Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

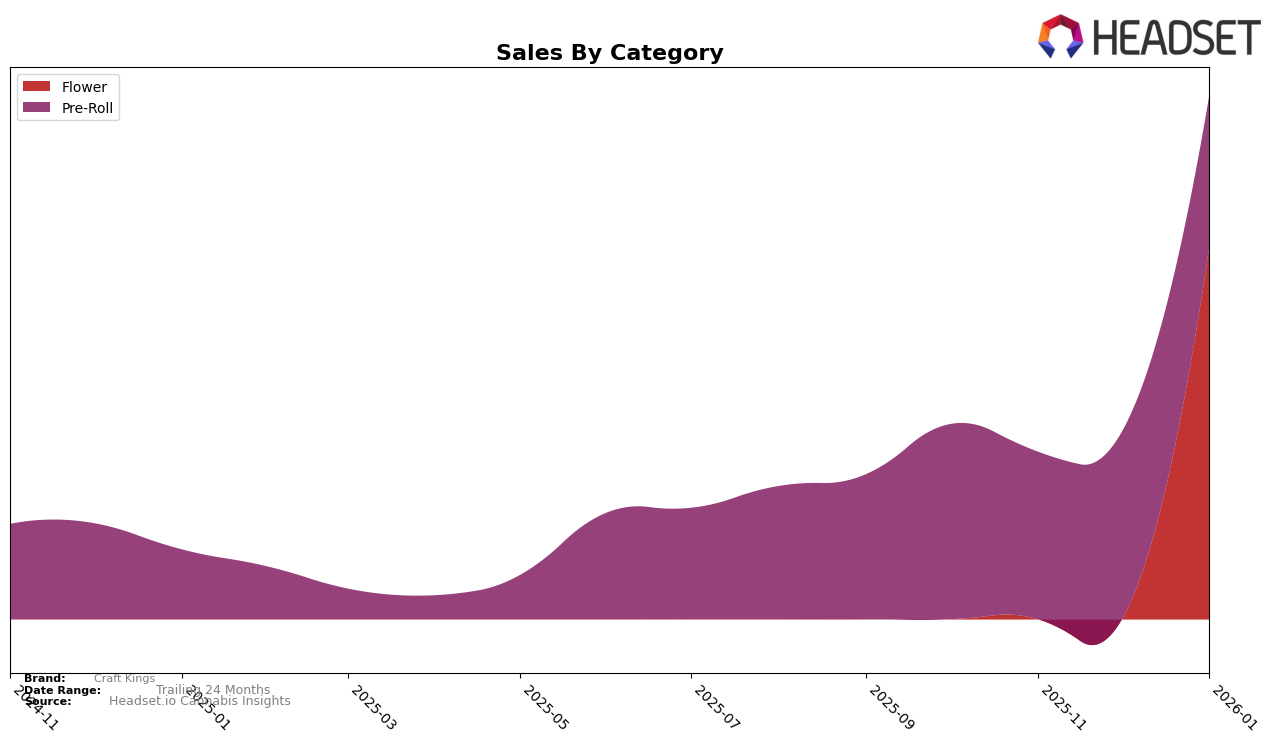

In the state of New Jersey, Craft Kings has shown varied performance across different cannabis categories. Notably, the brand made a significant entry into the Flower category in January 2026, securing the 30th position. This marks a new presence in the top 30, indicating a potential growth trajectory within this category. Meanwhile, in the Pre-Roll category, Craft Kings experienced a slight decline in their ranking from 17th in October 2025 to 23rd by January 2026. This drop could suggest increased competition or shifting consumer preferences within the Pre-Roll market in New Jersey.

Despite the fluctuations in rankings, Craft Kings has maintained a consistent presence in the Pre-Roll category in New Jersey, staying within the top 30 throughout the observed months. However, the absence of Craft Kings in the top 30 for the Flower category prior to January 2026 highlights a previous gap in market reach or brand recognition in this segment. The sales figures for Pre-Rolls show a downward trend from October to January, with a notable decrease in sales. This trend may warrant further analysis to understand underlying market dynamics or brand strategies that could be impacting sales performance.

