Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

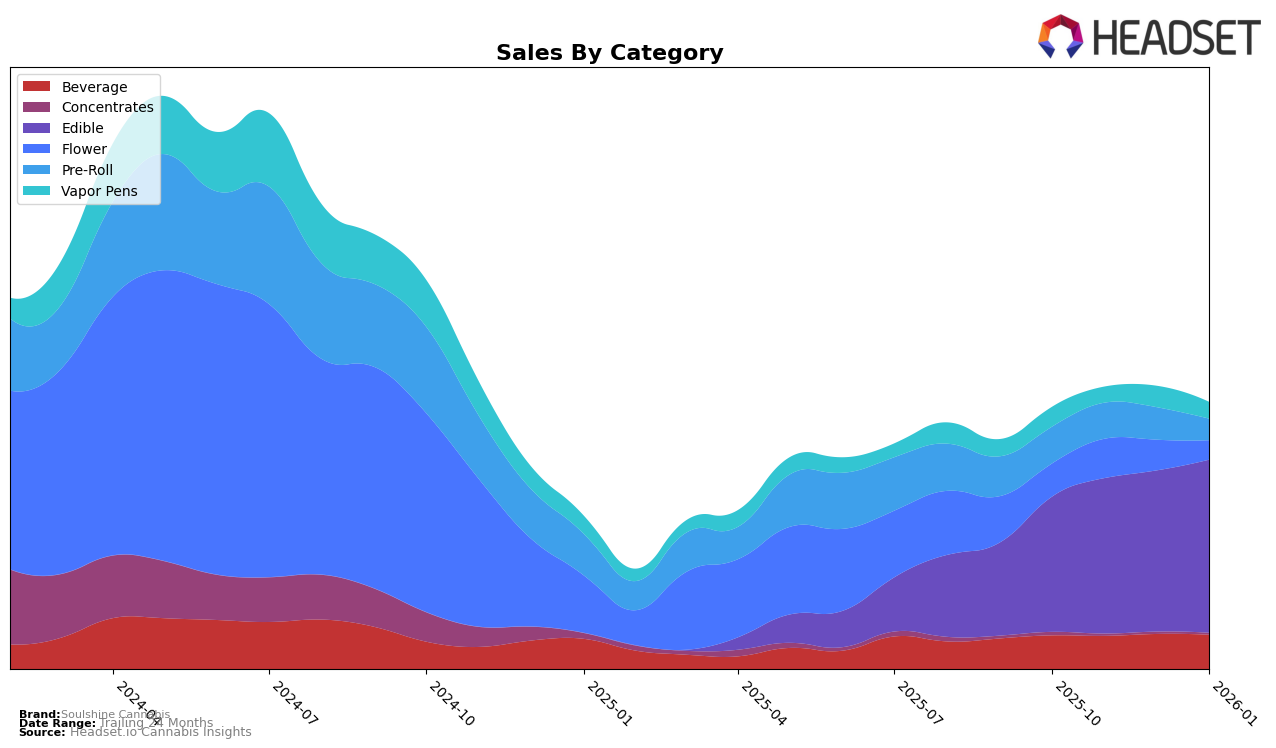

Soulshine Cannabis has shown a consistent performance in the Washington market, particularly within the Beverage and Edible categories. In the Beverage category, the brand maintained its presence within the top 20, although there was a slight decline from 15th in October 2025 to 17th by January 2026. Despite this minor drop in ranking, sales figures remained relatively stable, indicating a loyal consumer base. Meanwhile, in the Edible category, Soulshine Cannabis demonstrated a positive upward trend, improving its rank from 23rd in October 2025 to 20th in January 2026. This upward movement was accompanied by a steady increase in sales, suggesting a growing popularity of their edible products.

Interestingly, the Edible category not only saw an improvement in rank but also in sales volume, with a notable increase from October to January. This could imply a strategic focus on enhancing their edible offerings, which seems to be resonating well with consumers in Washington. However, it's worth noting that Soulshine Cannabis did not feature in the top 30 brands in other states or provinces, which might indicate either a limited geographical reach or a highly competitive market landscape outside of Washington. The absence of rankings in other regions could be seen as a potential area for growth, should the brand decide to expand its footprint beyond its current market stronghold.

