Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

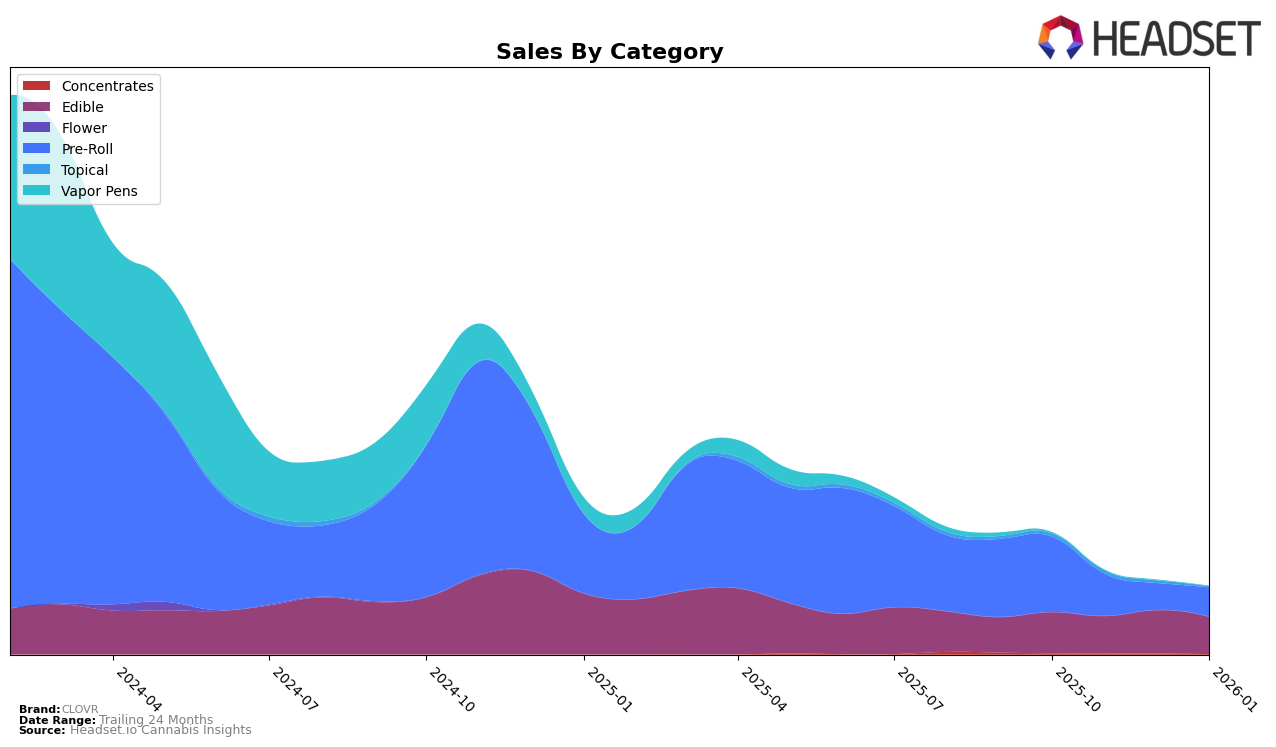

In the Missouri market, CLOVR has shown a consistent presence in the Edible category, maintaining a rank just outside the top 30, moving from 41st in October 2025 to 39th by January 2026. This slight upward trend suggests a steady improvement in their market position, albeit still outside the top tier. The sales figures also reflect this trend with a peak in December, indicating a potential seasonal demand or successful marketing strategy during that period. However, the brand's inability to break into the top 30 could signal challenges in capturing a larger market share or facing stiff competition from more dominant brands.

Conversely, CLOVR's performance in the Pre-Roll category in Missouri presents a more volatile picture. The brand's ranking witnessed significant fluctuations, dropping from 42nd in October to 60th in December, before recovering slightly to 52nd by January. This instability might point to inconsistent consumer preferences or operational challenges impacting their market standing. The sharp decline in sales from October to November, followed by a moderate recovery, further underscores the competitive and dynamic nature of this category. Such movements highlight the importance of strategic adjustments to maintain or improve their position in the Pre-Roll market.

Competitive Landscape

In the Missouri edible market, CLOVR has shown a consistent presence, maintaining its rank at 39th place from December 2025 to January 2026. Despite a dip in sales from November to January, CLOVR's December sales saw a notable increase, suggesting a potential for recovery. Comparatively, Monopoly Melts experienced a decline in rank from 37th in October to 40th in January, with a significant drop in sales in January, which could present an opportunity for CLOVR to capture some of their market share. Meanwhile, The Standard has maintained a stronger position, consistently ranking higher than CLOVR, indicating a competitive edge in the market. Dark Horse Cannabis showed a positive trend, improving its rank from 44th in November to 37th in January, which CLOVR should monitor closely as a rising competitor. Lastly, Big Pete's Treats remained outside the top 40, indicating less immediate competition for CLOVR in terms of rank.

Notable Products

In January 2026, the top-performing product for CLOVR was the Watermelon Sucker 25mg, which ascended to the number one rank with sales of 437 units, maintaining its strong position from the previous months. Following closely was the Slurricane Distillate Infused Pre-Roll 1g, debuting in the rankings at the second spot with a notable 405 units sold. The 72% Venezuelan Dark Chocolate Bar 10-Pack 100mg made a significant leap to the third position, showing a marked increase from its absence in December 2025 rankings. The Burnt Toast Pre-Roll 1g entered the rankings at fourth place with 316 units sold. The CBD/THC/CBG 1:1:1 Mocha Milk Chocolate Bar 10-Pack 100mg maintained its fifth position from December, indicating stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.