Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

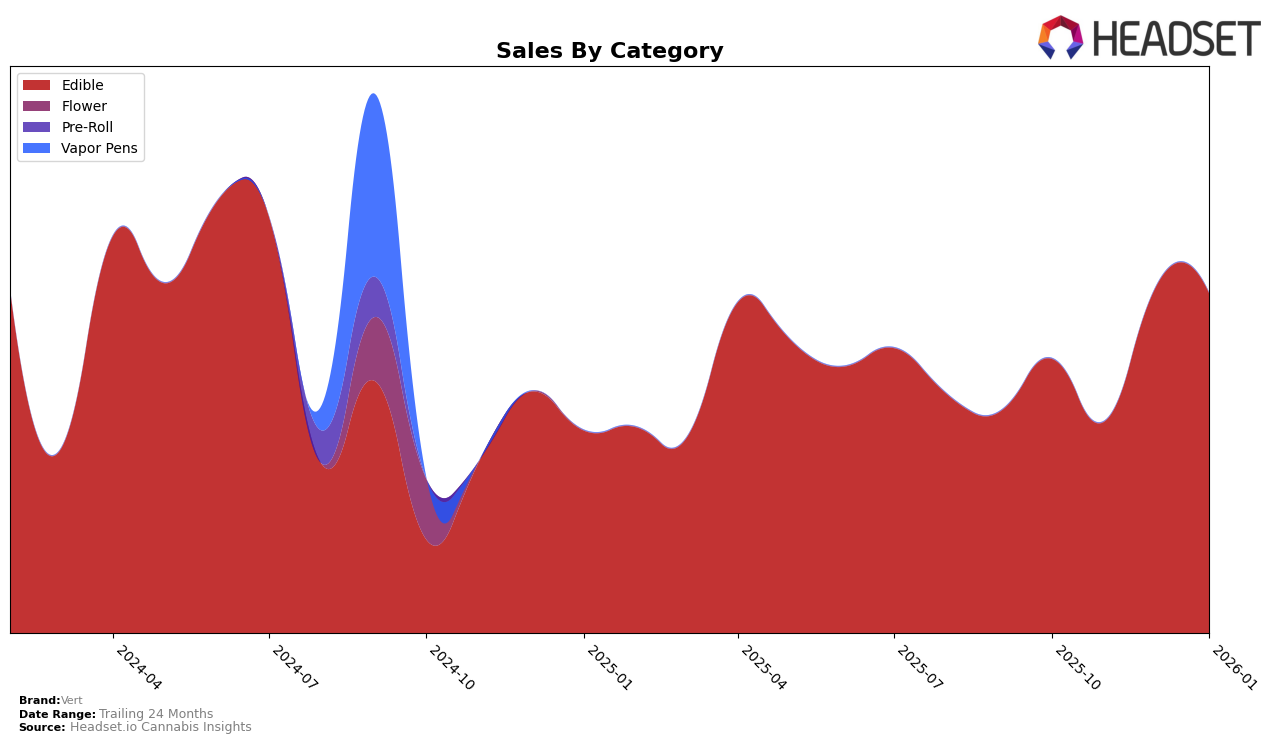

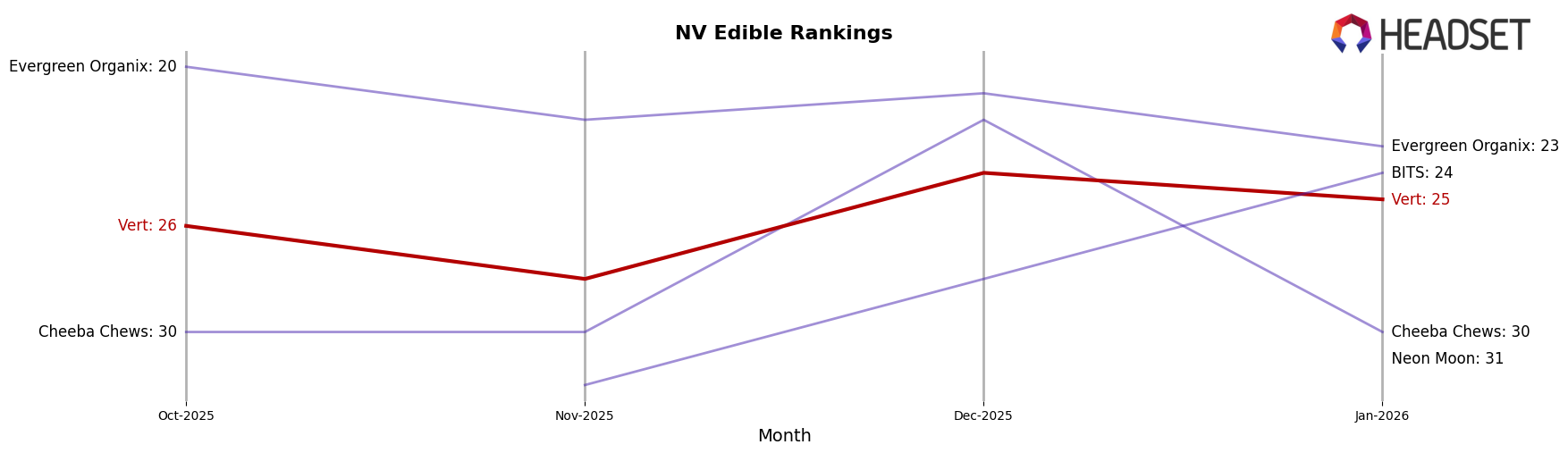

Vert's performance in the Edible category within Nevada has shown some fluctuations over the last few months. In October 2025, Vert was ranked 26th, but experienced a slight dip in November, moving down to the 28th position. However, the brand recovered in December, climbing back up to the 24th spot, and maintained a stable presence by January 2026, ranking 25th. Notably, Vert's sales in November 2025 were lower than in October, but there was a significant rebound in December, indicating a positive trend as they managed to maintain a strong position in the competitive Nevada market.

It is important to highlight that Vert consistently remained within the top 30 brands in the Edible category in Nevada, which could be seen as a testament to its resilience and consumer appeal in this specific market. The fact that Vert did not drop out of the top 30 rankings during this period is a positive indicator, suggesting that the brand has a steady customer base and potential for growth. While the exact details of Vert's performance in other states or categories are not disclosed here, the available data from Nevada suggests a brand that is capable of navigating market challenges and capitalizing on opportunities within the Edible category.

```Competitive Landscape

