Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

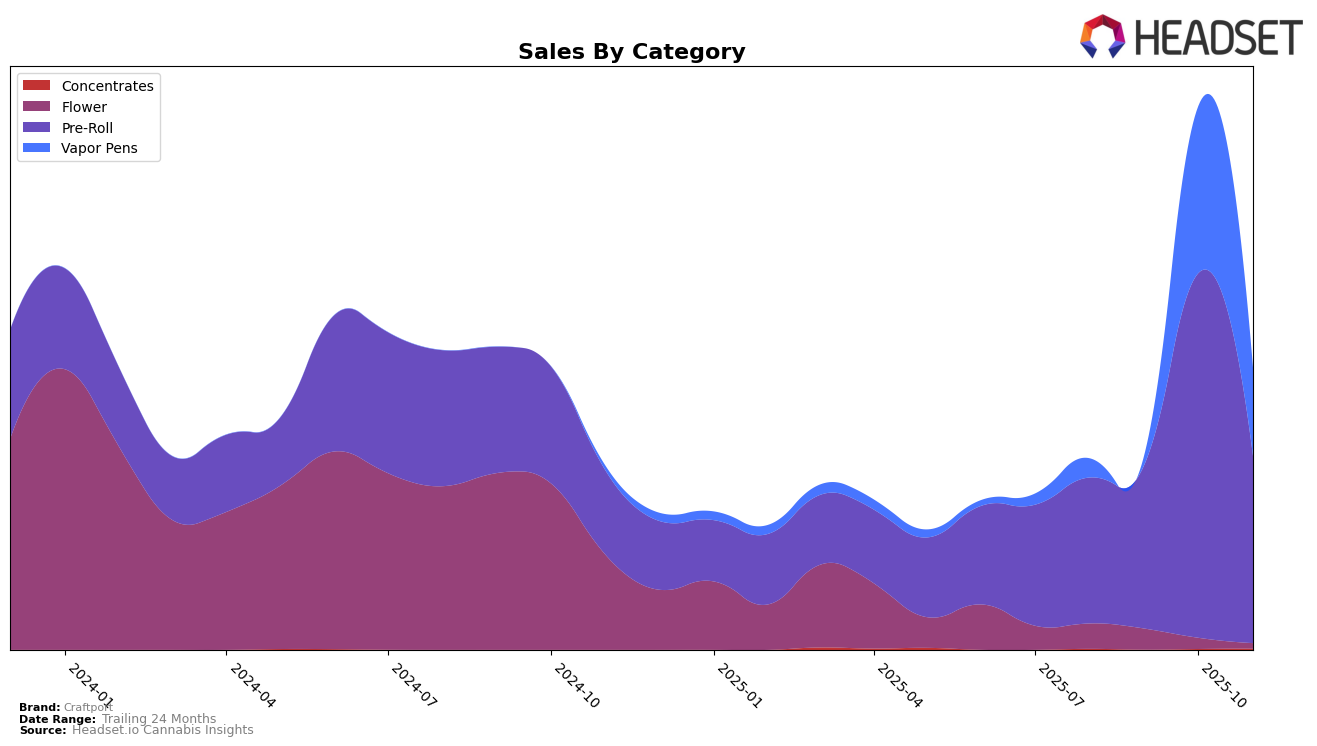

In recent months, Craftport has exhibited varied performance across different product categories and regions. In Alberta, the brand has not managed to break into the top 30 in the Flower and Vapor Pens categories as of October and November 2025, which indicates room for improvement. However, in the Pre-Roll category, Craftport has maintained a presence in the rankings, albeit with some fluctuations. Notably, their Pre-Roll rank dropped from 42 in September to 60 in November, despite a peak in sales during September. Such variations suggest that while Craftport is competitive in certain categories, there is potential for growth and stabilization in others.

Meanwhile, in British Columbia, Craftport's performance in the Pre-Roll category saw a significant surge, moving from a rank of 85 in September to 22 in October before settling at 43 in November. This upward trend in October is particularly noteworthy and suggests a strong market response during that period. Additionally, Craftport's entry into the top 30 for Vapor Pens in October, debuting at rank 18, signals a promising expansion in this category. In Saskatchewan, however, Craftport's presence is limited, with only a brief appearance in the Pre-Roll category back in August. The absence from the top rankings in subsequent months highlights potential challenges in establishing a foothold in this region.

Competitive Landscape

In the competitive landscape of pre-rolls in British Columbia, Craftport has experienced significant shifts in its market position over recent months. Notably, Craftport's rank surged from 85th in September 2025 to an impressive 22nd in October 2025, before slightly declining to 43rd in November 2025. This dramatic rise in October was accompanied by a substantial increase in sales, indicating a successful strategy or product launch during that period. In contrast, competitors like Good Buds and Jonny Chronic have seen fluctuating ranks, with Good Buds dropping from 30th in August to 45th in November, and Jonny Chronic re-entering the top 50 in November after being absent in October. Meanwhile, Sweetgrass Organic Cannabis closely mirrors Craftport's trajectory, rising to 19th in October before settling at 42nd in November. These dynamics suggest a competitive and volatile market, where Craftport's recent performance indicates potential for sustained growth if they can capitalize on their October momentum.

Notable Products

In November 2025, Craftport's top-performing product was the Silver Rhino Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one rank despite a drop in sales to 4731 units. Cherry Lime Kiss Pre-Roll 3-Pack (1.5g) rose to second place, showing a notable improvement from its consistent third-place position in the prior months. The Soaring Tiger Pre-Roll 2-Pack (1g) ranked third, a position it regained after a brief absence from the rankings in September 2025. Cherry Lime Kiss Pre-Roll (0.7g) made a return to the rankings in fourth place after being unranked in October. Silver Rhino Pre-Roll 5-Pack (2.5g) maintained its fifth-place ranking from October, indicating stable sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.