Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

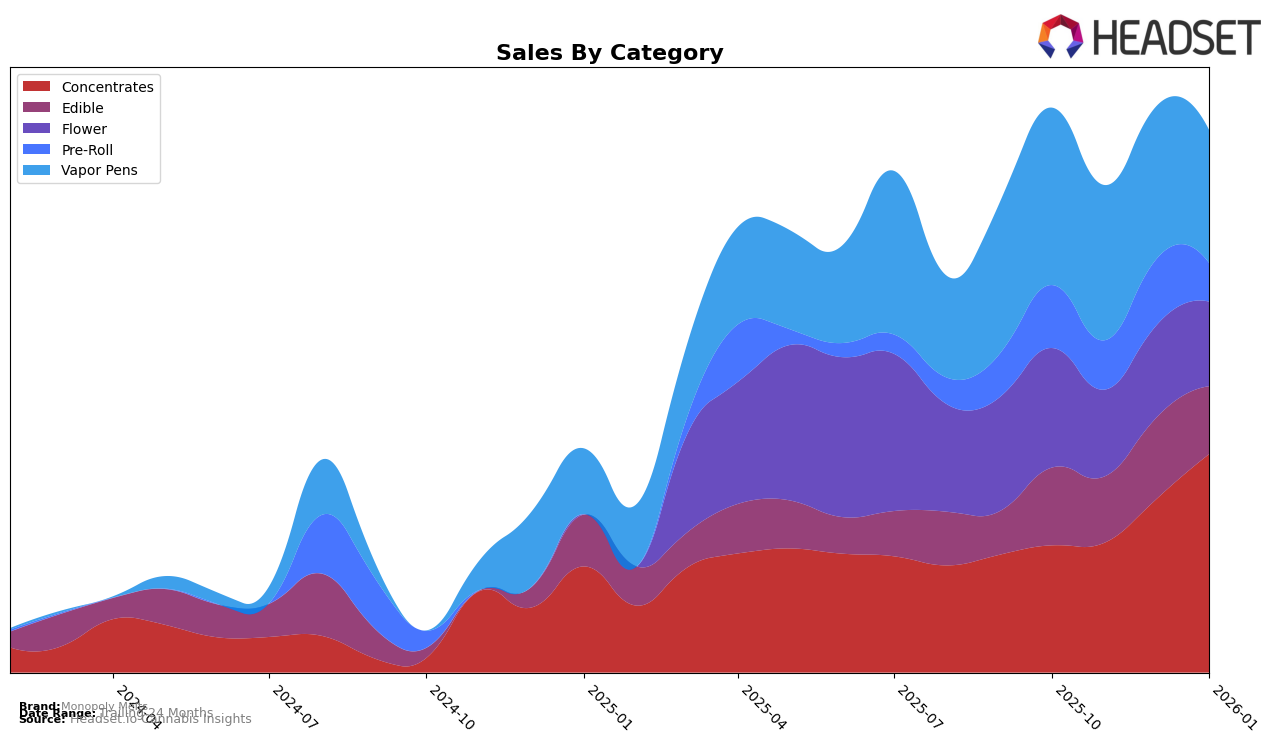

Monopoly Melts has shown notable performance in the Michigan market, particularly in the Concentrates category. Over the span from October 2025 to January 2026, the brand climbed from a rank of 73 to 32, indicating a significant upward trend in popularity and sales. This rise is underscored by a sharp increase in sales from $48,601 to $129,848. In contrast, their performance in the Edible category was less impressive, as they only appeared in the rankings in January 2026 at position 96, suggesting a late but emerging presence. Meanwhile, their Vapor Pens category experienced a steady but modest improvement, moving from rank 83 to 67. This suggests a consistent, if not dramatic, growth in consumer interest for their vapor products.

In Missouri, Monopoly Melts maintained a stable position in the Concentrates category, ranking consistently around the low 20s, which reflects a solid foothold in this segment despite a slight fluctuation in sales. However, the Edible category presents a different story, where the brand's rank hovered around the high 30s to low 40s, indicating a competitive challenge or a niche market focus. Their performance in the Vapor Pens category, however, showed a downward trajectory, falling from rank 51 to 80. This decline could point to shifting consumer preferences or increased competition. The Flower and Pre-Roll categories also saw modest fluctuations, with rankings staying outside the top 50, which may suggest areas for potential growth or repositioning strategies.

Competitive Landscape

In the Michigan concentrates category, Monopoly Melts has demonstrated a notable upward trajectory in its market presence, particularly from December 2025 to January 2026. During this period, Monopoly Melts improved its rank significantly from 50th to 32nd, indicating a positive shift in consumer preference and brand visibility. This improvement is particularly impressive given the competitive landscape, where brands like Exotic Matter experienced a decline from 10th to 30th place, despite having higher sales figures. Meanwhile, Light Sky Farms and Rise (MI) also showed fluctuations in their rankings, with Light Sky Farms moving from 37th to 29th and Rise (MI) climbing from 43rd to 34th. These dynamics suggest that while Monopoly Melts may not yet match the sales volume of some competitors, its strategic positioning and potential market strategies are effectively enhancing its competitive stance in the Michigan concentrates market.

Notable Products

In January 2026, Sunset Papaya Live Rosin (1g) emerged as the top-performing product for Monopoly Melts, achieving the number one rank in sales with 778 units sold. Rainbow Push Pop Live Rosin Disposable (0.5g) followed closely in second place, while S'mores Live Rosin Milk Chocolate 10-Pack (200mg) secured the third position. Tallymon Live Rosin Disposable (0.5g) ranked fourth, and Acai Mintz (3.5g) completed the top five. Notably, all these products were not ranked in the previous months, indicating a significant rise in popularity or a recent launch. The strong performance across categories such as Concentrates, Vapor Pens, Edible, and Flower highlights a diverse consumer interest in Monopoly Melts' offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.