In the Nevada edible market, Vert has shown a dynamic performance with fluctuations in its rank and sales from October 2025 to January 2026. While Vert's rank improved from 28th in November to 24th in December, it slightly declined to 25th in January. This indicates a competitive landscape where Vert is striving to maintain its position. Notably, Evergreen Organix consistently outperformed Vert, maintaining a rank between 20th and 23rd during the same period, suggesting a stable market presence. Meanwhile, BITS showed a notable improvement, rising from 32nd in November to 24th in January, directly competing with Vert. Cheeba Chews and Neon Moon were less consistent, with Cheeba Chews not breaking into the top 20 and Neon Moon only appearing in January at 31st. These dynamics highlight the competitive pressure Vert faces and the need for strategic initiatives to enhance its market share in the Nevada edible category.

Notable Products

In January 2026, the top-performing product for Vert was the CBD:THC 1:1 Caramel Brownie Cookie Square (100mg CBD, 100mg THC) in the Edible category, maintaining its first-place rank from December 2025 with sales of 362. The Red Velvet Cookie Square (100mg) secured the second position, up from fourth in December, indicating a notable increase in popularity. The Chocolate Chip Brownie Cookie Square (100mg), previously ranked second in December, slipped to third place. The Cookies n Cream Square Cookie (100mg) maintained its fourth position from December. Lastly, the Chocolate Caramel Brownie Cookie Square 10-Pack (100mg) remained consistent in fifth place, showing stable performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.