Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

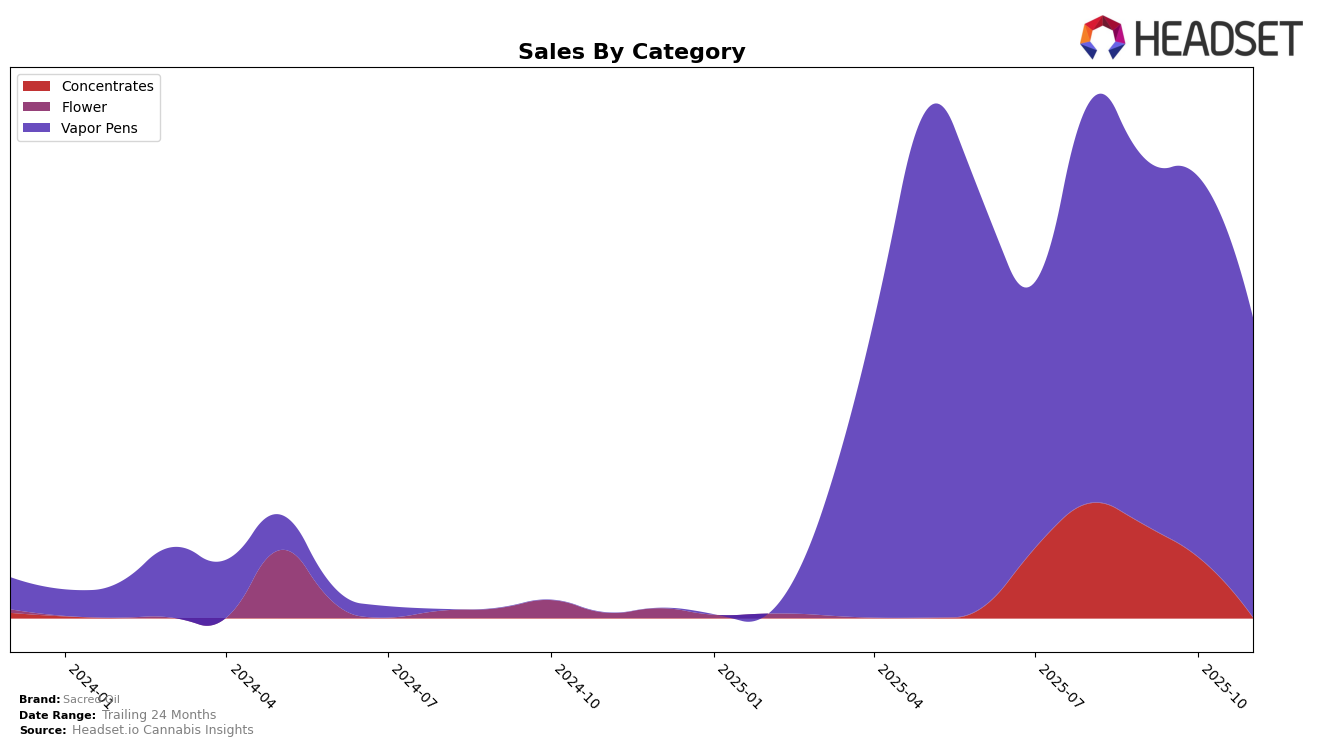

In the state of Nevada, Sacred Oil's performance in the Concentrates category has seen a downward trend in recent months. Starting from a rank of 23 in August 2025, the brand experienced a gradual decline to 27 by October, and by November, it fell out of the top 30 entirely. This movement indicates a significant drop in market presence, which is further evidenced by the decrease in sales from $27,662 in August to $14,623 in October. The absence of a rank in November suggests the brand needs to address its strategy in this category to regain its standing.

