Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

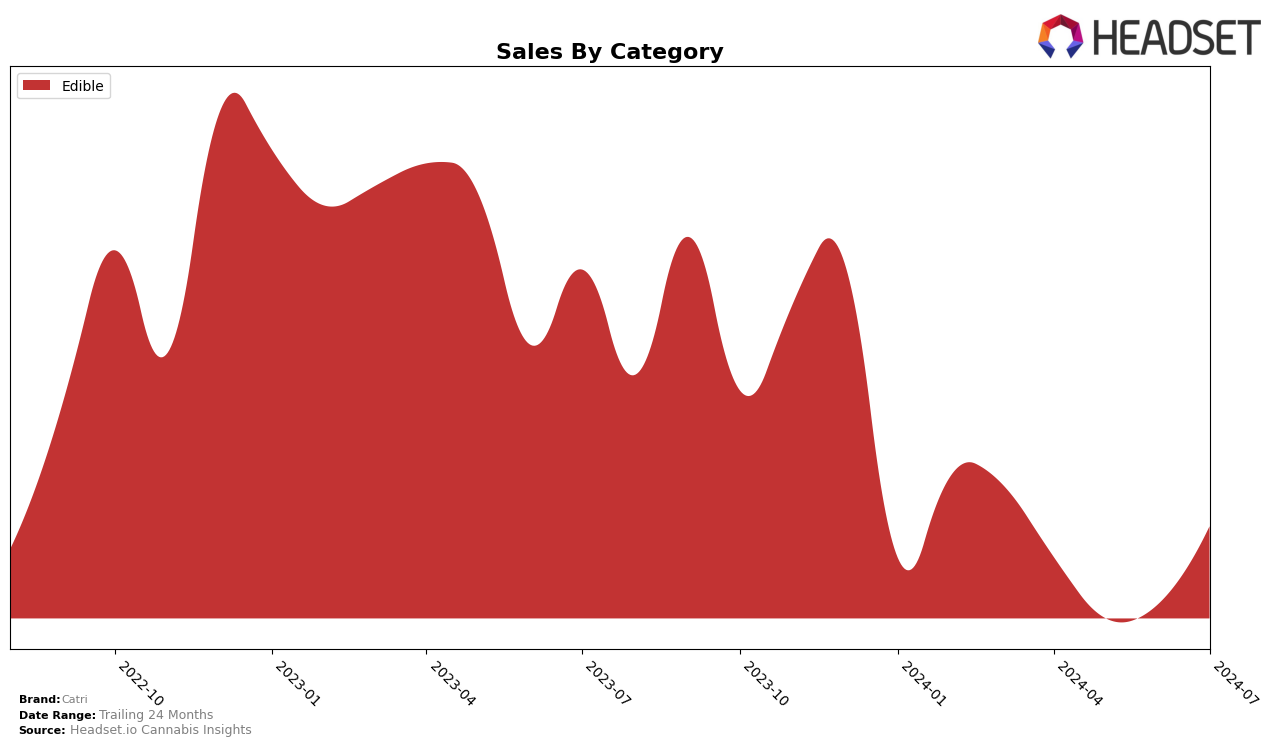

In Arizona, Catri has shown a notable performance in the Edible category over the past few months. Starting in April 2024, Catri was ranked 33rd, but its position fluctuated slightly, moving to 37th in May, 35th in June, and finally breaking into the top 30 with a 29th place ranking in July. This upward trend in July is significant, indicating a positive reception and increased consumer demand for Catri's edible products in Arizona. The sales figures also reflect this growth, with a marked increase from May to July, suggesting that Catri's strategic initiatives might be paying off in this state.

However, it is important to note that Catri's presence in the Edible category in Arizona was not consistently strong enough to stay within the top 30 for the entire period, as seen in the months of April, May, and June. This inconsistency could be a point of concern, highlighting potential challenges in maintaining a steady market position. The fluctuation in rankings suggests that while there are periods of growth, there may also be underlying factors affecting sustained performance. This mixed performance warrants a closer look at Catri's market strategies and consumer engagement efforts to understand the dynamics at play in Arizona's competitive edible market.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Catri has shown notable fluctuations in its ranking over recent months. From April to July 2024, Catri's rank improved from 33rd to 29th, indicating a positive trend in market performance. This improvement is significant when compared to competitors like iLava, which consistently hovered around the 27th to 30th positions, and Tipsy Turtle, which maintained a steady rank around 30th. Meanwhile, Grow Sciences showed a slight decline, moving from 25th to 26th place. Notably, Khalifa Kush was absent from the top 20 rankings for several months, only appearing in July at 33rd place. These shifts suggest that Catri is gaining traction in the market, potentially due to strategic marketing efforts or product innovations, while some competitors are either stagnating or losing ground.

Notable Products

In July 2024, the top-performing product from Catri was the CBD/THC/CBN/CBG 1:1:1:1 Manzana Platanito Gummies (100mg CBD, 100mg THC, 100mg CBN, 100mg CBG), maintaining its first-place ranking with notable sales of 1252 units. The CBD/THC/CBG 1:1:1 Tropic Trio Gummies (100mg CBD, 100mg THC, 100mg CBG) held steady in second place, despite a slight decrease in sales to 568 units. The Sativa Manzanita Gummies (100mg) climbed to third place from fifth in June 2024, with sales increasing to 538 units. Indica Dulce de Leche Gummies (100mg) dropped to fourth place, with sales of 495 units. The Hybrid Pina Colada Gummies (100mg) re-entered the rankings at fifth place, showing a sales figure of 370 units after being unranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.