Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

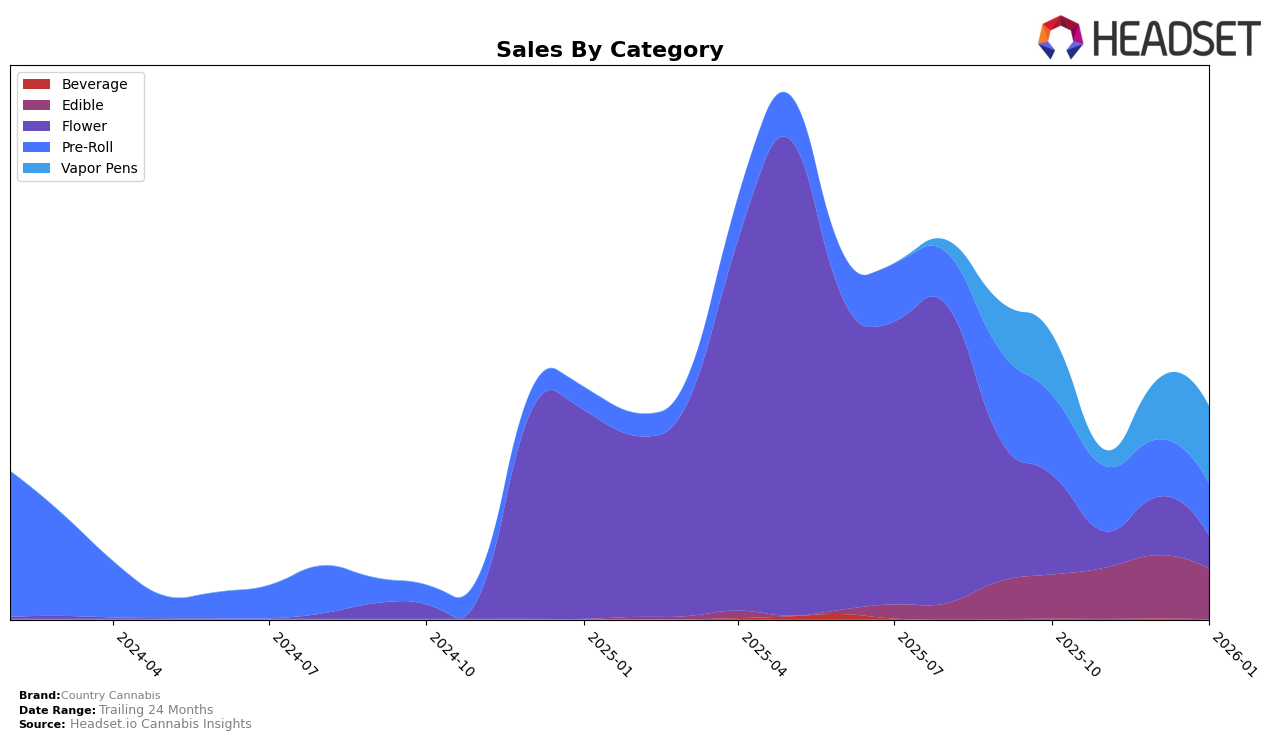

Country Cannabis has demonstrated fluctuating performance across different product categories and states. In the Massachusetts market, the brand's ranking in the Edible category has seen a slight improvement over the months, moving from 59th in October 2025 to 55th by January 2026. Despite this positive trend, the brand has yet to break into the top 30, indicating room for growth. In contrast, the Vapor Pens category shows more dynamic movement. Although Country Cannabis was not ranked in November 2025, they managed to climb to 85th by January 2026, suggesting a potential upward trajectory in this category.

While the rankings provide a glimpse into Country Cannabis's market position, the sales figures reveal more about their performance. In the Edible category, sales peaked in December 2025 before experiencing a decline in January 2026. This could imply a seasonal demand or a response to competitive pressures. Meanwhile, the Vapor Pens category showed a notable sales increase from October 2025 to January 2026, which might be indicative of growing consumer interest or successful marketing strategies. The absence of a ranking in November 2025 in this category highlights a potential challenge or opportunity that the brand may have faced during that period.

Competitive Landscape

In the competitive landscape of vapor pens in Massachusetts, Country Cannabis has shown a notable fluctuation in its market position. Starting at rank 99 in October 2025, the brand was absent from the top 20 in November, indicating a dip in visibility and possibly sales. However, it rebounded to rank 100 in December and improved to 85 by January 2026. This upward trend suggests a recovery in market presence, potentially driven by strategic marketing or product improvements. In comparison, The Clear experienced a consistent decline in rank from 64 to 81 over the same period, which might reflect a decrease in consumer interest or increased competition. Meanwhile, Sanctuary Medicinals showed a volatile pattern, peaking at rank 73 in December but dropping to 86 in January. These dynamics highlight the competitive pressures and opportunities for Country Cannabis to capitalize on its recent gains and further solidify its position in the Massachusetts vapor pen market.

Notable Products

In January 2026, the top-performing product for Country Cannabis was the Watermelon Rush Distillate Cartridge (1g) in the Vapor Pens category, climbing to the number one rank with sales of 449 units. The Blueberry Dream Distillate Cartridge (1g) also performed strongly, securing the second spot with a slight drop from its October 2025 rank of fourth. The Win The Day x London Jelly Pre-Roll 6-Pack (3.6g) improved to third place, demonstrating consistent sales growth from November and December 2025. The CBG/THC 1:1 Watermelon Rush Gummies 20-Pack, previously holding the top rank in December, fell to fourth position. Finally, the Blueberry Dream Gummies 20-Pack ranked fifth, showing a decline from its third place in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.