Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

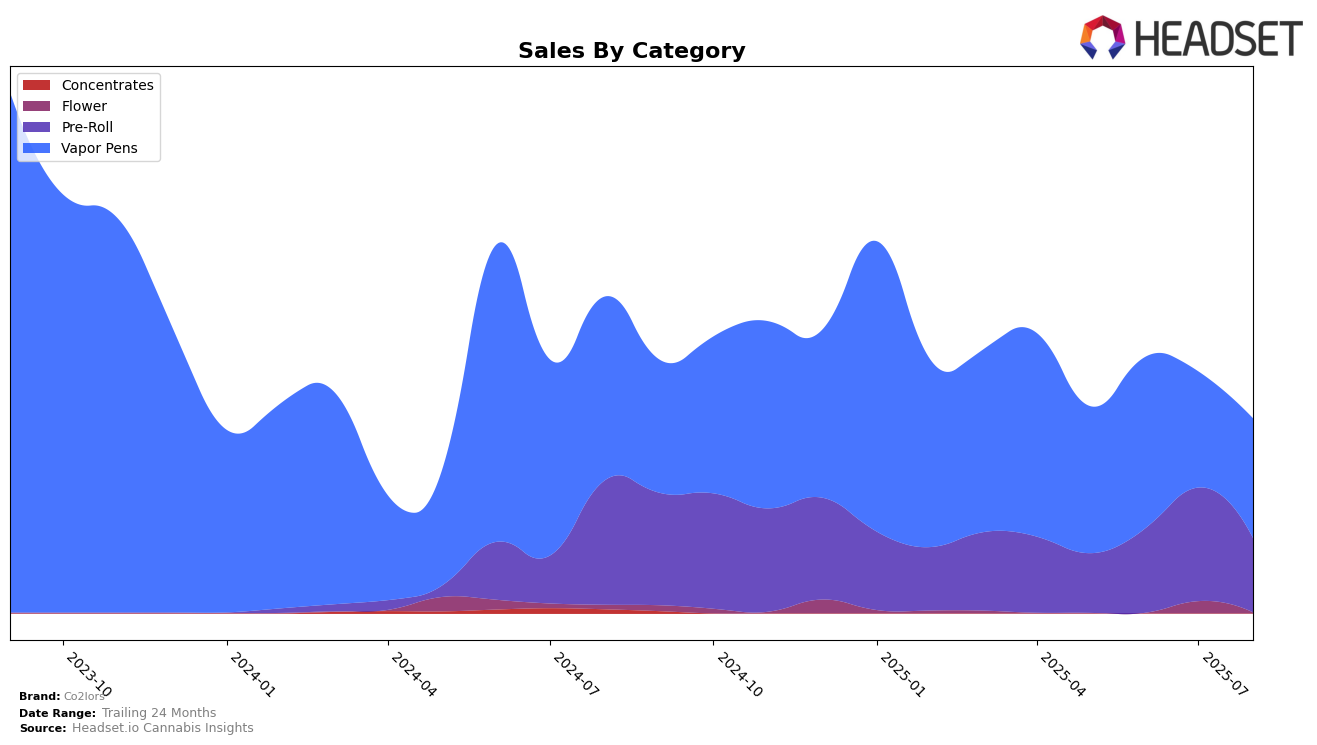

In the vapor pen category, Co2lors has experienced varying performance across different states. In Arizona, the brand did not make it into the top 30 rankings from May through August 2025, indicating a challenging market presence in that state. However, in Colorado, Co2lors showed a more dynamic performance, fluctuating between ranks 56 and 67 over the same period. The sales figures in Colorado reveal a recovery in August after a dip in July, suggesting potential market resilience. Meanwhile, in Maryland, Co2lors consistently ranked within the top 50 for vapor pens, although there was a downward trend in August, which could point to increasing competition or shifts in consumer preferences.

In the pre-roll category in Maryland, Co2lors has demonstrated a strong upward trajectory. Starting at rank 34 in May, the brand climbed to rank 24 by July, before experiencing a slight dip to rank 30 in August. This indicates a solid performance and a strong market position within Maryland's pre-roll segment. Notably, sales in this category peaked in July, underscoring the brand's growing popularity and consumer acceptance. However, the slight decline in August suggests the need for strategic adjustments to maintain momentum. This mixed performance across states and categories highlights the importance of localized market strategies for Co2lors as it navigates the competitive landscape.