Competitive Landscape

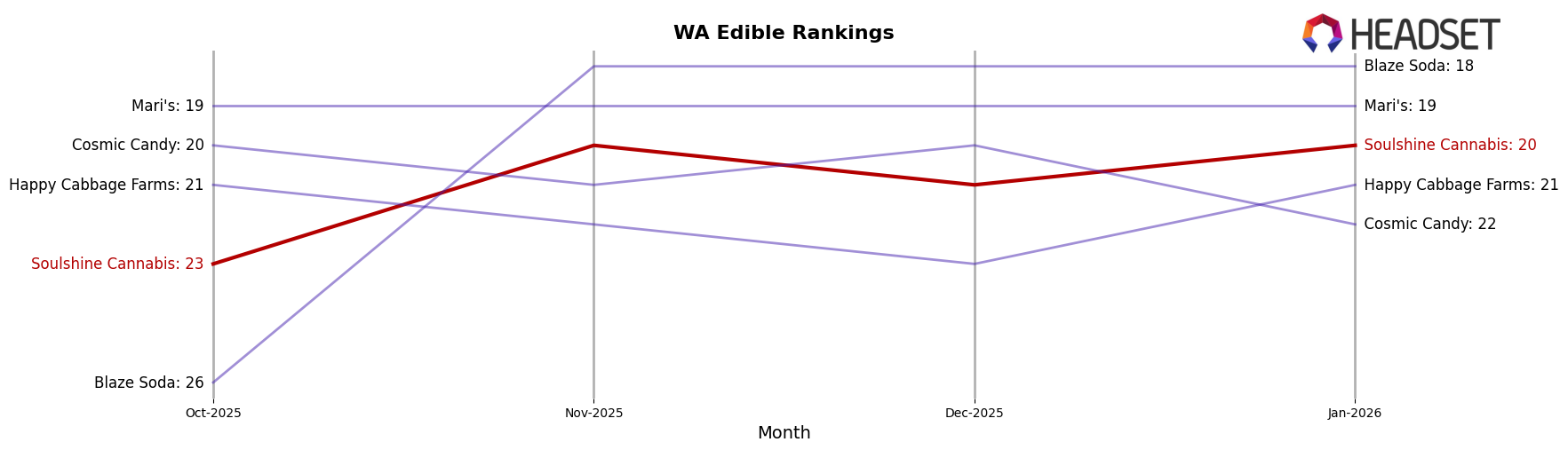

In the Washington edible market, Soulshine Cannabis has shown a steady presence, maintaining a rank within the top 20 from November 2025 to January 2026. Despite starting at rank 23 in October 2025, Soulshine Cannabis improved to rank 20 by November and maintained a similar position through January 2026. This upward trend in rank is mirrored by a consistent increase in sales, suggesting a positive reception of their products. However, competition remains fierce, particularly from Blaze Soda, which jumped from rank 26 in October to 18 by November and maintained that rank through January 2026, with sales figures surpassing Soulshine Cannabis by a notable margin. Mari's consistently held rank 19, indicating stable performance, while Cosmic Candy and Happy Cabbage Farms experienced fluctuations, with Cosmic Candy dropping to rank 22 by January. These dynamics highlight the competitive pressures Soulshine Cannabis faces, emphasizing the need for strategic marketing and product differentiation to maintain and improve its market position.

Notable Products

In January 2026, the top-performing product for Soulshine Cannabis was the Moon CBD/CBN/THC 3:2:1 Blueberry Gummies 10-Pack, maintaining its first-place rank from previous months with sales of 1247 units. The Sun CBD/CBG/THC 3:2:1 Strawberry Gummies 10-Pack held steady in second place, showing a notable increase from its fourth-place position in November. The Sun CBD/CBG/THC 3:2:1 Watermelon Hash Rosin Gummies 10-Pack ranked third, maintaining a consistent performance over the months. Newly introduced to the rankings, the Moon CBD/CBN/THC 3:2:1 Blue Raspberry Gummies 10-Pack debuted at fourth place. Meanwhile, the Moon CBD/CBN/THC 3:2:1 Mango Solventless Gummies 10-Pack retained its fifth-place position, showing a positive sales trend since its introduction in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.