Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

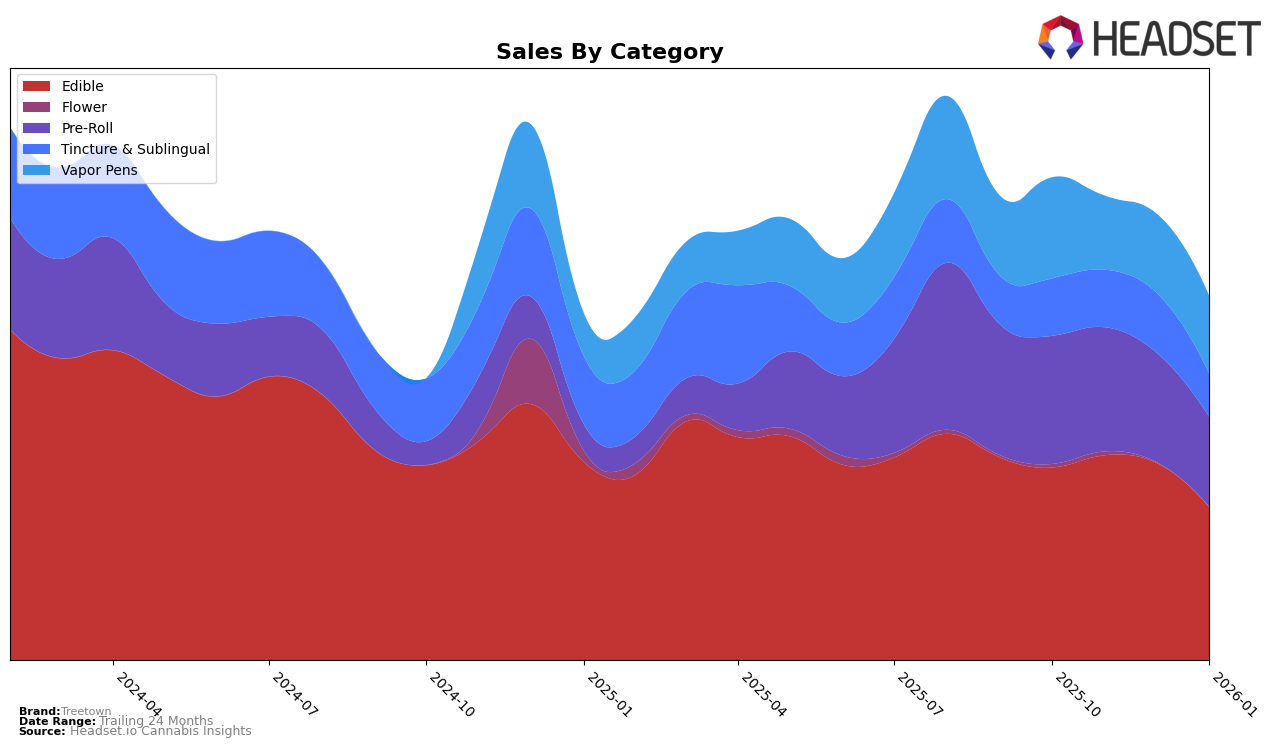

Treetown's performance in the Michigan market shows varying trends across different product categories. In the Edible category, Treetown managed to break into the top 30 in November 2025, ranking 30th, but slipped out of this range by December and January. This indicates a challenge in maintaining a competitive edge in the Edible segment. The Pre-Roll category paints a similar picture, with Treetown consistently ranking outside the top 30. This suggests that while Treetown has a presence in these categories, there is significant room for improvement to enhance their market position.

On a more positive note, Treetown has shown remarkable consistency in the Tincture & Sublingual category, maintaining the top position in Michigan for October and November 2025, and only slightly dropping to the second position in December and January. This indicates a strong brand presence and consumer preference in this category. However, the Vapor Pens category reflects a fluctuating performance, with Treetown's ranking moving from 69th in October to 76th by January. Despite these movements, the brand's sales figures in this category show a notable resilience, suggesting potential for future growth if strategic adjustments are made.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Michigan, Treetown has experienced fluctuations in its rank over the past few months, indicating a challenging environment. As of January 2026, Treetown's rank dropped to 34th, slightly behind Kiva Chocolate at 33rd, and Mischief at 30th. Despite this, Treetown consistently maintained a position within the top 35, showcasing resilience amidst fierce competition. Notably, Wonder Wellness Co. and Made By A Farmer have shown upward trends, with Made By A Farmer improving its rank from 51st in October 2025 to 36th in January 2026. This competitive pressure highlights the need for Treetown to innovate and differentiate its offerings to regain and improve its standing in the market. As competitors like Mischief continue to outperform in sales, Treetown must leverage strategic marketing and product development to capture a larger market share.

Notable Products

In January 2026, the top-performing product for Treetown was the Sleep - CBN/THC 2:1 Blackberry Lavender Gummies 10-Pack, which ascended to the number one rank with sales of 4088 units. This product showed a strong upward trend, improving from third in October 2025 and second in November 2025. The Standard Fruit Punch Gummies 10-Pack secured the second position, maintaining a consistent presence in the top five, improving from fifth in November. Sativa Peach Gummies 10-Pack rose to third place, marking a notable entry into the top rankings after being absent in the two prior months. The Cherry Gummies 10-Pack and Mango Full Spectrum Gummies 10-Pack rounded out the top five, with both experiencing a slight decline in their rankings compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.