Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

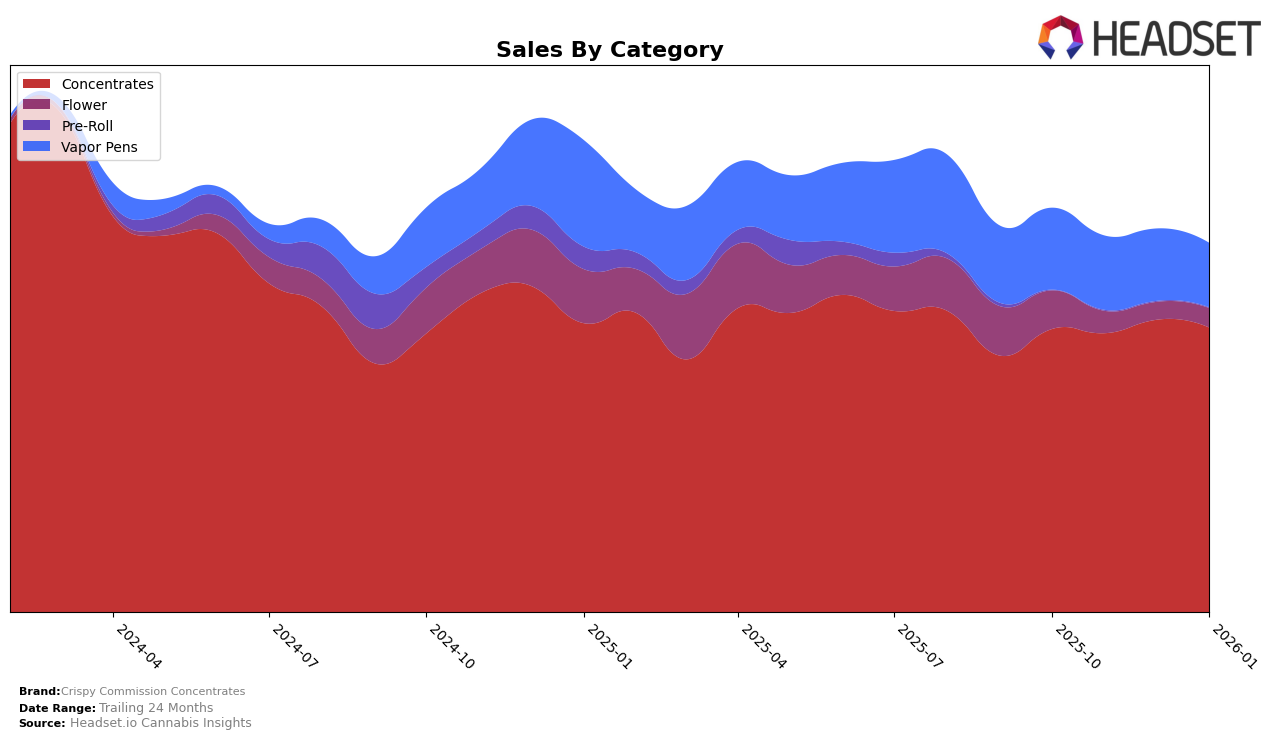

Crispy Commission Concentrates has demonstrated a strong performance in the Concentrates category within Massachusetts. The brand maintained a top position, starting at rank 1 in October 2025 and slightly dropping to rank 2 from November 2025 through January 2026. This consistency in high ranking suggests a solid consumer base and effective market strategies in the Concentrates category. Notably, the sales figures showed a slight increase in December 2025, reaching $525,731, which indicates a positive reception during the holiday season.

In contrast, the Vapor Pens category tells a different story for Crispy Commission Concentrates in Massachusetts. The brand did not break into the top 30, with rankings hovering in the low 40s across the four months analyzed. This indicates a less competitive position in this category, with sales showing a downward trend, culminating in $115,035 by January 2026. This performance disparity between categories highlights potential areas for strategic reevaluation or targeted marketing efforts to bolster their presence in the Vapor Pens market.

Competitive Landscape

In the Massachusetts concentrates market, Crispy Commission Concentrates has experienced a notable shift in its competitive positioning over recent months. Initially holding the top rank in October 2025, the brand saw a decline to the second position by November 2025, where it has remained through January 2026. This change in rank is primarily due to the rise of Good Chemistry Nurseries, which has consistently maintained the number one spot since November 2025, showcasing a significant increase in sales. Despite this, Crispy Commission Concentrates continues to outperform other competitors such as Nature's Heritage and Cultivators Classic, which have consistently held the third and fourth ranks, respectively. While Crispy Commission Concentrates' sales have remained relatively stable, the brand's ability to reclaim the top position may depend on strategic adjustments to counter the upward momentum of Good Chemistry Nurseries.

Notable Products

In January 2026, the top-performing product from Crispy Commission Concentrates was Garlic Peaches Budder (1g), achieving the highest rank with sales of 679 units. Following closely was Lemonhead Delight Cured Sugar (1g), securing the second position. Both Blue Imposter Cured Budder (1g) and Durban Pineapple Cured Budder (1g) shared the third rank, each with identical sales figures. Lemonhead Delight Live Resin Sauce Cartridge (1g) rounded out the top five, coming in fourth place. Notably, this is the first month these products have been ranked, indicating a strong debut for Crispy Commission Concentrates' offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.