Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

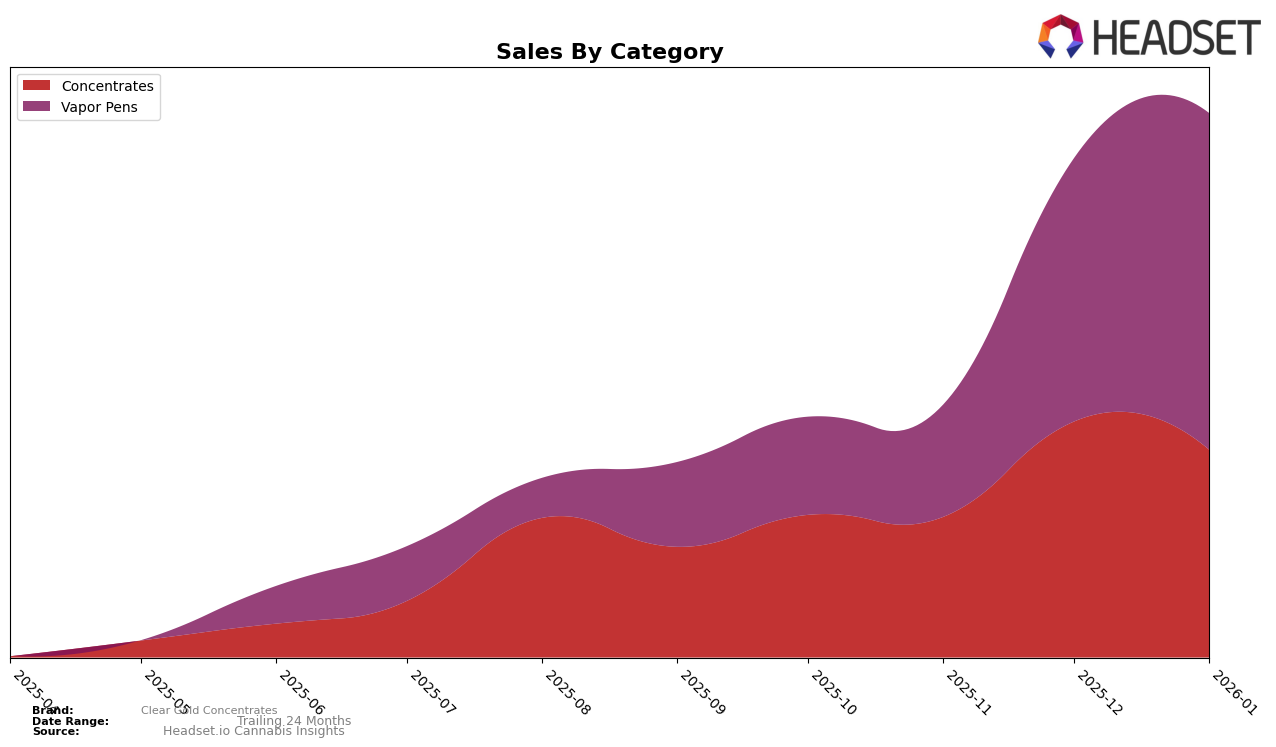

Clear Gold Concentrates has shown a notable performance in the Massachusetts market, particularly in the Concentrates category. Starting from October 2025, the brand was ranked 28th and saw a slight dip to 29th in November. However, by December, Clear Gold Concentrates surged to 19th place, maintaining a strong position at 22nd in January 2026. This upward trajectory suggests a growing consumer preference for their products in this category. The increase in sales from November to December is particularly impressive, highlighting a significant boost in demand, although the brand did not make it into the top 30 in some months, which indicates room for further growth and competition challenges.

In the Vapor Pens category, Clear Gold Concentrates has also demonstrated significant progress in Massachusetts. The brand was initially ranked 98th in October 2025, but it climbed steadily to 93rd in November and made a substantial leap to 71st by December. By January 2026, the brand reached 55th place, showcasing a consistent improvement in market positioning. This rise in rankings is accompanied by an impressive increase in sales, with January figures almost tripling those of October. The brand's ability to move from outside the top 30 to a more competitive position indicates a successful strategy in capturing market share, though there remains potential for further advancement.

Competitive Landscape

In the Massachusetts vapor pens category, Clear Gold Concentrates has shown a remarkable upward trajectory in brand ranking over the past few months. Starting from a rank of 98 in October 2025, it climbed to 55 by January 2026, indicating a significant improvement in market presence and consumer preference. This upward trend is particularly notable when compared to competitors like Natural Selections and Native Sun, both of which have seen either stagnation or a slight decline in rankings. For instance, Natural Selections remained outside the top 40, while Native Sun fluctuated around the 50s. Meanwhile, Just Vapes (MA) and Effin' Edibles have shown some rank improvements, but not as pronounced as Clear Gold Concentrates. This suggests that Clear Gold Concentrates is effectively capturing market share, likely due to strategic marketing or product innovation, positioning it as a rising star in the Massachusetts vapor pen market.

Notable Products

In January 2026, Clear Gold Concentrates saw Acapulco Gold Liquid Diamonds Cartridge (1g) as the top-performing product, maintaining its number one position from December 2025 with a notable sales figure of 1102 units. Tangie Liquid Diamonds Cartridge (1g) emerged as the second best-selling product, marking its debut in the rankings. Tangie Live Resin (1g) and Super Lemon Haze Live Resin (1g) secured the third and fourth ranks respectively, both appearing for the first time in the rankings. Purple Mimosa Live Resin Cartridge (1g) dropped to the fifth position from its previous second place in December 2025. This shift indicates a dynamic change in consumer preferences towards new product entries in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.