Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

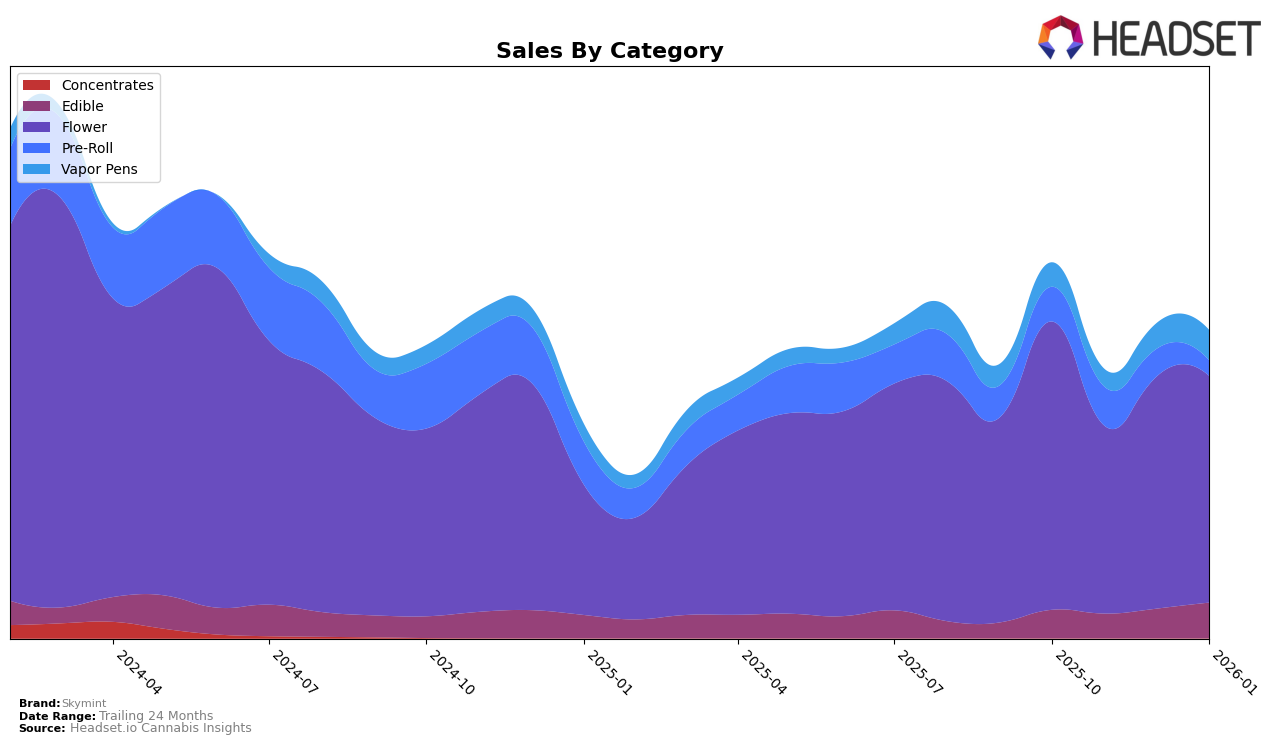

In the state of Michigan, Skymint has shown a varied performance across different cannabis categories. Notably, in the Edible category, Skymint has demonstrated a positive trajectory, moving from a rank of 48 in October 2025 to 38 by January 2026. This upward movement suggests a growing consumer preference or successful marketing strategies in this segment. Conversely, the Pre-Roll category presents a less favorable picture, where Skymint dropped out of the top 30 brands by January 2026, indicating a potential area for improvement or increased competition. The Flower category reflects a mixed performance, with a dip in ranking in November 2025 but recovering to 23 by January 2026, signifying a resilience in this core product line.

Skymint's performance in the Vapor Pens category in Michigan has been relatively stable with a slight upward trend, moving from a rank of 71 in October 2025 to 60 in January 2026. This indicates a steady consumer interest or effective brand positioning in this product category. The sales figures, while not detailed here, suggest that Skymint's overall strategy might be effectively addressing consumer demand in certain categories, but there remains room for growth in others. The absence of Skymint from the top 30 brands in the Pre-Roll category by January 2026 could be a strategic focus area for the brand moving forward, as maintaining a competitive edge in all categories is crucial for sustained market presence.

