Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

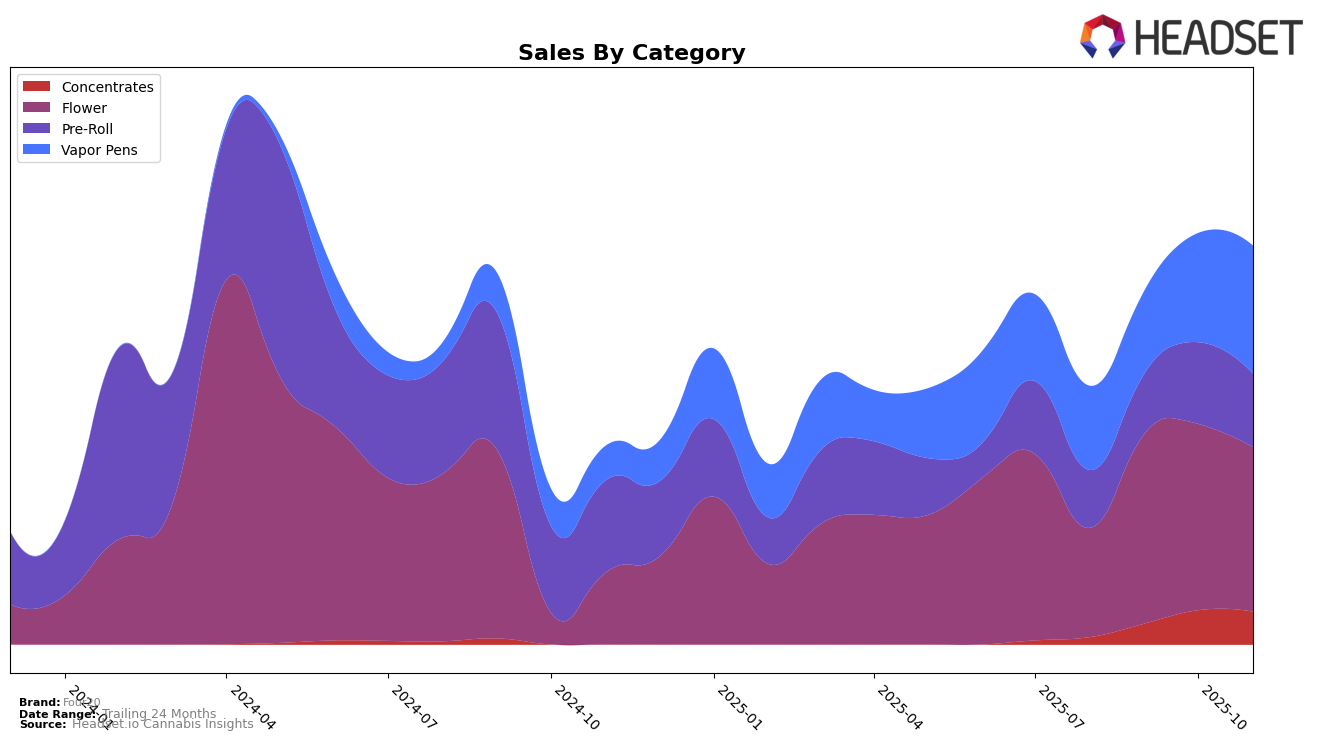

In Massachusetts, Four20 has shown notable improvements across several categories. In the Concentrates category, the brand made a significant leap into the rankings, moving from outside the top 30 in August to 26th place by November. This indicates a growing presence and acceptance among consumers, with sales increasing from $25,324 in August to $39,331 in October. Meanwhile, in the Vapor Pens category, Four20 consistently climbed the ranks, improving from 54th place in August to 39th by November, reflecting a strong upward trend that suggests a positive reception in this product line.

Conversely, in the Flower category, Four20 has faced challenges maintaining a strong position, as evidenced by its fluctuating rankings, moving from 79th in August to 59th in November. While sales figures remained relatively high, this volatility may suggest increased competition or shifting consumer preferences in Massachusetts. The Pre-Roll category also saw a modest improvement, with Four20 moving from 97th place in August to 79th by November. Despite these challenges, the brand's ability to break into the top 30 for Concentrates and improve in Vapor Pens suggests potential areas of focus for growth and market penetration.

Competitive Landscape

In the Massachusetts flower category, Four20 has shown a notable improvement in its market position, climbing from a rank of 79 in August 2025 to 59 by November 2025. This upward trajectory indicates a strengthening presence despite the competitive landscape. In contrast, Kynd Cannabis Company experienced a significant drop from rank 5 in August to 56 in November, suggesting a potential opportunity for Four20 to capture market share from a once-dominant player. Meanwhile, Khalifa Kush and Berkshire Roots maintained relatively stable positions, with slight fluctuations around the 50s and 60s ranks, indicating a consistent but not aggressive competition. Standard Farms also showed volatility, dropping from 48 in August to 63 in November, which may present additional opportunities for Four20 to further improve its standing and sales in the Massachusetts flower market.

Notable Products

In November 2025, the top-performing product for Four20 was the Blueberry Yum Yum Distillate Cartridge in the Vapor Pens category, achieving the number one rank with sales of 1592 units. The Blue Dream Blowfish Pre-Roll secured the second position, marking its debut in the rankings. Apple Season Infused Pre-Roll climbed to third place, up from fifth in October, reflecting a significant increase in popularity. Meanwhile, the Orange Tart Pre-Roll fell from first place in October to fourth in November, despite previously leading the pre-roll category. Jack the Ripper Distillate Cartridge entered the rankings in fifth place, indicating a growing interest in vapor pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.