or changing consumer preferences.

The sales figures offer additional insights into Cannavative's market dynamics in Nevada. For Pre-Rolls, there was a notable dip in November sales, but a recovery was observed by January, which aligns with the slight improvement in rank. This recovery could suggest effective strategic adjustments or seasonal factors influencing consumer behavior. Conversely, the Vapor Pens category experienced a consistent decline in sales from October to January, which correlates with the drop in rankings. This trend may highlight the need for Cannavative to reassess its approach in the Vapor Pens market to regain its competitive edge. Understanding these movements can provide valuable insights for stakeholders looking to optimize their strategies in the evolving cannabis landscape.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Nevada, Cannavative has seen fluctuating rankings over the past few months, indicating a dynamic market environment. As of January 2026, Cannavative improved its rank to 26th, up from 31st in November 2025, suggesting a positive trend in market positioning. However, brands like Polaris MMJ and Neon Moon present significant competition, with Polaris MMJ maintaining a higher rank than Cannavative in most months and Neon Moon consistently outperforming with a rank as high as 15th in both October and December 2025. Meanwhile, Superior (NV) and Spiked Flamingo have shown varied performance, with Superior (NV) closing in on Cannavative's rank by January 2026. These dynamics highlight the importance for Cannavative to strategize effectively to enhance its market share and improve its competitive standing in the Nevada Pre-Roll sector.

Notable Products

In January 2026, Cannavative's top-performing product was Motivator - Diesel Spice Infused Pre-Roll (1g), leading the sales with a notable figure of 425 units sold. Following closely, Motivator - Ghost Haze Infused Pre-Roll (1g) secured the second spot, while Lemon Fresh Infused Pre-Roll (1g) ranked third. Motivator - Cheddar Cheeze Infused Pre-Roll (1g) experienced a slight drop from second place in December 2025 to fourth in January 2026. Mini Motivator - NYC Diesel Infused Pre-Roll (0.5g) rounded out the top five, maintaining its fifth position. The rankings highlight a strong preference for infused pre-rolls, with slight shifts in consumer choices from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.