Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

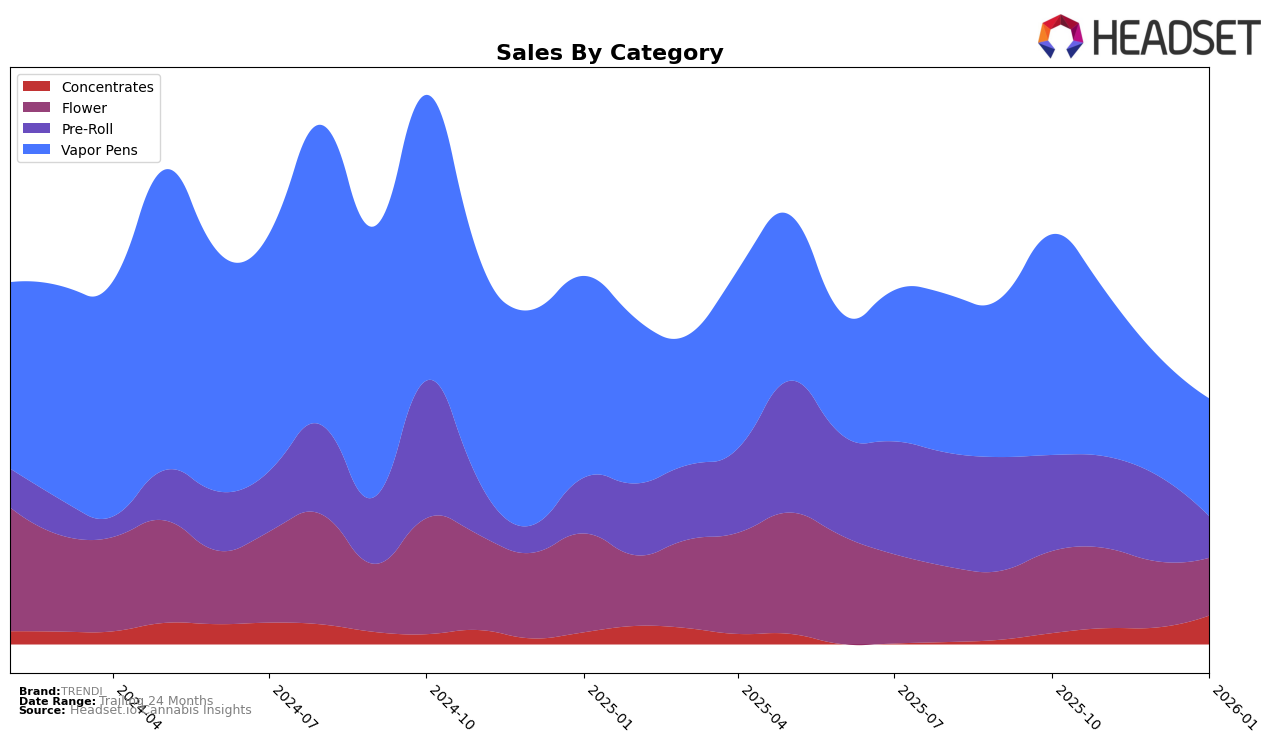

TRENDI has shown notable performance in the Nevada market, particularly in the Concentrates category, where it has consistently climbed the rankings from 10th in October 2025 to 4th by January 2026. This upward trend is indicative of a strong market presence and increasing consumer preference. In contrast, the Pre-Roll category saw a decline, with TRENDI dropping from 6th place in October and November to 10th in January. Such movements suggest a shift in consumer demand or increased competition within this category. Meanwhile, the Vapor Pens category also experienced a decline in ranking, moving from 6th in October to 10th in January, which could reflect changing consumer preferences or market dynamics.

In the Flower category, TRENDI was not among the top 30 brands in October and December, ranking 58th, but saw an improvement by January, moving up to 47th place. This suggests a potential recovery or strategic changes that might be influencing the brand's performance. Despite these fluctuations, the brand's sales numbers in the Flower category increased from October to January, indicating a positive reception in the market. The absence of TRENDI from the top 30 in some months across categories highlights areas for potential growth and the need for strategic adjustments to maintain competitiveness in a dynamic market like Nevada.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, TRENDI has experienced notable fluctuations in its market position, reflecting both challenges and opportunities. Over the four-month period from October 2025 to January 2026, TRENDI's rank shifted from 6th to 10th, indicating a decline in its competitive standing. This shift can be attributed to the dynamic performances of competitors such as Brass Knuckles and City Trees. Brass Knuckles, for instance, improved its rank from 9th to 8th, demonstrating resilience and a capacity to capture market share, while City Trees showed volatility, peaking at 7th in December before dropping back to 12th in January. Meanwhile, Sauce Essentials maintained a relatively stable position, closely trailing TRENDI. Despite TRENDI's decline in rank, its sales figures reveal a more nuanced picture; although sales decreased from October to January, the brand still outperformed several competitors in terms of revenue, suggesting that while its market share may have slipped, its brand strength and customer loyalty remain significant factors in its overall performance.

Notable Products

In January 2026, the top-performing product from TRENDI was Skinny Minny Pre-Roll 5-Pack (2.5g), securing the number one spot with sales reaching 1161 units. Following closely, Chimera (3.5g) ranked second, marking a strong presence in the Flower category. GMO Infused Pre-Roll (1g) maintained its position at third place from December 2025, although its sales slightly dipped to 979 units. Hawaiian Mints Shatter (0.5g) and Gastro Pop (3.5g) rounded out the top five, ranking fourth and fifth respectively, both making notable entries in the Concentrates and Flower categories. Compared to previous months, Skinny Minny Pre-Roll 5-Pack and Chimera have shown significant upward movement, as they were not in the top ranks before January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.