Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

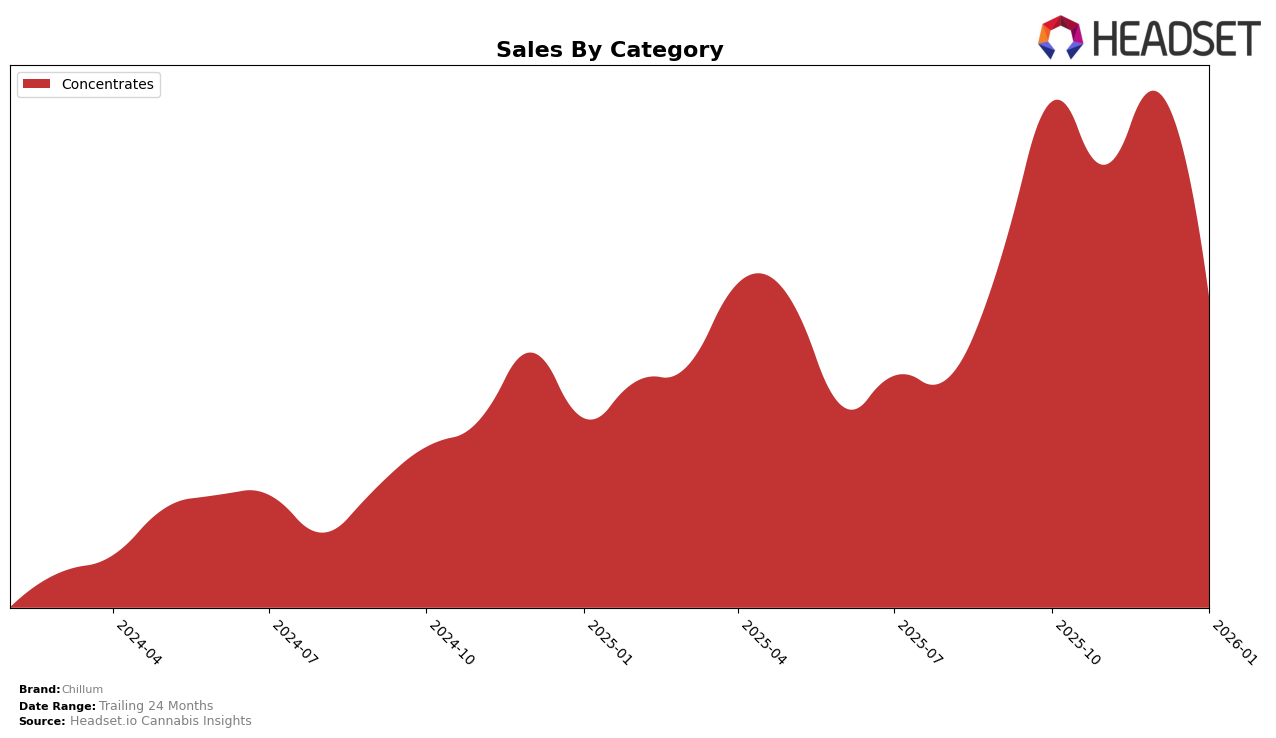

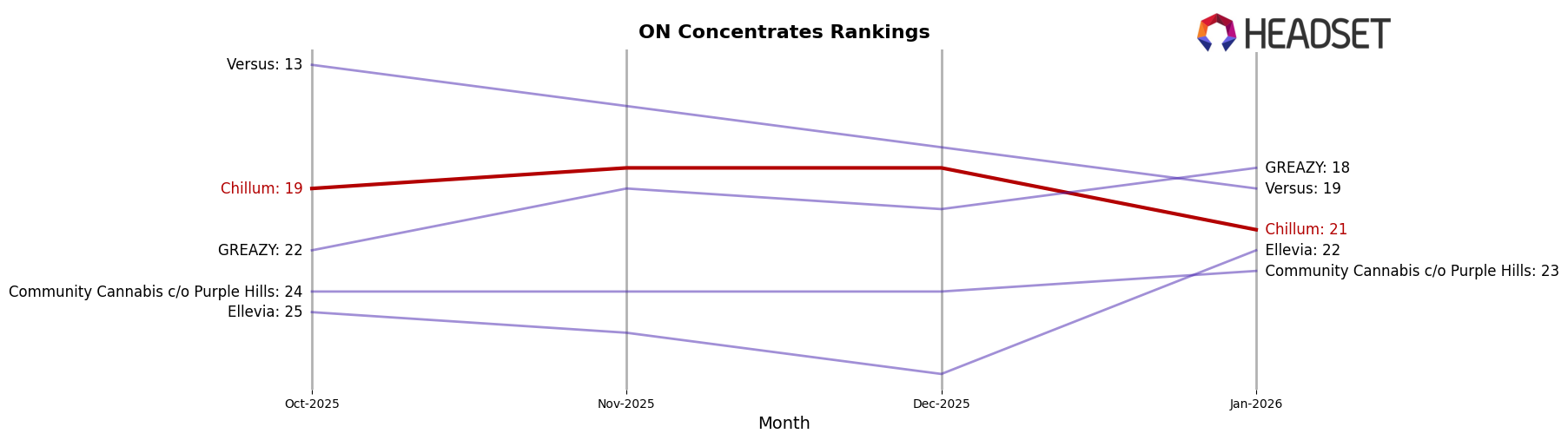

Chillum has shown a dynamic performance across various categories and states, with notable activity in the Concentrates category in Ontario. Over the months from October 2025 to January 2026, Chillum's ranking in the Concentrates category shifted slightly, starting at 19th place in October, improving to 18th in November and December, but then dropping to 21st in January. This fluctuation suggests that while Chillum maintained a steady presence in the top 20 for a time, there was a slight decline at the beginning of 2026, which could be indicative of increased competition or seasonal factors affecting sales. It's also worth noting that despite the drop in rank, Chillum's sales in December 2025 were higher than in October, indicating a possible increase in demand or effective sales strategies during that period.

The absence of Chillum from the top 30 brands in other states or categories during this timeframe may highlight either strategic focus on specific markets or challenges in expanding their reach. The decrease in sales from December to January, despite maintaining a consistent rank in the earlier months, suggests potential areas for improvement in retaining customer interest or adapting to market changes. These insights underscore the importance of understanding regional market dynamics and consumer preferences, as Chillum navigates the competitive landscape of cannabis concentrates in Ontario.

Competitive Landscape

