Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

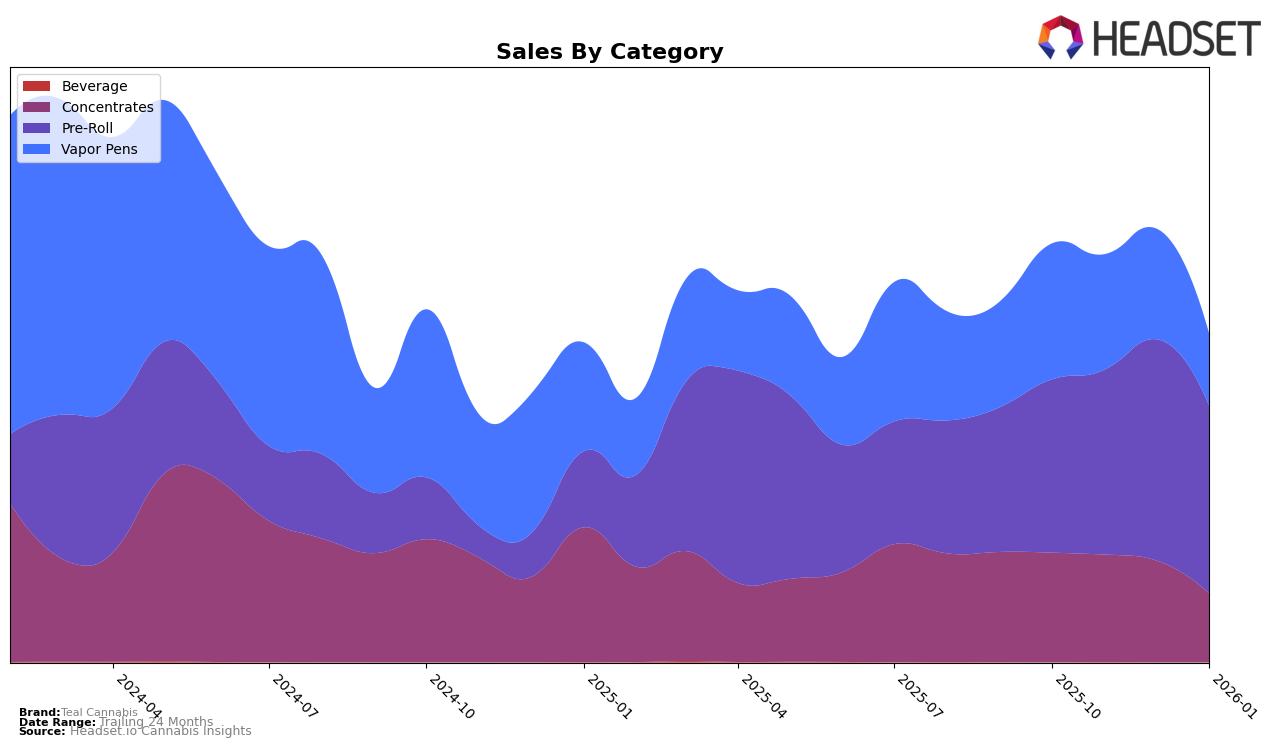

Teal Cannabis has shown varied performance across different product categories in Missouri. In the Concentrates category, the brand has experienced a downward trend, slipping from rank 22 in October 2025 to rank 29 by January 2026. This decline in ranking is mirrored by a decrease in sales, which saw a notable drop from $69,411 in October to $43,466 by January. Such a movement indicates potential challenges in maintaining market share within this category. Meanwhile, in the Vapor Pens category, Teal Cannabis did not manage to break into the top 30 brands, indicating a significant gap in performance compared to its competitors.

Conversely, Teal Cannabis has shown resilience in the Pre-Roll category within Missouri. Starting from a rank of 39 in October 2025, the brand improved its position to 28 by December, although it slightly dipped to 32 in January 2026. This positive trajectory suggests a growing consumer acceptance and potential for further growth in this category. The sales figures support this trend, as there was an increase from $109,666 in October to a peak of $140,177 in December, before a slight decrease in January. This performance indicates that while Teal Cannabis faces challenges in some areas, it has opportunities for growth and market penetration, particularly in the Pre-Roll segment.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, Teal Cannabis has shown a promising upward trajectory in its rankings over the past few months. Starting from a rank of 39 in October 2025, Teal Cannabis improved its position to 34 in November, reaching a peak of 28 in December, before slightly declining to 32 in January 2026. This positive trend in rankings is mirrored by a consistent increase in sales, particularly notable in December when Teal Cannabis experienced a significant boost. In comparison, TRIP also demonstrated a strong performance, moving from a rank of 41 in October to 29 in December, indicating a competitive edge in the market. Meanwhile, Sundro Cannabis and Lake Water have experienced a downward trend in sales, which may present an opportunity for Teal Cannabis to capture more market share. Despite these fluctuations, Teal Cannabis remains a formidable player, with its strategic improvements in rank and sales positioning it well against competitors like Kaviar, which has maintained a relatively stable but lower rank throughout the same period.

Notable Products

In January 2026, the top-performing product for Teal Cannabis was the Florida Kush Pre-Roll (1g), leading with sales of 1168 units. Following closely, the Lemon Cherry Gelato Pre-Roll 2-Pack (1g) secured the second rank. The Applescotti x Heirheads Pre-Roll 2-Pack (1g) improved its position significantly, moving from fifth in October 2025 to third in January 2026. The Papa Burger x Chem Gem Diamond Infused Pre-Roll (1g) maintained its fourth position from December 2025 to January 2026. Lastly, the Apples & Bananas x Apple Fritter Pre-Roll (1g) rounded out the top five, marking its first appearance in the rankings for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.