Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

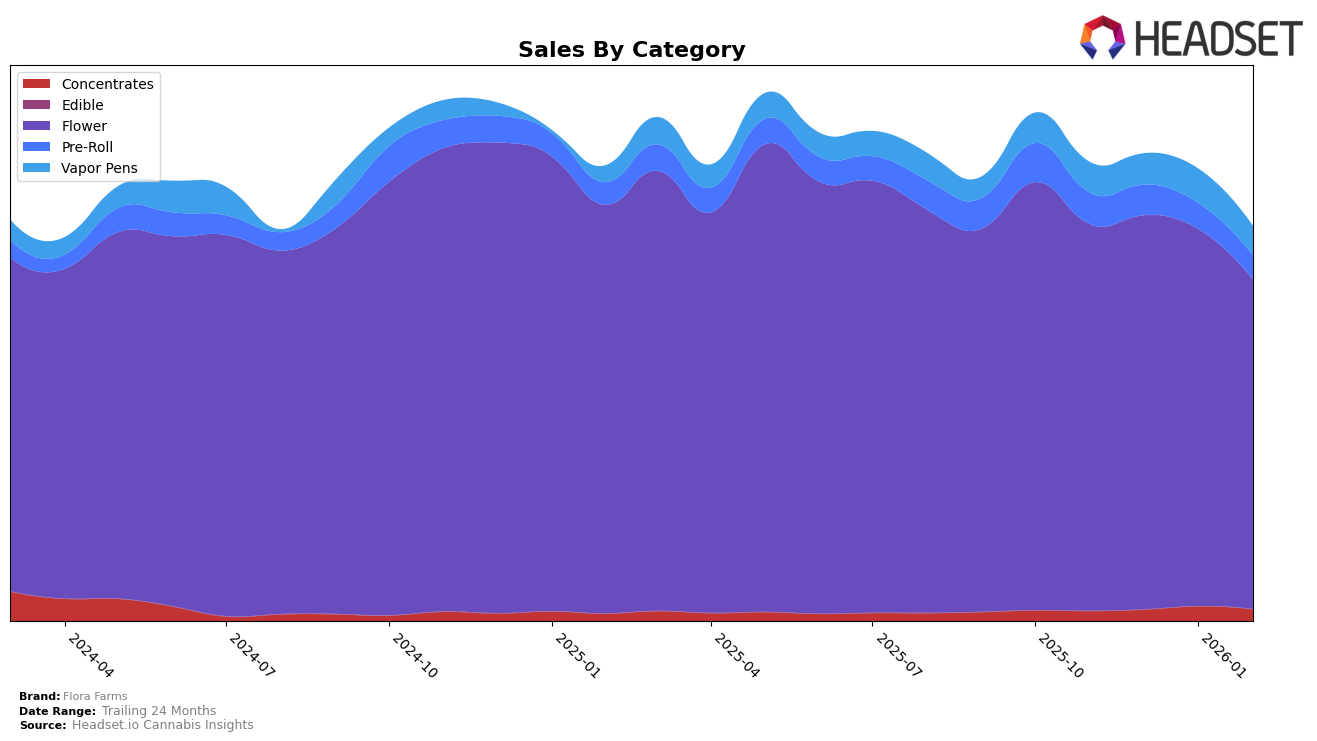

Flora Farms has shown a varied performance across different product categories in Missouri. In the Flower category, Flora Farms has maintained a dominant position, consistently ranking 1st from November 2025 through February 2026. This stability highlights their strong presence and consumer preference in this segment. However, the Pre-Roll category tells a different story, where the brand's rank slipped from 12th in November 2025 to 16th by February 2026, indicating a decline in market position. This downward trend could be a point of concern as it suggests increasing competition or shifting consumer preferences in the Pre-Roll category.

In the Concentrates category, Flora Farms has managed to hover around the 14th to 15th rank, showing a relatively stable performance, though not breaking into the top 10. This consistency might be seen as positive, but it also highlights a potential area for growth if the brand aims to climb higher in the rankings. The Vapor Pens category shows some positive momentum, with Flora Farms improving its rank from 25th in November 2025 to 21st by January 2026, though the rank stabilized in February. This upward movement suggests a growing acceptance or improvement in their offerings within this category, but the brand is still outside the top 20, indicating room for improvement. Notably, Flora Farms did not make it to the top 30 in any other states or provinces across these categories, which could imply a focus on the Missouri market or challenges in expanding their footprint beyond this state.

Competitive Landscape

In the Missouri flower category, Flora Farms has consistently maintained its top rank from November 2025 through February 2026, showcasing its dominance in the market. Despite a decline in sales from December 2025 to February 2026, Flora Farms remains ahead of its competitors. Illicit / Illicit Gardens and CODES have been vying for the second and third positions, with CODES overtaking Illicit / Illicit Gardens in December 2025. While Flora Farms experienced a notable decrease in sales by February 2026, its lead in the market remains unchallenged, as its sales figures are still significantly higher than those of its closest competitors. This sustained leadership suggests a strong brand loyalty and market presence, although the downward trend in sales may warrant strategic adjustments to maintain its competitive edge.

Notable Products

In February 2026, Flora Farms' top-performing product was Cheers - Black Garlic Pre-Roll (1g) in the Pre-Roll category, reclaiming its number 1 rank from December 2025 after a brief drop to 5th place in January. Cheers - Bubba Fett Pre-Roll (1g) rose to the 2nd position, maintaining a strong presence after its 3rd place ranking in January. Key Lime Gelato (14g), a Flower category product, secured the 3rd spot, showing consistent performance despite not ranking in January. Cheers - Key Lime Gelato Pre-Roll (1g) debuted in February at 4th place, indicating a successful launch. Notably, 24K Gold x Kosher Tangie (14g) remained stable in the top 5, holding the 5th rank with sales of $2,798.00, after peaking at 2nd in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.