In the competitive landscape of the Ontario concentrates market, Chillum has experienced notable fluctuations in its ranking and sales over the past few months. Starting in October 2025, Chillum was ranked 19th, maintaining its position in November and December before dropping to 21st in January 2026. This decline in rank coincides with a significant drop in sales from December to January, suggesting a potential challenge in maintaining market share. In contrast, GREAZY improved its rank from 22nd in October to 18th in January, with a consistent upward trend in sales, indicating a strengthening position in the market. Meanwhile, Versus saw a decline in both rank and sales, dropping from 13th to 19th, which might present an opportunity for Chillum to reclaim some market share if it can address the factors contributing to its recent sales dip. Additionally, Community Cannabis c/o Purple Hills maintained a stable rank around 24th, while Ellevia showed a slight improvement in rank, moving from 25th to 22nd, with a steady increase in sales. These dynamics highlight the competitive pressures Chillum faces and the need for strategic adjustments to regain its competitive edge in the Ontario concentrates market.

Notable Products

In January 2026, Black Hash (3.5g) from Chillum maintained its position as the top-performing product in the Concentrates category, continuing its streak as the number one ranked product since October 2025. Despite a decrease in sales to 2744 units, it remained the leader, highlighting its consistent demand. Notably, Black Hash (3.5g) has held the top rank for four consecutive months, indicating strong consumer loyalty and preference. This consistency in ranking underscores its dominance in the market over the past months. The product's performance suggests it is a key driver in Chillum's sales strategy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.