Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

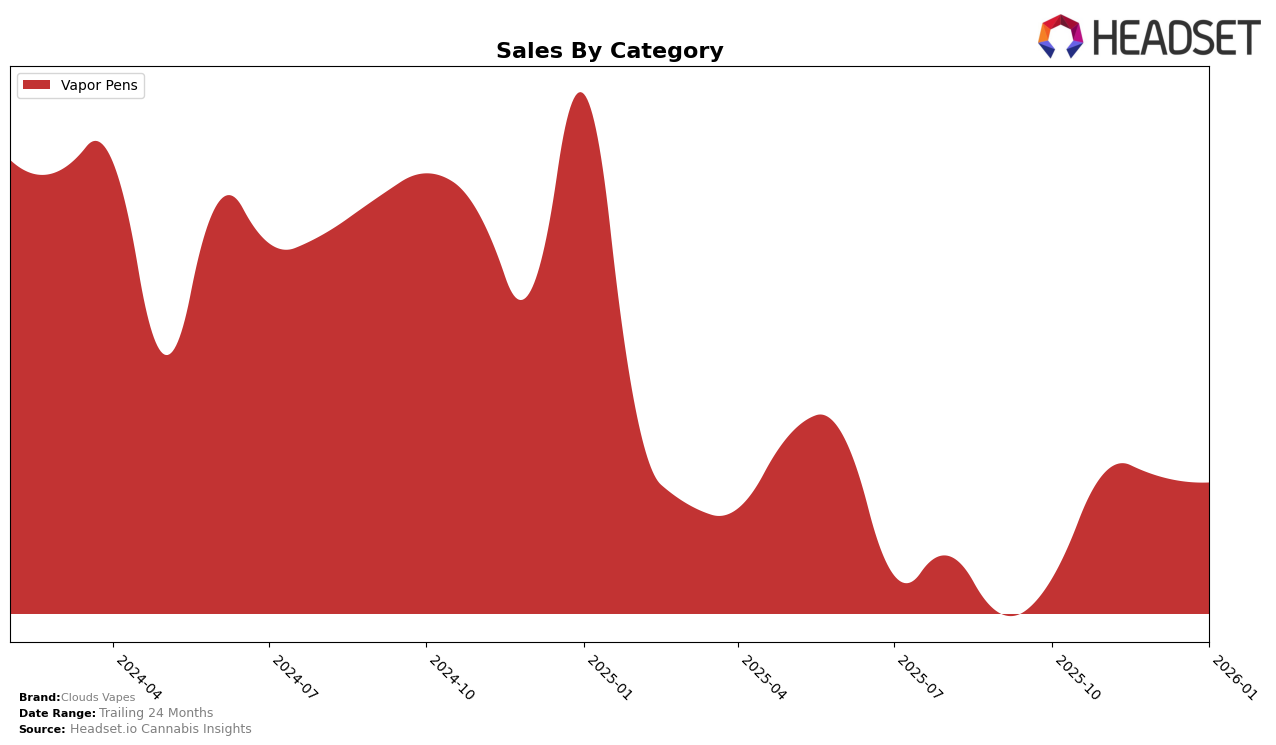

In the state of Missouri, Clouds Vapes has shown a consistent presence in the Vapor Pens category, maintaining a ranking within the top 30 over the past few months. Starting from October 2025, the brand was ranked 27th, improving to 23rd by November, and then slightly dropping to 24th in December before returning to 23rd in January 2026. This indicates a relatively stable performance with minor fluctuations in their ranking. The sales data supports this trend, with a noticeable increase from October to November, followed by a slight decrease in December and January. The consistent ranking in Missouri suggests that Clouds Vapes has a solid foothold in the Vapor Pens category, although there is room for improvement to climb higher in the rankings.

It's noteworthy that the absence of Clouds Vapes from the top 30 in other states or provinces during this period might indicate either a lack of presence or competitive challenges in those markets. The brand's focus on Missouri could be a strategic decision, leveraging their established customer base and market understanding. However, the data suggests that expanding their reach or improving their rankings in other regions could be beneficial for overall growth. The performance in Missouri could serve as a benchmark for potential strategies in other regions, where similar market conditions might allow for successful entry or expansion.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Clouds Vapes has shown a promising upward trend in rankings, moving from 27th place in October 2025 to 23rd by January 2026. This improvement in rank suggests a positive reception in the market, especially when compared to competitors such as Timeless, which fluctuated between 17th and 24th place during the same period, and Safe Bet, which maintained a relatively stable position around 20th place. Despite not breaking into the top 20, Clouds Vapes' consistent sales growth, with sales peaking in November 2025, indicates a strong potential to climb higher in the rankings. The brand's performance is notably better than Proper Cannabis and Flora Farms, both of which remained outside the top 20 throughout the period. This data suggests that Clouds Vapes is gaining traction and could continue to improve its market position with strategic marketing and product offerings.

Notable Products

In January 2026, the top-performing product for Clouds Vapes was the Maui Wowie Distillate Disposable (1g) in the Vapor Pens category, achieving the number one rank with sales of 913 units. Following closely, the Cherry Dosido Distillate Cartridge (1g) secured the second position. The Slurricane Distillate Cartridge (1g) and Wedding Cake Distillate Cartridge (1g) were ranked third and fourth, respectively, with the Banana Cream Cake Distillate Cartridge (1g) rounding out the top five. Notably, this is the first time these products have been ranked, suggesting a strong debut in the new year. The sales figures indicate a competitive market within the Vapor Pens category, with slight variations in rankings compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.