Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

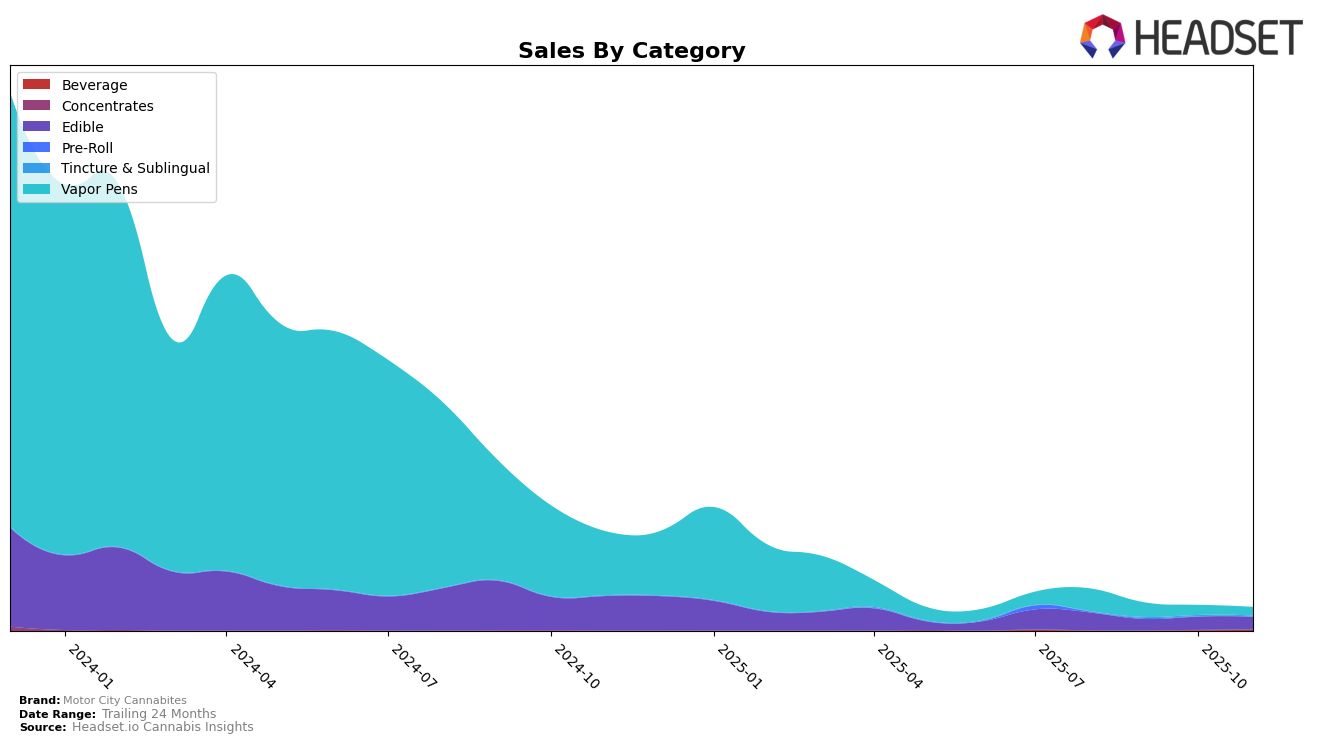

Motor City Cannabites has shown a notable presence in the Michigan market, particularly within the Edible category. Despite not breaking into the top 30 rankings in recent months, their August 2025 sales figures indicate a steady consumer interest, with sales amounting to $15,557. This suggests a solid foundation in Michigan, even if their brand recognition hasn't yet propelled them into the higher echelons of the rankings. The absence from top rankings in subsequent months could indicate increased competition or a need for strategic adjustments to enhance market visibility.

Across other states and provinces, Motor City Cannabites has not made a significant impact, as evidenced by their absence from the top 30 rankings in any category beyond Michigan. This lack of presence in other markets could be seen as a challenge, suggesting that their current traction is highly localized. It may also present an opportunity for growth if the brand can leverage its Michigan experience to expand into new regions. The data implies a potential for Motor City Cannabites to explore strategies that could elevate their status not just locally but on a broader scale, should they choose to expand their reach beyond Michigan's borders.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Motor City Cannabites has shown a promising yet challenging trajectory. As of August 2025, Motor City Cannabites entered the rankings at position 96, but unfortunately, it did not maintain a presence in the top 20 in subsequent months, indicating a need for strategic adjustments to sustain its market position. In contrast, Sauce Essentials consistently outperformed, holding ranks from 51 to 66 between August and October 2025, although their sales showed a downward trend. Meanwhile, brands like Green DR, Zilla's, and Green Gruff also appeared in the rankings but similarly struggled to maintain a consistent top 20 presence. This competitive environment suggests that while Motor City Cannabites has potential, it must innovate and adapt to the dynamic market to improve its rank and sales performance.

Notable Products

In November 2025, the top-performing product from Motor City Cannabites was the Banana Split Distillate Disposable (1g) in the Vapor Pens category, maintaining its number one rank since September. The Caramel Apple Stixx Fast Acting Suckers 4-Pack (200mg) climbed to the second position in the Edible category, with notable sales of 279 units, showing a significant improvement from its fifth position in October. The Banana Nut Brownie (200mg) held a consistent rank at third place in November, despite a decrease in sales compared to October. Cannacarts - CBD/THC 1:1 Green Apple Distillate Disposable (1g) moved down to fourth rank in the Vapor Pens category, indicating slight fluctuations in its popularity. Garlic Parmesan Pretzel Sticks (200mg) remained in the fifth position in the Edible category, showing steady sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.