Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

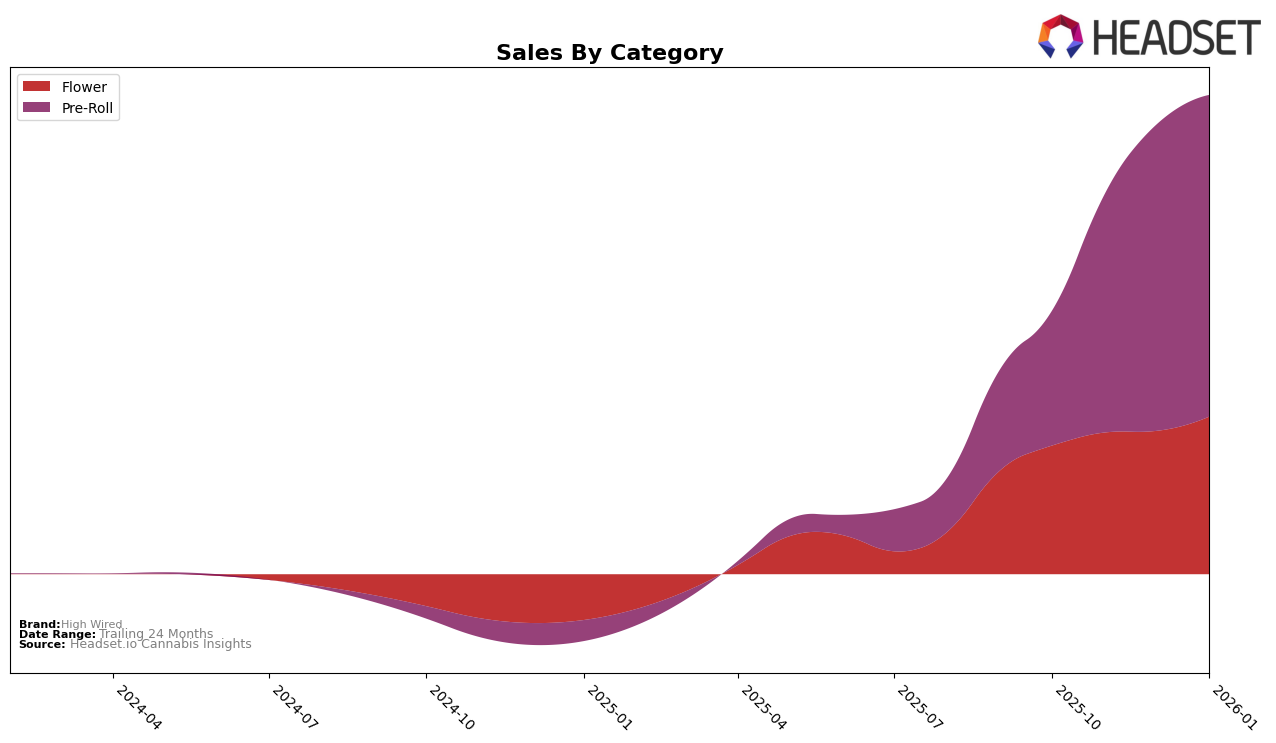

High Wired has shown noteworthy performance trends across different states and product categories. In the Illinois market, the brand's Flower category has seen a steady climb in rankings, moving from 50th in October 2025 to 41st by January 2026. Meanwhile, their Pre-Roll category in Illinois has demonstrated robust growth, ascending from 23rd to 8th place over the same period. This indicates a strong consumer preference for their Pre-Roll products in Illinois, which is further supported by a significant increase in sales figures. Conversely, in the Massachusetts market, High Wired's Pre-Roll category has experienced some fluctuation, initially jumping from 97th to 40th, but then stabilizing around the 40th position in subsequent months, suggesting a more competitive environment.

In New Jersey, High Wired has maintained a consistent presence in the Flower category, hovering around the 40th rank without significant movement, which might imply a stable but not particularly dynamic market position. However, the Pre-Roll category in New Jersey tells a different story, with the brand improving its rank from 22nd to 10th by January 2026, highlighting a positive trajectory and growing consumer acceptance. The absence of High Wired in the top 30 rankings in some months across certain categories and states could be viewed as a challenge or opportunity for growth, depending on strategic priorities. These movements provide a glimpse into the brand's varied performance and market dynamics, offering insights into potential areas for expansion or strategic focus.

Competitive Landscape

In the competitive landscape of the Illinois pre-roll category, High Wired has demonstrated a remarkable upward trajectory in recent months. Starting from a rank of 23rd in October 2025, High Wired climbed to 13th in November, 9th in December, and achieved 8th place by January 2026. This ascent indicates a significant improvement in market presence and consumer preference. In contrast, Nature's Grace and Wellness maintained a relatively stable position, hovering around the 11th and 12th ranks before improving to 9th in January. Meanwhile, Ozone experienced a decline, dropping from 8th to 10th place, and Aeriz and 93 Boyz showed slight fluctuations but remained consistently within the top 10. High Wired's rise is particularly notable given the competitive nature of the market, suggesting effective strategies in branding and consumer engagement that have translated into increased sales and improved rankings.

Notable Products

In January 2026, the top-performing product for High Wired was Rainbow Chip Infused Pre-Roll (1g), maintaining its number one rank from December with sales of 3029 units. Modified Bananas Infused Pre-Roll (1g) debuted strongly in second place, showing significant sales momentum. Dual OG Infused Pre-Roll (1g) secured the third position, marking its entry into the rankings. Animal Cake Infused Pre-Roll (1g) climbed to fourth place, up from its previous third position in November. Mandarin Z Infused Pre-Roll (1g) was ranked fifth, a drop from its second-place finish in December, indicating a decrease in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.