Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

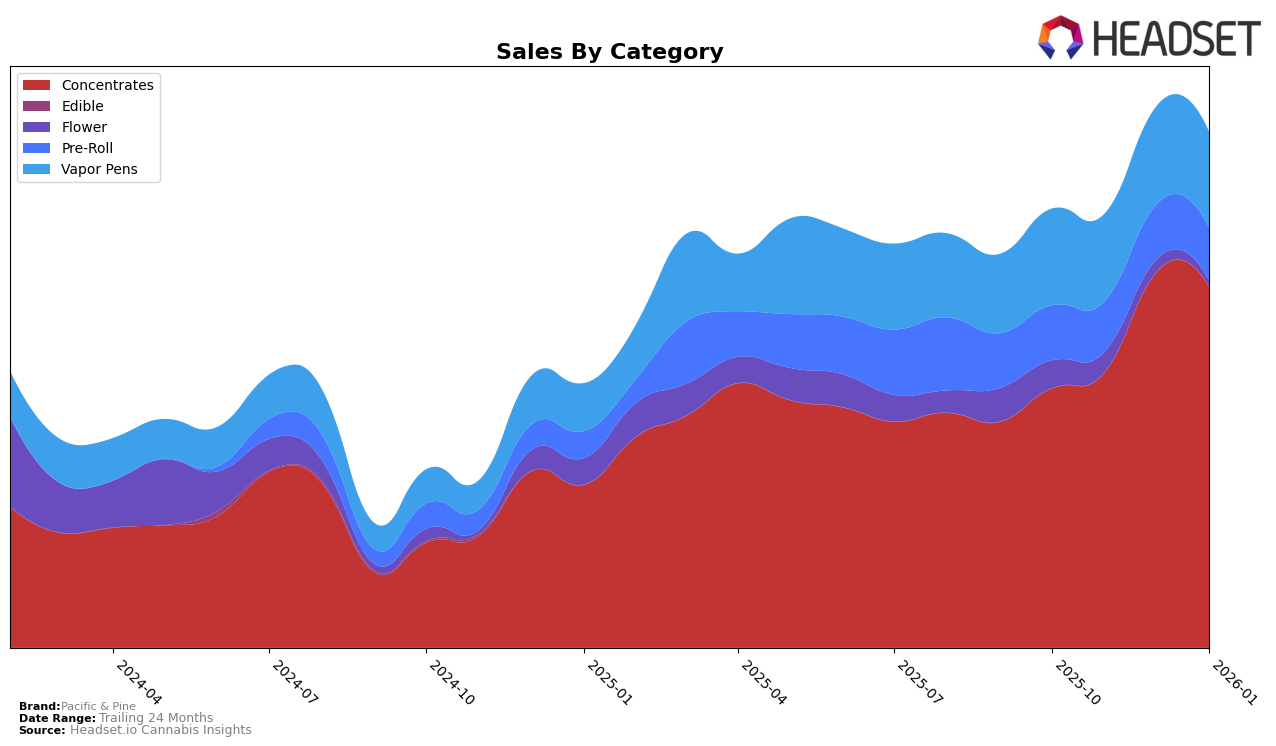

Pacific & Pine has shown noteworthy performance in the Washington market, particularly in the Concentrates category. Over the four-month period from October 2025 to January 2026, the brand has climbed from a rank of 14 to 9. This upward movement is indicative of a strong market presence and growing consumer preference. The sales figures for Concentrates also reflect this positive trend, with a significant increase from October to December, although there was a slight dip in January. However, the brand's absence from the top 30 in other state markets or categories could be seen as a potential area for growth or concern, depending on their strategic objectives.

In contrast, Pacific & Pine's performance in the Vapor Pens category in Washington has been less remarkable, maintaining a position outside the top 80 for the entire period. Despite a slight improvement from rank 90 in October to 80 in January, the brand remains far from a leading position in this category. The sales figures for Vapor Pens have been relatively stable, with minor fluctuations across the months. This stability, while not demonstrating significant growth, suggests a consistent customer base. The absence from the top 30 in this category highlights potential challenges in capturing a larger market share compared to their success in Concentrates.

Competitive Landscape

In the Washington concentrates market, Pacific & Pine has shown a notable upward trajectory in brand ranking, moving from 14th in October 2025 to 8th by December 2025, before slightly declining to 9th in January 2026. This positive trend reflects a significant improvement in sales performance, particularly in December 2025, where Pacific & Pine surpassed several competitors. Notably, Phat Panda maintained a relatively stable position, fluctuating between 8th and 10th place, while Skagit Organics consistently held the 7th position, indicating strong market presence. Meanwhile, Snickle Fritz and Tasty Terps experienced more variability in their rankings, with Snickle Fritz climbing from 13th to 10th and Tasty Terps dropping from 9th to 11th over the same period. This competitive landscape suggests that Pacific & Pine's strategic initiatives are effectively enhancing its market position and sales, positioning it as a formidable player in the concentrates category.

Notable Products

In January 2026, Super Boof Solventless Hash Cold Cured Rosin (1g) reclaimed the top spot among Pacific & Pine's offerings with sales reaching 850 units, marking a steady rise from its second-place ranking in the previous two months. Orange Fruit Snax Live Hash Rosin (1g), which had been leading in November and December 2025, slipped to second place. Blueberry Diesel Solventless Live Hash Rosin (1g) maintained its position at third, showing consistent performance since its debut in December 2025. Purple Pineapple Live Hash Rosin (1g) improved its standing slightly, moving up to fourth from fifth place in December. Notably, Honey Banana x Lemon Hash Plant Live Hash Rosin (1g) entered the rankings in January, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.