Competitive Landscape

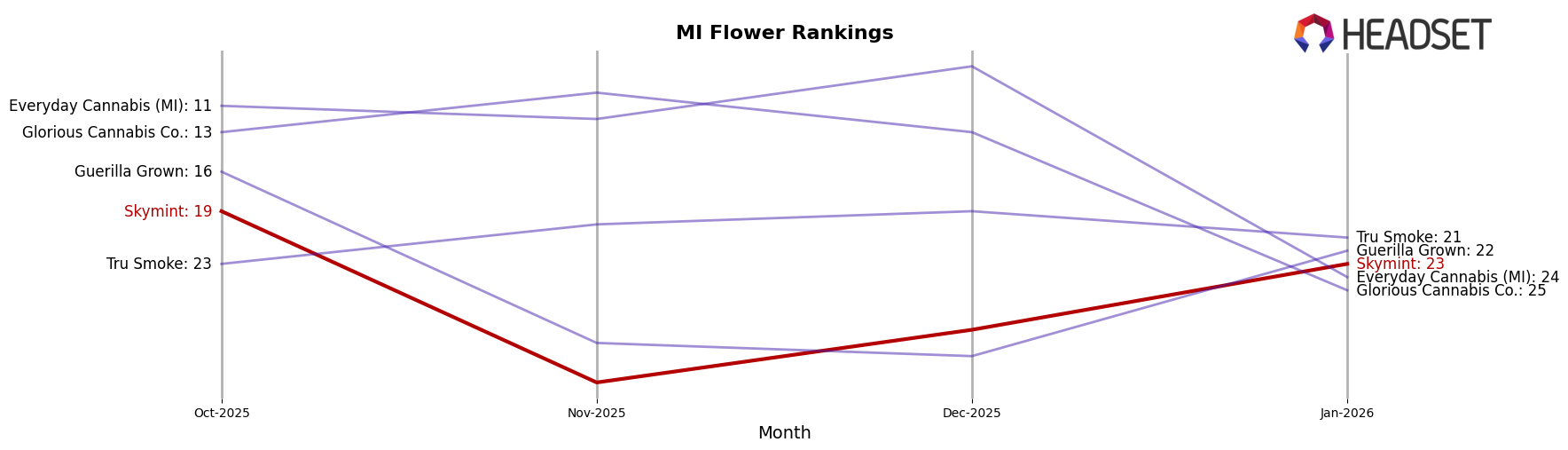

In the competitive landscape of the Michigan Flower category, Skymint has experienced notable fluctuations in its ranking and sales over the recent months. Starting from October 2025, Skymint was ranked 19th, but it fell out of the top 20 in November, only to re-enter at 28th in December and improve to 23rd by January 2026. This volatility suggests a challenging market environment, possibly influenced by the performance of competitors like Glorious Cannabis Co., which consistently maintained a higher rank, peaking at 10th in November. Meanwhile, Everyday Cannabis (MI) showed strong performance, reaching as high as 8th in December, which may have contributed to the competitive pressure on Skymint. Despite these challenges, Skymint's sales showed resilience, with a noticeable recovery from November to December, although it still lagged behind competitors like Tru Smoke and Guerilla Grown, both of which maintained steadier sales figures. This dynamic highlights the importance for Skymint to strategize effectively to regain and sustain a stronger market position in the coming months.

Notable Products

In January 2026, the top-performing product from Skymint was THC:CBN 5:1 Night Berry Gummies 10-Pack, maintaining its leading position from December 2025 with sales reaching 4849 units. Wedding Cake (3.5g) emerged as a strong contender, ranking second, marking its debut in the top rankings. Strawberry Lemonade Live Resin Gummies 20-Pack, which ranked second in December, slipped to the third position. Flo (3.5g) re-entered the rankings at fourth place, showing a notable performance improvement since October 2025 when it was ranked fourth. Honey Buns (3.5g), previously a top performer in October, fell to fifth place in January 2026, indicating a shift in consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.