Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

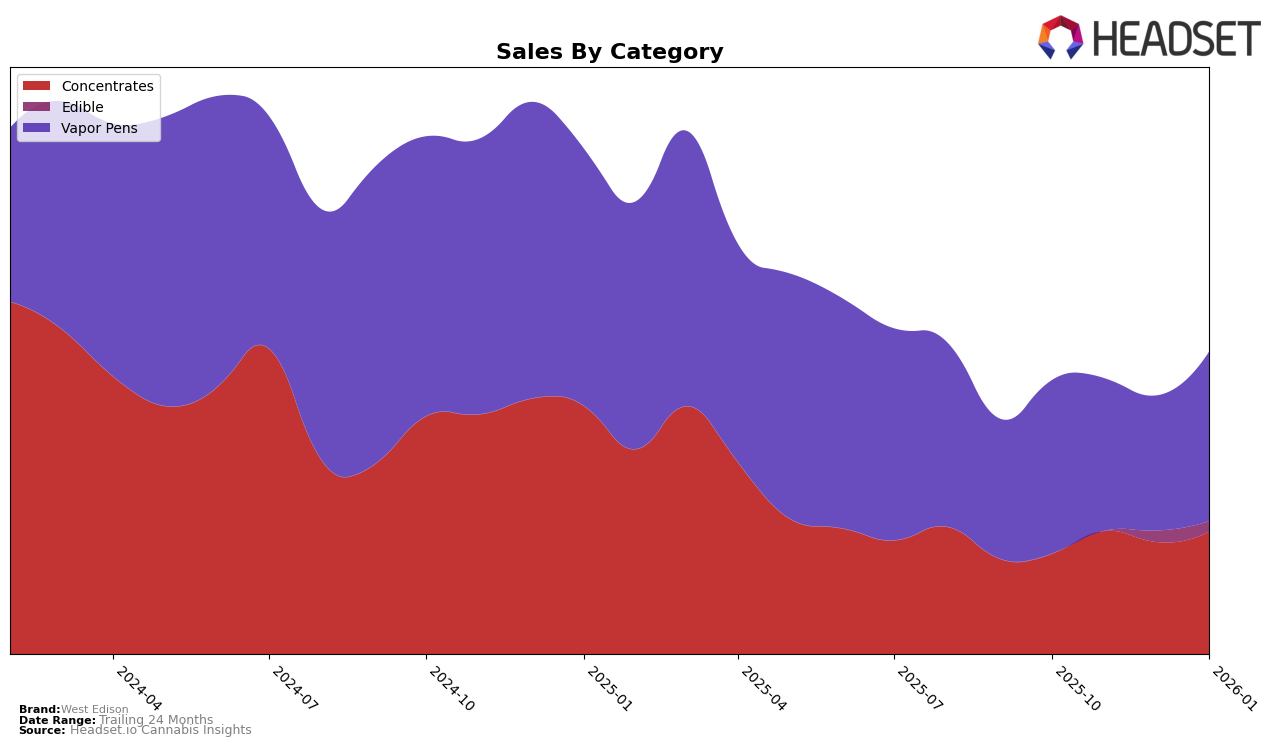

West Edison has demonstrated a consistent performance in the Colorado market, particularly within the concentrates category. Over the months from October 2025 to January 2026, West Edison maintained a steady presence in the top 30, with rankings fluctuating slightly but showing a positive trend from 27th to 23rd. This stability is indicative of a solid market presence and suggests a loyal consumer base. In contrast, the brand's performance in the edible category did not make it into the top 30 until January 2026, where it emerged in the 38th position, indicating potential growth opportunities but also highlighting the competitive nature of this segment.

In the vapor pens category, West Edison faced more challenges, with its ranking slipping from 37th in October 2025 to 40th in December 2025 before recovering slightly to 36th in January 2026. This fluctuation suggests volatility and possibly heightened competition in this category within the Colorado market. Despite this, the brand's sales figures portray a different story, with a notable increase in January 2026 sales compared to the previous months, hinting at a potential upward trajectory. These insights into West Edison’s performance across different product categories and their respective rankings provide a glimpse into the brand's strategic positioning and market dynamics in Colorado.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, West Edison has shown a dynamic performance over the past few months. While it started at rank 37 in October 2025, it experienced a slight decline to 40 in December, before bouncing back to 36 in January 2026. This fluctuation indicates a competitive market where brands like AO Extracts and Wavelength Extracts have also been vying for top positions. Notably, Wavelength Extracts made a significant leap from 43 in October to 25 in November, showcasing a strong upward trend that could pose a challenge to West Edison. Meanwhile, Good Chemistry Nurseries and Roll One / R.O. have remained outside the top 20, indicating less immediate threat. West Edison's ability to regain its rank in January suggests resilience and potential for growth, but the brand must remain vigilant against the rising competition to maintain and improve its market position.

Notable Products

In January 2026, Green Crack Distillate Cartridge (1g) emerged as the top-performing product for West Edison, climbing from the fifth position in December 2025 to first place, with sales reaching 618 units. Kabuki Sour Budder (1g) made a notable entry as the second-ranked product, having not appeared in the rankings of previous months. Blueberry Blast Distillate Cartridge (1g) secured the third spot, marking its debut in the rankings. Sour Diesel Distillate Cartridge (1g), which was previously unranked in November and December 2025, re-entered the list at fourth place. White Rhino Distillate Cartridge (1g) followed closely, debuting at the fifth position in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.