Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

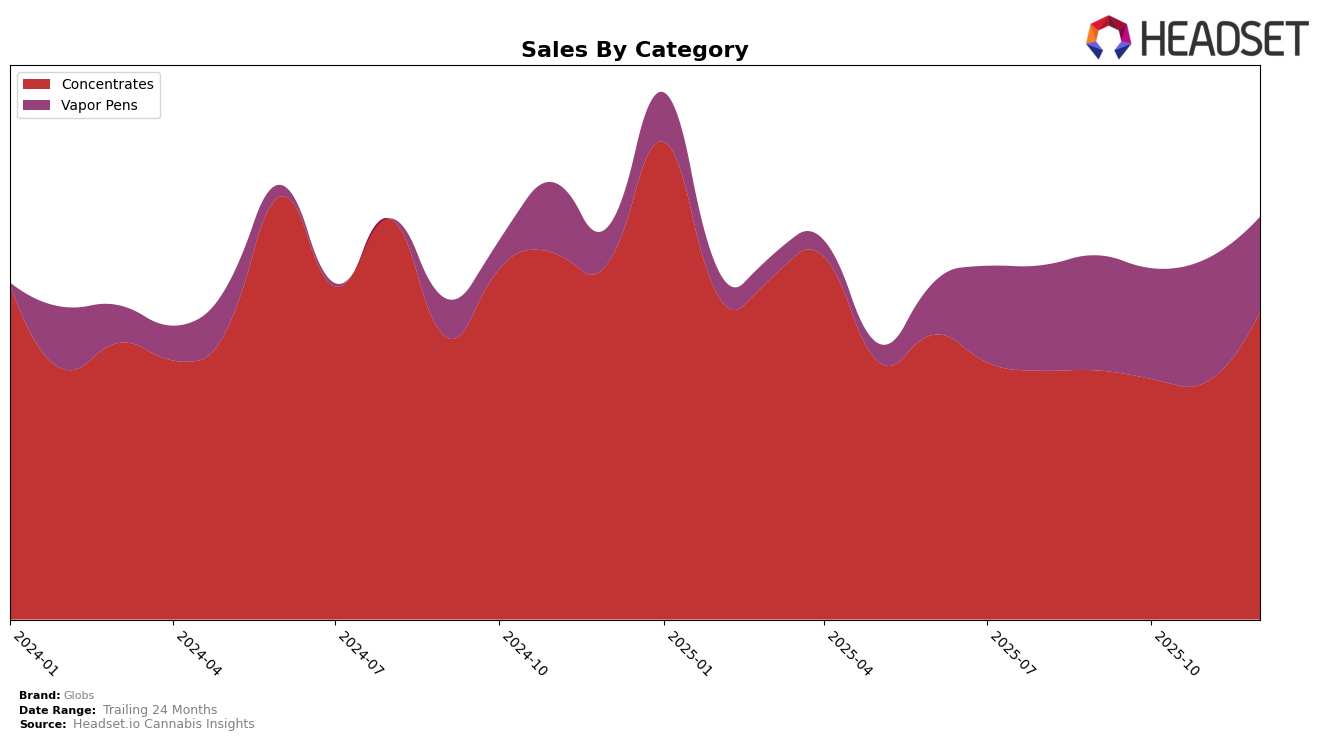

In the California market, Globs has shown some interesting movements within the Concentrates category over the last few months. After slipping out of the top 30 in October and November, Globs made a notable comeback in December, climbing back to the 26th position. This resurgence in rank is accompanied by a significant increase in sales, suggesting a strong finish to the year. The fluctuation in their ranking highlights the competitive nature of the Concentrates category in California, where Globs is striving to maintain a foothold.

