Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

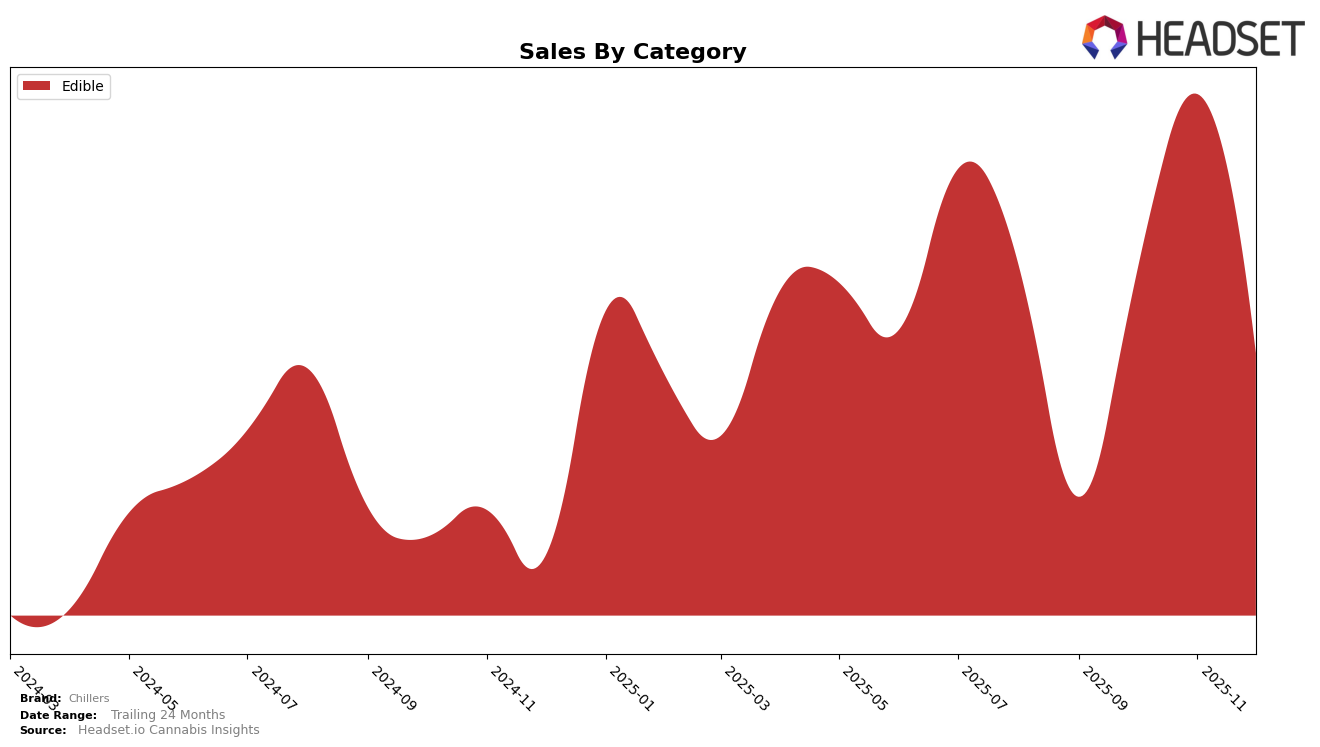

Chillers has shown a dynamic performance in the Edible category within the state of Nevada over the last few months of 2025. Starting from a rank of 30 in September, Chillers improved its position significantly to 25 in October and further climbed to 21 by November. However, December saw a decline back to rank 29, indicating some volatility in their market presence. This fluctuation suggests a competitive landscape in the Edible category, where Chillers has managed to make noticeable gains but also faces challenges in maintaining a consistent top-tier position.

The rise in Chillers' rank from September to November can be attributed to a strong increase in sales, with October's sales more than doubling from September, and November showing even further growth. Nevertheless, the drop in December highlights a potential seasonal effect or increased competition, which may have impacted their sales performance. The fact that Chillers was not consistently in the top 20 throughout these months indicates room for improvement in their strategy to sustain higher rankings. Observing these trends can provide insights into the competitive dynamics and consumer preferences within the Nevada edible cannabis market.

Competitive Landscape

In the Nevada edible cannabis market, Chillers has shown a fluctuating performance in the final months of 2025. Starting at rank 30 in September, Chillers improved its position to 21 by November, before slipping back to 29 in December. This volatility suggests a competitive landscape where brands like Gron / Grön and Wana maintain stronger footholds, consistently ranking in the top 10. Notably, Gron / Grön held the 4th position from October to November, indicating robust sales performance. Meanwhile, Voon, despite its lower rank, showed a positive trend by climbing from 34 in October to 27 in December. For Chillers, the challenge lies in stabilizing its rank amidst these competitive pressures, potentially by leveraging insights from advanced data analytics to better understand consumer preferences and optimize its market strategy.

Notable Products

In December 2025, the Cherry Amaretto Live Resin Gummies 20-Pack (100mg) emerged as the top-performing product for Chillers, reclaiming its first-place rank from September with impressive sales of 1,734 units. The Tropical Paradise Live Resin Gummies 20-Pack (100mg) maintained a strong presence, holding steady at the second position for two consecutive months. Strawberry Mimosa Live Resin Gummies 20-Pack (100mg) saw a significant drop in sales, falling to third place despite previously topping the rankings in October. The Indica Apple Sangria Gummies 20-Pack (100mg), which had led in November, were not ranked in December. Overall, the December rankings reflect a dynamic shift in consumer preferences, with Cherry Amaretto making a notable comeback to the top spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.