Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

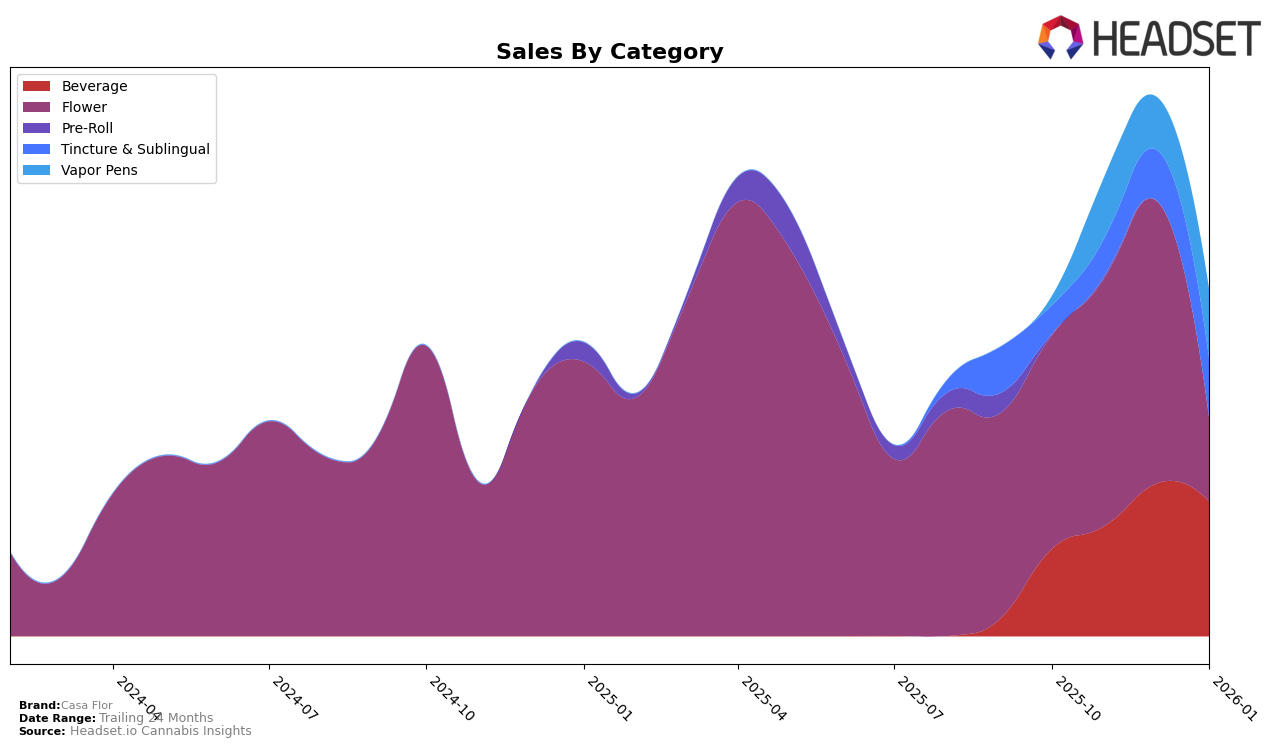

Casa Flor has shown a promising upward trajectory in the beverage category within California. Starting from a rank of 19 in October 2025, the brand steadily climbed to the 12th position by January 2026. This consistent improvement suggests a growing consumer preference for Casa Flor's offerings in this category. The sales figures also support this trend, with a noticeable increase from $17,106 in October to $26,380 in January. However, in the tincture and sublingual category, the brand only emerged in the rankings in January 2026, securing the 21st spot. This late entry into the top 30 could indicate either a recent strategic push into this category or a slow build-up of consumer interest.

The absence of Casa Flor in the top 30 rankings for tinctures and sublinguals in the preceding months might be seen as a missed opportunity or a sign of the brand's limited focus on this category until recently. The brand's ability to enter the rankings by January 2026 could suggest a potential area for growth if they continue to innovate or market effectively in this segment. The performance in beverages, on the other hand, highlights a strong position and potential for further expansion in California. The trends indicate that while Casa Flor is solidifying its presence in the beverage market, it may need to bolster its efforts in other categories to achieve a more balanced market presence.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Casa Flor has shown a promising upward trajectory in recent months. From October 2025 to January 2026, Casa Flor improved its rank from 19th to 12th, indicating a significant gain in market position. This upward movement is particularly notable when compared to competitors like CQ (Cannabis Quencher) and Kikoko, which have maintained relatively stable ranks, with CQ moving from 16th to 13th and Kikoko from 15th to 14th. Meanwhile, Lime and Treesap have consistently held higher ranks, with Treesap notably securing the 10th position throughout the period. Casa Flor's sales growth, particularly the jump in December 2025, suggests a strong consumer response, positioning it as a rising contender in a competitive field. This trend highlights Casa Flor's potential to continue climbing the ranks if it maintains its current momentum.

Notable Products

In January 2026, the top-performing product for Casa Flor was Watermelon Tamarindo Syrup (1000mg THC) in the Beverage category, which climbed to the first rank with sales reaching 470. Flight 23 (1g) in the Flower category debuted impressively at the second position. Galleta Gas (3.5g) also remained strong, securing the third rank, although it dropped from its second position in November 2025. Aguas Fresca Live Resin Disposable (1g) entered the rankings at fourth place, showcasing a notable entry in the Vapor Pens category. Spanish Haze (3.5g) experienced a decline, moving down to fifth from its previous second position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.