Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

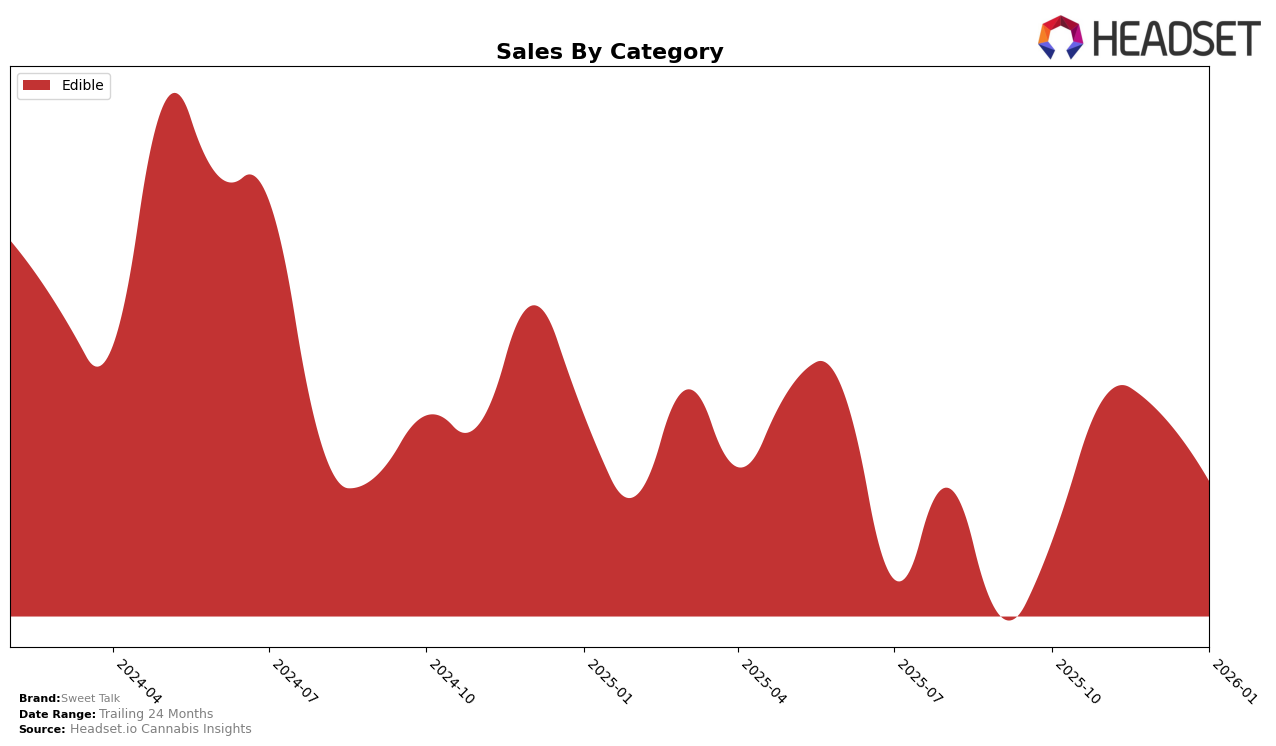

Sweet Talk has maintained a consistent presence in the Edible category within Maryland. Across the months from October 2025 to January 2026, the brand consistently held the 25th rank, indicating a stable position in a competitive market. Despite fluctuations in monthly sales figures, with a peak in November 2025, Sweet Talk's ability to remain in the top 30 brands highlights its resilience and steady consumer demand. This consistent ranking suggests that while Sweet Talk is not leading the category, it has established a reliable foothold, which is crucial for long-term brand sustainability.

Analyzing Sweet Talk's performance across different states and categories reveals that its presence is not as strong outside of Maryland, as it did not appear in the top 30 brands in other states during the same period. This absence could either reflect a strategic focus on Maryland or signal opportunities for expansion and growth in new markets. The lack of ranking in other states might be a concern for stakeholders looking for broader market penetration, but it also presents potential for targeted marketing efforts to boost visibility and sales in untapped regions. Understanding these dynamics can help guide future strategies for Sweet Talk as it navigates the competitive cannabis landscape.

```Competitive Landscape

In the Maryland edible market, Sweet Talk consistently held the 25th rank from October 2025 through January 2026, indicating stable positioning amidst fluctuating sales figures. Despite this consistency, Sweet Talk faces stiff competition from brands like Coast, which saw a notable rise in rank from 23rd in October to 17th in December, before settling back to 23rd in January. This upward trend in Coast's ranking suggests a potential threat to Sweet Talk's market share, as Coast's sales also surged significantly in December. Meanwhile, Valhalla and Garcia Hand Picked showed more volatility in their rankings, with Valhalla peaking at 23rd in November and Garcia Hand Picked maintaining a relatively stable presence around the 24th to 26th positions. Sweet Talk's consistent rank amidst these fluctuations highlights its steady performance, yet the brand must strategize to capitalize on growth opportunities and counter the rising competition from brands like Coast.

Notable Products

In January 2026, Sweet Talk's Blue Raspberry Gummies 10-Pack (100mg) emerged as the top-performing product, climbing from the second position in November 2025 to the first, with notable sales of 671 units. Watermelon Gummies 10-Pack (100mg) also showed a strong performance, securing the second rank after consistently holding the fourth position in December 2025. Guava Passionfruit Gummies 10-Pack (100mg), previously the leader for three consecutive months, dropped to the third position. Watermelon Gummies 20-Pack (100mg) maintained its momentum, moving up to the fourth rank from fifth in December 2025. Indica Strawberry Kiwi Nano Gummies 10-Pack (100mg) slipped to the fifth position, showcasing a decline in sales figures compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.