Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

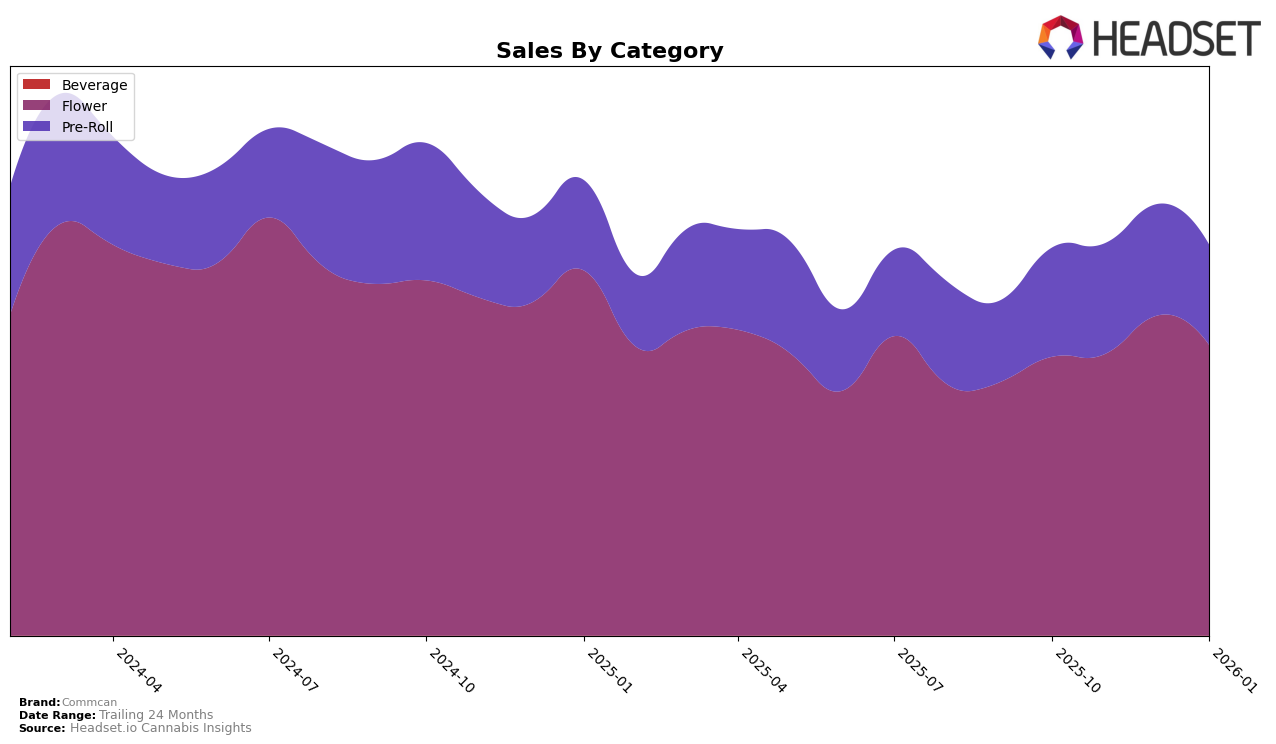

Commcan has shown a consistent performance in the Massachusetts market, particularly in the Flower category. Over the months from October 2025 to January 2026, Commcan improved its ranking from 28th to 24th, demonstrating a positive trend. This upward movement is complemented by a noticeable increase in sales, especially in December 2025, where sales peaked. This suggests a strong market presence and possibly effective marketing strategies or product offerings that resonate well with consumers in Massachusetts. However, the brand did not make it to the top 30 in the Pre-Roll category during this period, which could indicate a need for strategic adjustments in that segment.

In the Pre-Roll category, Commcan's performance in Massachusetts has been less impressive, maintaining a consistent rank of 33rd during the last three months of the reported period. Despite this stability, the brand did not break into the top 30, which might be seen as a missed opportunity in a competitive market. The sales figures in this category show a slight decline in January 2026, which could be a point of concern if the trend continues. This suggests that while Commcan has a strong foothold in the Flower category, there is room for growth and improvement in their Pre-Roll offerings to capture more market share and improve their overall brand positioning.

Competitive Landscape

In the Massachusetts flower category, Commcan has shown a dynamic performance over the past few months, with notable fluctuations in its ranking. Starting from October 2025, Commcan was ranked 28th, but it improved to 25th in November and further climbed to 22nd in December, before slightly dipping to 24th in January 2026. This upward trend in late 2025 indicates a positive reception of their products, although the slight drop in January suggests increased competition. Notably, Garcia Hand Picked consistently maintained a higher rank than Commcan, despite experiencing a dip in sales in November. Meanwhile, Legends made a significant leap from 49th in October to 25th by December, matching Commcan's rank in January, which could indicate a rising threat. Bostica also demonstrated strong performance, starting at 12th and gradually declining to 23rd, yet still maintaining a competitive edge over Commcan. These shifts highlight the competitive landscape in Massachusetts, where Commcan must strategize to maintain and improve its market position amidst strong contenders.

Notable Products

In January 2026, Orange Zorbet Pre-Roll (1g) emerged as the top-performing product for Commcan, with sales reaching 2028 units. Following closely was J1 Pre-Roll (1g), securing the second position. Sour Diesel Pre-Roll (1g) improved its rank from fourth in November to third in January, showing a notable increase in popularity. Valley Vixen Pre-Roll (1g) maintained a consistent presence, ranking fourth in both October and January. Daily Special Pre-Roll (1g) rounded out the top five, highlighting a strong entry for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.