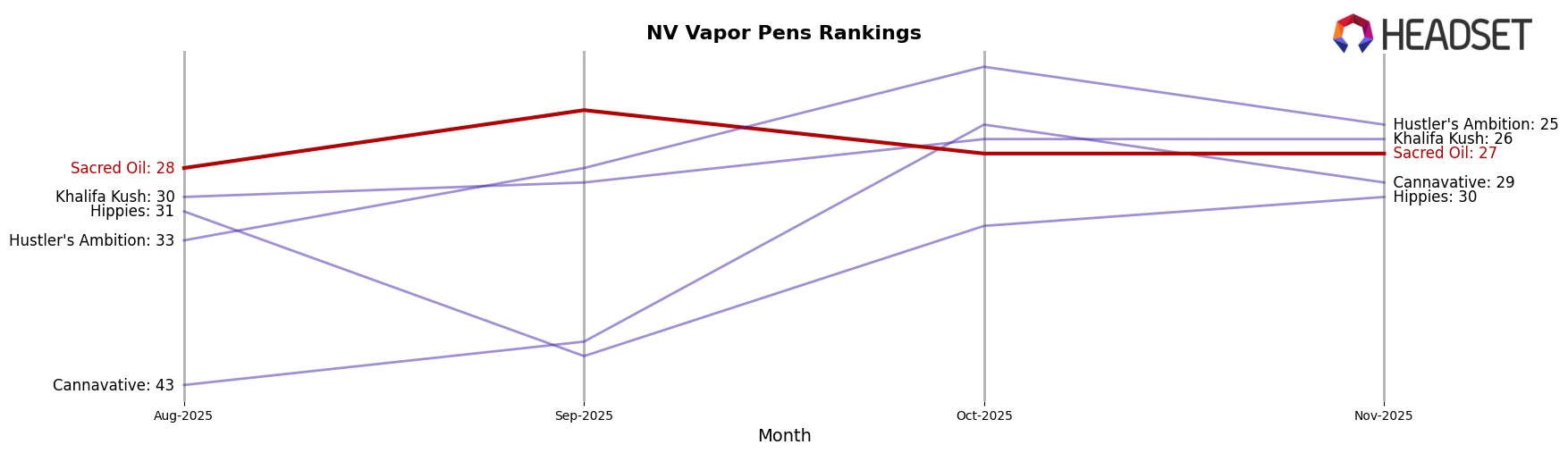

Conversely, in the Vapor Pens category in Nevada, Sacred Oil has maintained a more stable position. While the brand fluctuated slightly, moving from rank 28 in August to 24 in September, it settled at rank 27 in both October and November. Despite this consistency, the sales figures reveal a decline from $96,693 in August to $71,938 by November, indicating a potential area for improvement. The steady rank amidst falling sales suggests that while Sacred Oil retains some loyalty or recognition in this category, there is room to enhance their product offering or marketing efforts to boost sales.

Competitive Landscape

In the Nevada Vapor Pens category, Sacred Oil experienced a relatively stable performance from August to November 2025, maintaining a rank within the top 30 brands. Despite a slight dip in October, where it fell to 27th place, Sacred Oil managed to regain its position by November, indicating resilience in a competitive market. Notably, Hustler's Ambition showed a significant rise, moving from 33rd in August to 25th in November, with a peak at 21st in October, suggesting a strong upward trend that could pose a competitive threat. Meanwhile, Cannavative and Khalifa Kush hovered around the lower 20s and 30s, with Cannavative not breaking into the top 20, which might indicate a less aggressive competitive stance. Sacred Oil's consistent sales figures, despite the competitive pressure, highlight its solid market presence, but the brand should remain vigilant of rising competitors like Hustler's Ambition to maintain its market share.

Notable Products

In November 2025, the top-performing product for Sacred Oil was the Strawberry Dream Distillate Cartridge (0.9g) in the Vapor Pens category, maintaining its position at rank 1 with sales of 1568 units. The Secret Orchard Distillate Cartridge (0.9g) also held steady at rank 2, showing a consistent performance from October with sales of 1555 units. Notably, Hindu Runtz Cured Resin (1g) dropped out of the rankings after being at rank 4 in October. Indigo Bliss Distillate Cartridge (0.9g) and Jealousy Runtz Cured Resin (1g) were not ranked in November, indicating a shift in consumer preference towards the top two products. This data highlights a strong preference for the Vapor Pens category among customers of Sacred Oil.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.