Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

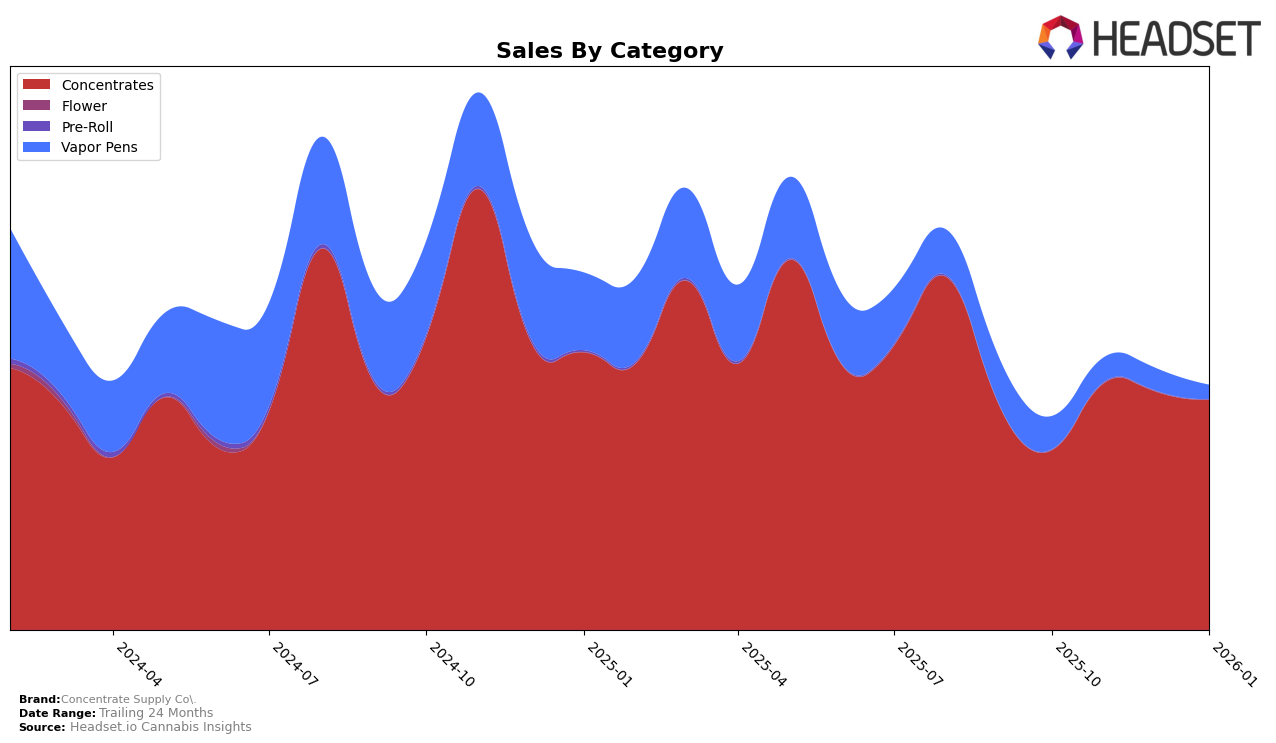

Concentrate Supply Co. has demonstrated notable performance in the Colorado concentrates category, showing a consistent presence in the top rankings. From October 2025 to January 2026, the brand improved its position from 15th to 9th place, a significant upward trend indicating growing consumer preference and market penetration. This consistent presence in the top 15 underscores the brand's strong foothold in the concentrates category, with sales peaking in November 2025. Such movements suggest that Concentrate Supply Co. is effectively maintaining its competitive edge in a dynamic market.

In contrast, the performance in the vapor pens category presents a different picture. Concentrate Supply Co. did not rank in the top 30 in Colorado, indicating a weaker position in this segment. The rankings fluctuated from 72nd in October 2025 to 80th by January 2026, reflecting challenges in capturing market share or consumer interest in vapor pens. This decline in rankings, coupled with decreasing sales figures over the same period, highlights potential areas for strategic improvement or reevaluation of their product offerings within this category.

Competitive Landscape

In the Colorado concentrates market, Concentrate Supply Co. has demonstrated a notable improvement in its competitive positioning over the last few months. Starting from a rank of 15th in October 2025, the brand climbed to 9th place by November, briefly dropped to 11th in December, and regained the 9th position in January 2026. This upward trend in rank reflects a strategic enhancement in market presence, likely driven by increased sales performance, as evidenced by a significant sales jump from October to November. In comparison, Denver Dab Co maintained a stable rank around 8th, while Dabble Extracts and LEIFFA experienced fluctuations in their rankings, with LEIFFA dropping from 8th to 11th by January. Meanwhile, Billo showed a strong performance, consistently ranking in the top 7, except for a dip in November. These dynamics suggest that while Concentrate Supply Co. is gaining ground, it faces stiff competition from established brands that are also vying for higher market shares in Colorado.

Notable Products

In January 2026, Concentrate Supply Co.'s top-performing product was Double Solo Burger Sugar Wax (1g), which secured the number one spot with sales reaching 913 units. Willyz Wonkaz Sugar Wax (1g) followed closely behind in second place, marking a strong entry into the top rankings. Party Crasher Wax (1g) experienced a slight decline, moving from first place in November and December 2025 to third place in January 2026, with sales of 476 units. Sweet Durban Shatter (1g) and Hybrid Wax (1g) completed the top five, ranking fourth and fifth, respectively. This shift in rankings indicates a dynamic change in consumer preferences, with Double Solo Burger Sugar Wax making a significant leap to the forefront.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.