Competitive Landscape

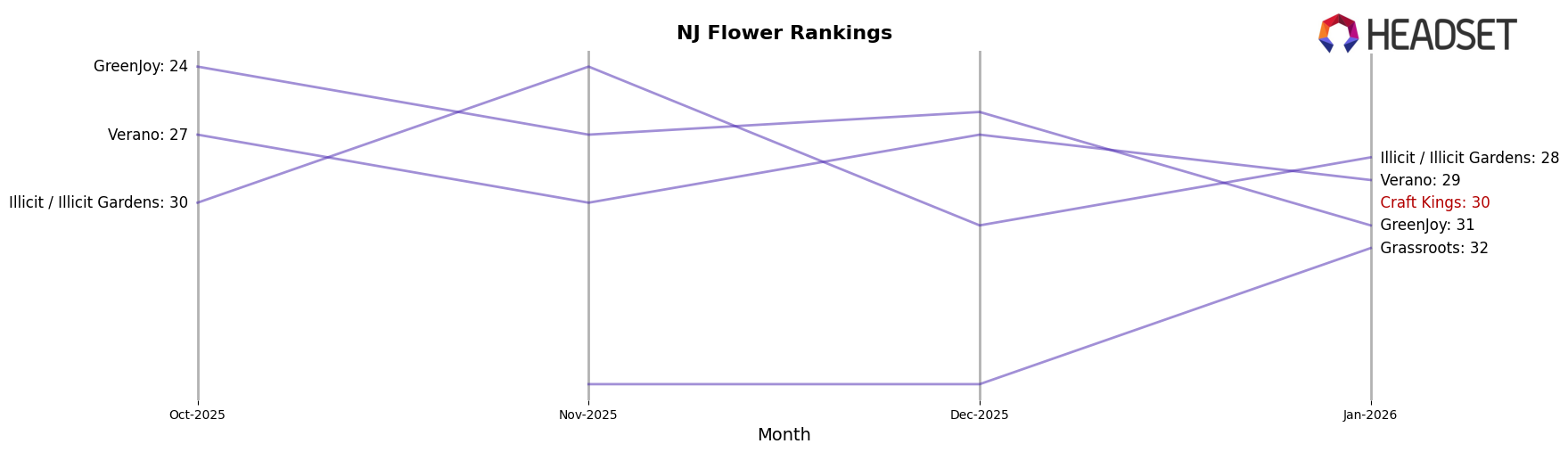

In the competitive landscape of the Flower category in New Jersey, Craft Kings has shown a notable entry into the top 30 rankings by January 2026, securing the 30th position. This marks a significant development for Craft Kings, as it was absent from the top 20 rankings in the preceding months. The brand's emergence is indicative of a positive trend, potentially driven by strategic marketing or product differentiation. In contrast, GreenJoy experienced a decline from 24th in October 2025 to 31st by January 2026, suggesting a potential shift in consumer preferences or competitive pressures. Meanwhile, Illicit / Illicit Gardens displayed a fluctuating performance, ending slightly above Craft Kings at 28th in January 2026. The competitive dynamics are further highlighted by Verano and Grassroots, both of which have not broken into the top 20, with Verano maintaining a relatively stable position around the 27th to 30th range. These insights suggest that Craft Kings is gaining traction in a competitive market, with potential opportunities for further growth if current trends continue.

Notable Products

In January 2026, the top-performing product for Craft Kings remained the Sativa Blend Pre-Roll (1g) in the Pre-Roll category, maintaining its consistent first-place ranking despite a sales figure of 3330. The Indica Blend Pre-Roll (1g) held its second-place position, showing a slight increase in sales from the previous month. Hybrid Blend Pre-Roll (1g) moved down to third place, indicating a decline from its previous second-place ranking in December 2025. Notably, the Ice Cream Cake (7g) in the Flower category debuted at fourth place, showcasing strong initial sales. Candy Cut (7g), also in the Flower category, followed closely behind in fifth place, marking its presence in the top rankings for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.