Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Choklit Park's performance in the Flower category across Canadian provinces shows varied results. In Alberta, the brand's ranking fluctuated significantly, starting at 53rd in November 2025, dropping to 80th in December, and then climbing back to 60th in January 2026 before settling at 68th in February. This volatility suggests a competitive market where Choklit Park is struggling to maintain a consistent position. In contrast, the situation in British Columbia reflects a more stable performance, with the brand consistently ranking around the 68th position from January to February 2026, despite a notable drop from 46th in November 2025. This could imply a more saturated market in British Columbia where maintaining a steady ranking is a challenge.

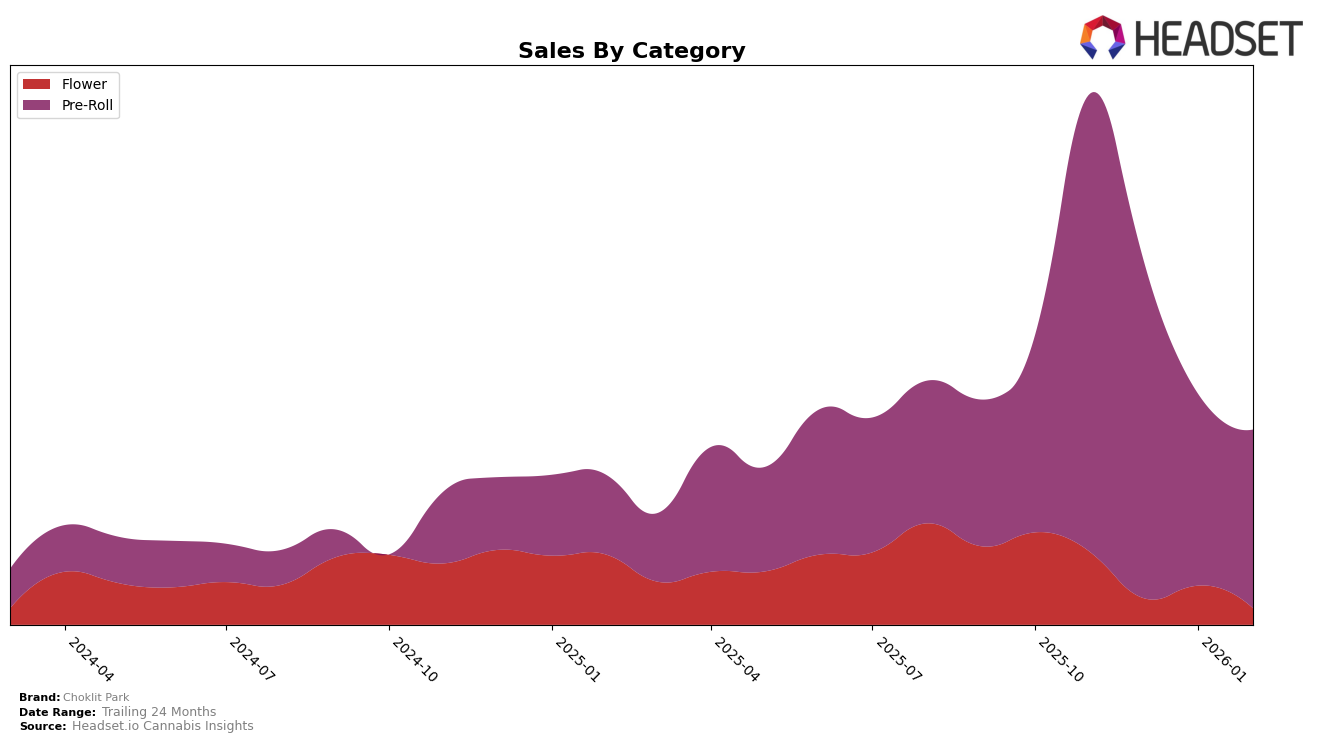

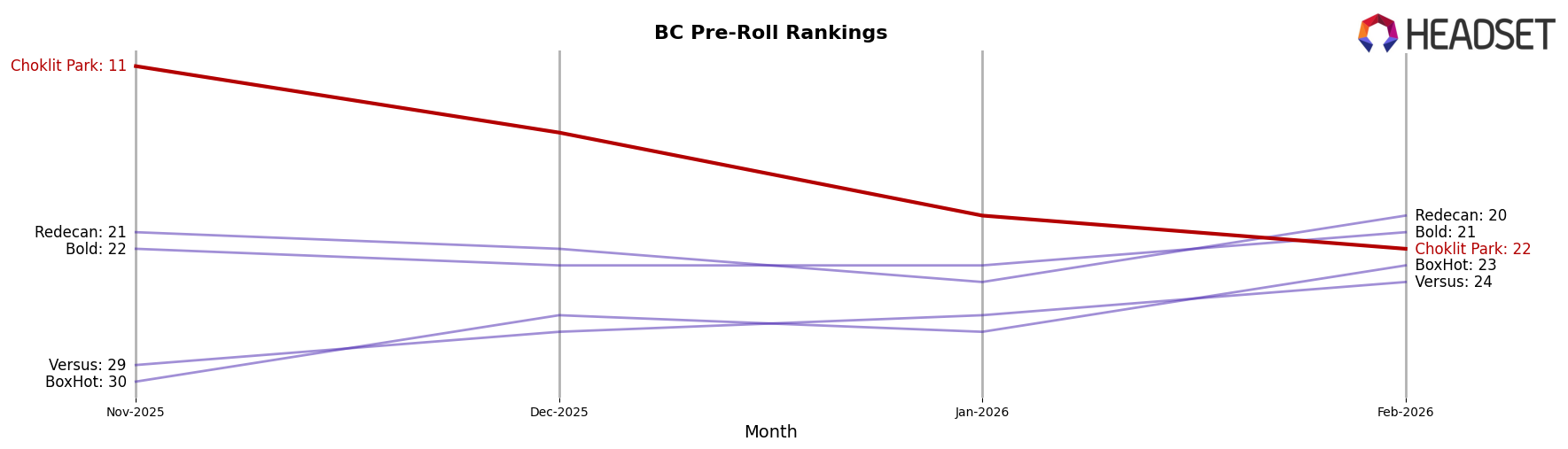

In the Pre-Roll category, Choklit Park demonstrates a stronger presence, particularly in British Columbia, where the brand maintained a solid position within the top 30, ranking from 11th in November 2025 to 22nd by February 2026. This consistent performance indicates a robust market position in British Columbia's Pre-Roll category. However, the brand's absence from the top 30 in January 2026 in Alberta suggests a competitive environment where Choklit Park faces challenges in maintaining visibility. In Ontario, Choklit Park's presence in the Pre-Roll category was marked by a brief appearance at 77th in November 2025, after which it did not rank in the top 30, indicating potential growth opportunities or increased competition in the region.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Choklit Park has experienced a notable decline in its ranking over the past few months, dropping from 11th place in November 2025 to 22nd place by February 2026. This downward trend in rank is mirrored by a significant decrease in sales, suggesting potential challenges in maintaining market share. In contrast, competitors like Redecan and Bold have maintained relatively stable positions, with Redecan even re-entering the top 20 in February 2026. Meanwhile, BoxHot and Versus have shown gradual improvements in their rankings, indicating a competitive push that could be drawing customers away from Choklit Park. This competitive pressure highlights the need for Choklit Park to reassess its strategies to regain its footing in the market.

Notable Products

In February 2026, the top-performing product for Choklit Park was the Hawaiian Snow Pre-Roll 10-Pack (5g) in the Pre-Roll category, maintaining its number one rank from the previous two months, with sales reaching 5,391 units. Moon Puppies Pre-Roll 10-Pack (5g) held steady at the second rank, showing a sales increase from January. Crystal Cascade Pre-Roll 10-Pack (5g) climbed to the third position, improving from its fifth-place rank in January. Blueberry Yum Yum Pre-Roll 3-Pack (3g) was ranked fourth, a slight decline from its third position the previous month. Flawless Victory Pre-Roll 3-Pack (1.5g) entered the rankings in February at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.