While the data for other states and categories is not disclosed here, the performance in California can serve as a microcosm of Globs' broader market strategy. The brand's ability to rebound in California may reflect strategic adjustments or successful marketing efforts that could potentially be replicated in other regions. However, without additional data from other states or categories, it's challenging to ascertain whether this trend is isolated or part of a larger pattern. The absence of Globs in the top 30 for two consecutive months in California also underscores the challenges faced by brands in maintaining consistent rankings amidst evolving market dynamics.

Competitive Landscape

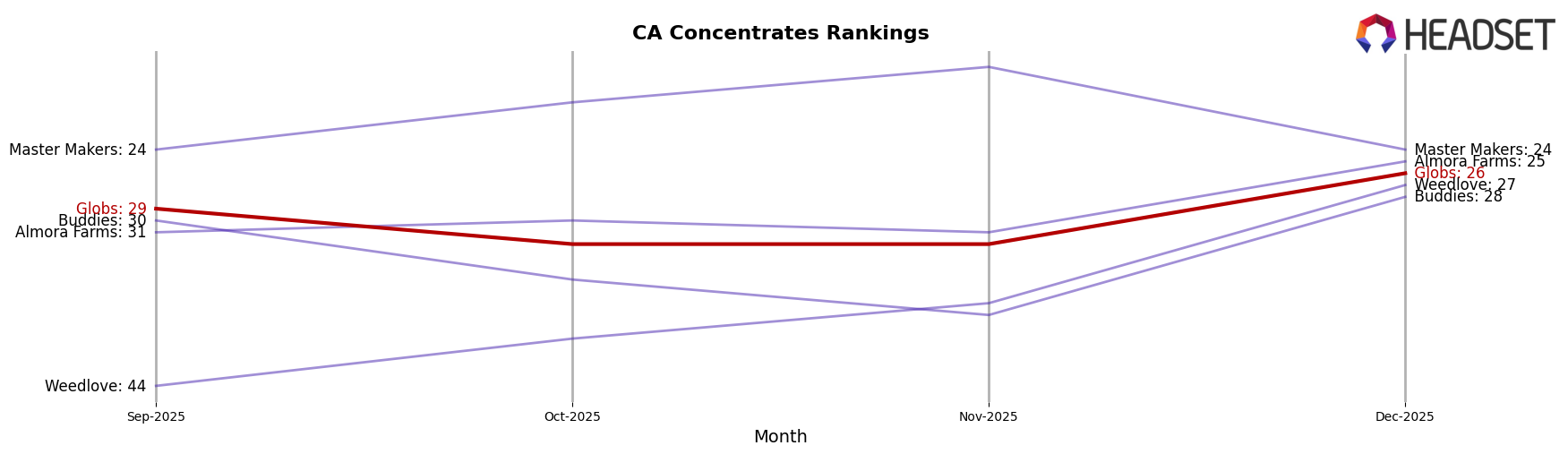

In the competitive landscape of the California concentrates market, Globs has experienced a fluctuating presence, with its rank moving from 29th in September 2025 to 26th by December 2025. Despite this slight improvement, Globs faces stiff competition from brands like Almora Farms, which climbed to 25th place in December, and Master Makers, which consistently maintained a stronger position, peaking at 17th in November. Interestingly, Buddies and Weedlove also showed dynamic shifts in their rankings, with Buddies ending the year at 28th and Weedlove making a notable leap to 27th in December. These movements highlight a competitive environment where Globs must strategize to enhance its market position and sales trajectory amidst brands that are either stabilizing or gaining momentum.

Notable Products

In December 2025, the top-performing product from Globs was Platinum Papaya Badder (1g) in the Concentrates category, maintaining its number 1 rank since October with a notable sales figure of 1126 units. Modified Honey Badder (1g) climbed to the second position, showing a significant rise from its debut at rank 3 in November. Sweet-N-Sour Diesel Badder (1g) also improved its standing, moving up to rank 3 from rank 4 in November. Hella Grapes Live Resin Cartridge (1g) entered the rankings at position 4, marking its first appearance. Lemon Thai Diamonds (0.5g) rounded out the top five, debuting at rank 5.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.