Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

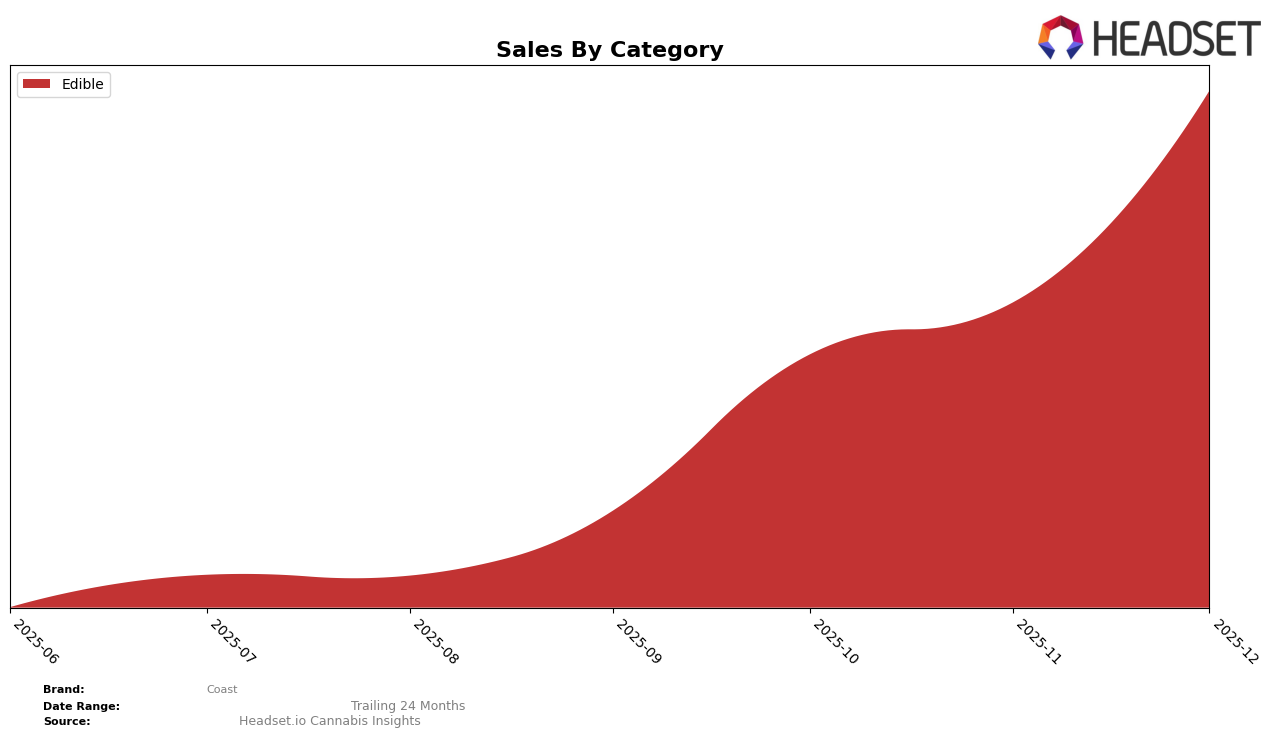

In the state of Maryland, Coast has demonstrated a consistent upward trajectory in the Edible category. Starting from a rank of 28 in September 2025, Coast improved its position to 16 by December 2025, marking a significant rise in its market presence. This improvement is underscored by a substantial increase in sales, with December figures nearly doubling those of November. The brand's ability to climb the rankings in Maryland suggests strong consumer acceptance and effective market strategies, which could indicate a promising outlook for the upcoming year.

Conversely, Coast's performance in the Edible category in New Jersey has been relatively stable, although less dynamic than in Maryland. The brand managed to break into the top 30 by October 2025 and maintained its position, ending the year at rank 29. While this indicates some level of market penetration, the lack of significant movement within the top 30 suggests that Coast may face more competitive pressures or market challenges in New Jersey. The consistent ranking, however, does reflect a stable consumer base, which could be leveraged for future growth opportunities.

Competitive Landscape

In the Maryland edible cannabis market, Coast has demonstrated a significant upward trajectory in its brand ranking and sales performance over the last quarter of 2025. Starting from a rank of 28 in September, Coast climbed to the 16th position by December, indicating a strong market presence and increasing consumer preference. This rise is particularly notable when compared to competitors like Dixie Elixirs, which maintained a relatively stable rank around 13-14, and Sunnies by SunMed, which hovered between ranks 15 and 18. While Beezle Extracts and Evermore Cannabis Company experienced fluctuations, Coast's consistent improvement in sales, culminating in a December sales figure comparable to the top brands, suggests a successful strategic positioning and growing brand loyalty in the competitive Maryland market.

Notable Products

In December 2025, the top-performing product from Coast was the THC/CBN/CBC 1:1:1 Blissful Blueberry Gummies 20-Pack, which climbed to the number one rank with notable sales of 2602 units. The THCV/CBD/THC 1:1:1 Raspberry Lime Gummies maintained a consistent second place throughout the last three months, demonstrating stable demand. The Nighttime - CBN/CBD/THC 1:1:1 Cranberry Pomegranate Gummies rose to the third position from fifth in November, indicating a surge in popularity. Meanwhile, the Nighttime - CBN/THC 5:1 Goodnight Grape Gummies fell from the top spot in previous months to fourth in December. The CBG/CBD/THC 1:1:1 Tangerine Gummies rounded out the top five, showing a steady performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.