Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

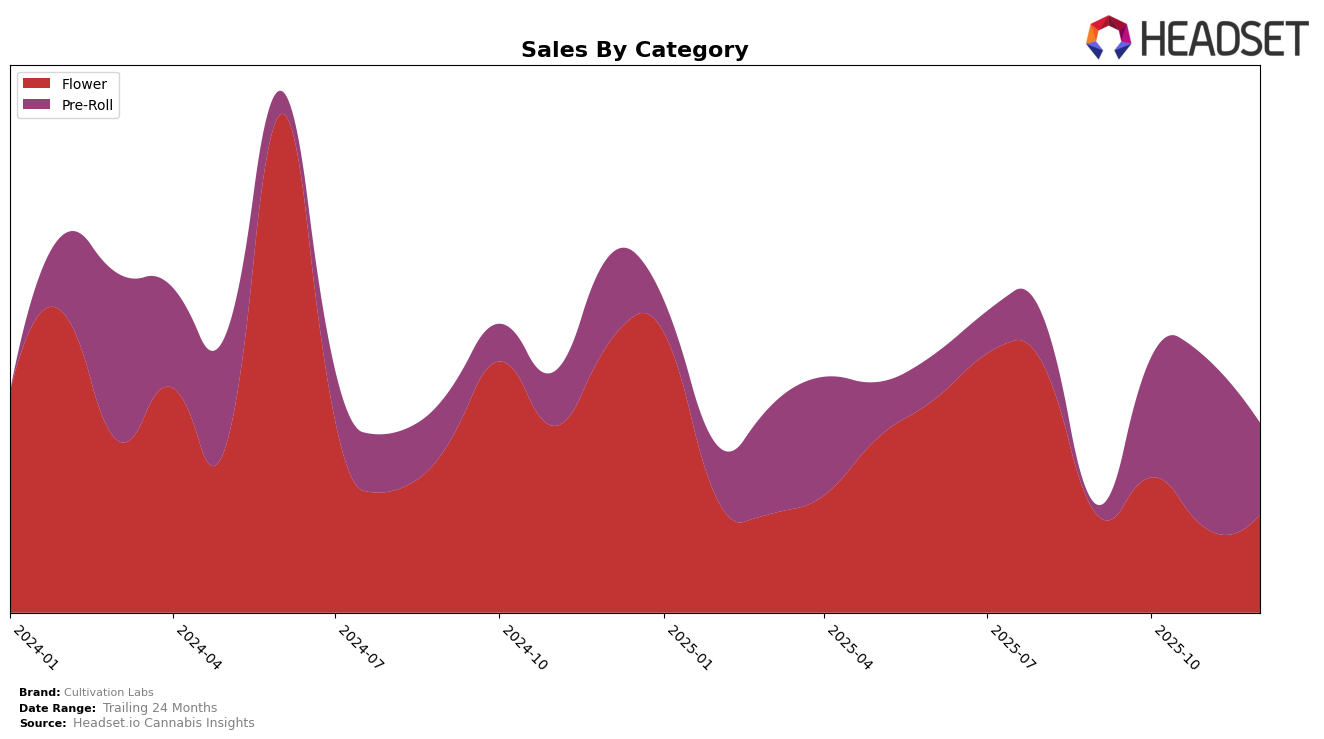

In Nevada, Cultivation Labs has shown a steady improvement in the Flower category. Despite not being in the top 30 in September 2025, the brand climbed to the 60th position by December 2025. This upward trend suggests a positive reception of their Flower products in the state. The sales figures reflect this growth, with a notable increase from September to October, although there was a slight dip in November before rebounding in December. This fluctuation in sales could indicate a seasonal demand or a response to market competition.

In contrast, the Pre-Roll category in Nevada presents a mixed performance for Cultivation Labs. The brand was absent from the top 30 in September but made a significant leap to rank 31st in October and further improved to 19th in November. However, by December, it had slipped back to the 29th position. This volatility suggests a competitive landscape for Pre-Rolls in Nevada, where Cultivation Labs managed to briefly capture significant market share before facing challenges. The sales trajectory mirrors these ranking changes, with a peak in October followed by a decline in subsequent months, highlighting the need for strategic adjustments to maintain market position.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Cultivation Labs has experienced notable fluctuations in its ranking and sales over the last few months of 2025. While Cultivation Labs improved its rank from 73rd in September to 60th by December, it faced stiff competition from brands like TRENDI and Tyson 2.0, both of which consistently ranked higher. TRENDI, for instance, maintained a position in the 50s throughout the period, while Tyson 2.0, despite a dip in November, ended December at 56th. Meanwhile, Hippies showed a similar upward trajectory, improving from 74th to 67th, indicating a competitive pressure on Cultivation Labs to maintain its upward momentum. The sales trends reflect these rankings, with Cultivation Labs experiencing a dip in November but recovering slightly in December, suggesting a need for strategic adjustments to sustain growth amidst a competitive market environment.

Notable Products

In December 2025, Jenny Kush Pre-Roll (1g) maintained its position as the top product for Cultivation Labs, continuing its streak as the number one ranked item since October. Following closely is Jenny Kush (1g) in the Flower category, which held steady at the second rank for three consecutive months. New entrants in the Pre-Roll category, Blueberry Diesel Pre-Roll (1g), Grape Bubblegum Pre-Roll (1g), and Pineapple Doughnut Pre-Roll (1g), captured the third, fourth, and fifth ranks respectively, indicating a significant shift in consumer preferences. Notably, Jenny Kush Pre-Roll (1g) achieved a remarkable sales figure of 6,290 units in December. These changes suggest a growing interest in pre-roll products, with Jenny Kush Pre-Roll (1g) leading the charge in popularity and sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.