Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

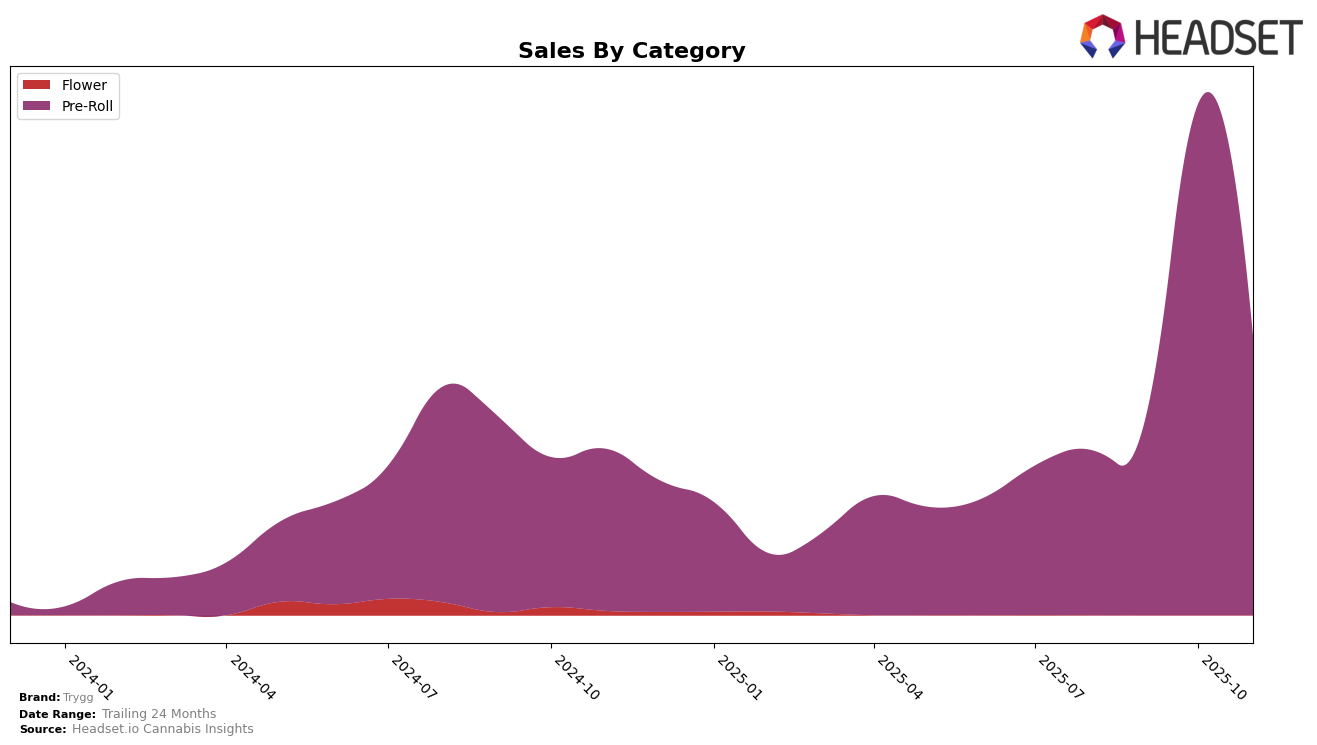

In the British Columbia market, Trygg has experienced notable fluctuations in the Pre-Roll category rankings over the past few months. Starting from a position outside the top 30 in August, Trygg made a significant leap to rank 11th in October. This upward movement was accompanied by a substantial increase in sales, indicating a successful strategy or product offering that resonated well during that period. However, by November, the brand experienced a downturn, dropping to the 26th position, suggesting potential challenges or increased competition in the market. The volatility in rankings highlights the dynamic nature of the cannabis industry in British Columbia and underscores the importance of maintaining momentum to sustain high rankings.

While the dramatic rise in rankings in October is a positive sign for Trygg, the subsequent drop in November serves as a cautionary tale about the competitive landscape in the Pre-Roll category. The brand's ability to break into the top 30 and then climb to an impressive 11th position reflects its potential to capture market share when conditions align. However, the decline in November suggests that maintaining such a position requires continuous innovation and strategic adjustments. The insights from British Columbia could serve as a valuable lesson for Trygg as it navigates other markets, emphasizing the need for adaptability and resilience in the face of shifting consumer preferences and industry trends.

Competitive Landscape

In the competitive landscape of pre-rolls in British Columbia, Trygg has shown a dynamic shift in rankings over the months from August to November 2025. Starting at rank 39 in August, Trygg made a significant leap to rank 11 by October, before settling at rank 26 in November. This upward trajectory was mirrored by a substantial increase in sales, particularly noticeable in October. In comparison, All Nations experienced a remarkable rise from rank 36 in August to rank 6 in October, indicating a strong competitive presence. Meanwhile, Bold and BoxHot showed fluctuating performances, with Bold dropping out of the top 20 in October before recovering slightly in November, and BoxHot maintaining a relatively stable but lower ranking. Woody Nelson also saw a notable peak in October, reaching rank 10. These shifts highlight a competitive and volatile market environment, where Trygg's ability to climb the ranks suggests effective strategies or product offerings that resonated well with consumers during this period.

Notable Products

In November 2025, the top-performing product for Trygg was Trance Pre-Roll 2-Pack (2g), which climbed to the number one rank after maintaining the second position for the previous three months, with notable sales of 5,139 units. Ignite Pre-Roll 2-Pack (2g) dropped to the second spot after leading in October, showing a slight decrease in sales figures. Block Party Variety Pack Pre-Roll 20-Pack (10g) remained consistent at the third rank, while Block Party - Dawn To Dusk Pre-Roll 20-Pack (10g) held steady at fourth throughout the months. Uncut Pre-Roll 2-Pack (2g) maintained its position at fifth, having been introduced in October. The rankings indicate a competitive market for pre-roll products, with slight shifts reflecting changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.