Competitive Landscape

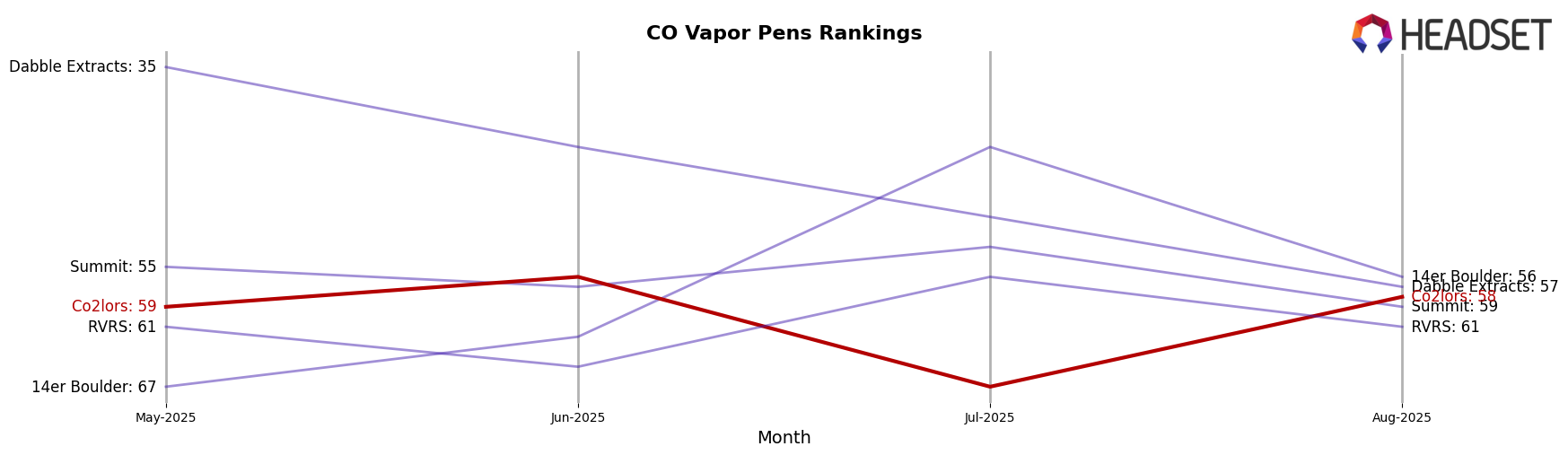

In the competitive landscape of vapor pens in Colorado, Co2lors has experienced fluctuating rankings from May to August 2025, indicating a dynamic market presence. In May, Co2lors ranked 59th, slightly improving to 56th in June, but then dropping to 67th in July before recovering to 58th in August. This volatility is mirrored by its competitors, such as Dabble Extracts, which saw a consistent decline in rank from 35th in May to 57th in August, and Summit, which maintained a relatively stable but lower rank, peaking at 53rd in July. Meanwhile, 14er Boulder showed a significant improvement, climbing from 67th in May to 43rd in July before dropping again. Co2lors' sales figures reflect these ranking changes, with a notable dip in July, aligning with its lowest rank, but showing resilience with a rebound in August. This suggests that while Co2lors faces stiff competition, particularly from brands like 14er Boulder, it remains a significant player capable of recovering market position amidst fluctuating dynamics.

Notable Products

In August 2025, the top-performing product for Co2lors was Sweet Melon BDT Distillate Disposable (1g) in the Vapor Pens category, reclaiming its top spot with sales reaching 665 units. Another notable product is the Apricot x Whoopie Pie Infused Pre-Roll 2-Pack (1g), which climbed to the second position from fourth in July. Sweet Melon x Sour Papaya Infused Pre-Roll 2-Pack (1g) saw a slight decline, moving from second to third place. Grape Dreams CO2 Distillate Disposable (1g) reentered the rankings at fourth, while Strawberry Lemonade BDT Distillate Cartridge (2g) made its debut in the fifth position. Overall, the rankings indicate a dynamic shift in consumer preferences, with infused pre-rolls gaining traction over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.