Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

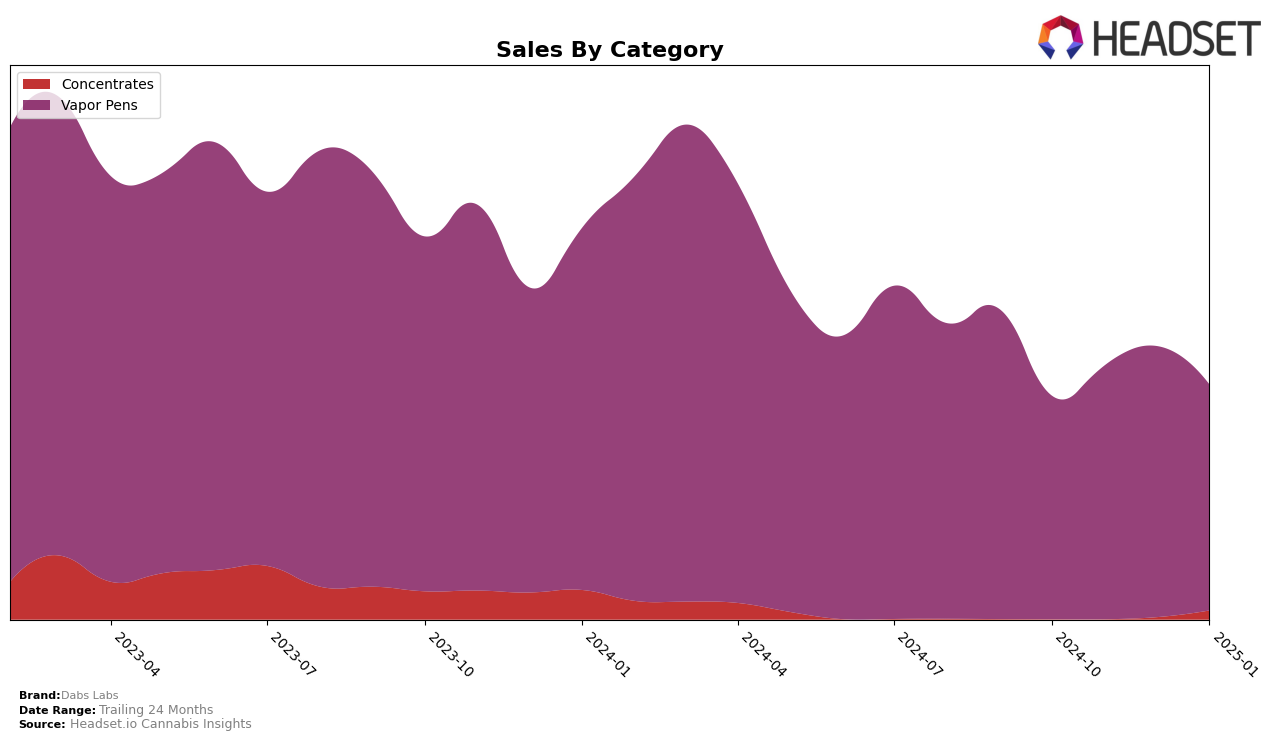

Dabs Labs has shown a notable presence in the Colorado market, particularly within the Vapor Pens category. Over the span from October 2024 to January 2025, Dabs Labs maintained a consistent ranking within the top 30, fluctuating slightly between 26th and 28th positions. This steady performance indicates a strong foothold in the Vapor Pens market, with sales peaking in December 2024. However, their absence from the top 30 in the Concentrates category during the same period suggests a potential area for growth or a need for strategic adjustments to increase their market share in this segment.

In January 2025, Dabs Labs did not appear in the top 30 brands for Concentrates in Colorado, which could be seen as a missed opportunity to capitalize on this growing market. Despite this, their ability to sustain rankings in Vapor Pens suggests a focused strategy that could be leveraged to enhance their performance in other categories. The brand's consistent sales figures in Vapor Pens indicate a loyal customer base, which could be pivotal in driving future growth and expansion efforts across different product lines and states.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Dabs Labs has shown a consistent, albeit modest, improvement in its ranking over the last few months, moving from 28th in October 2024 to 26th in December 2024, before slightly dropping back to 27th in January 2025. This upward trend in rank, despite the slight dip in January, suggests a positive reception to their products, as reflected in the increase in sales from October to December. However, Dabs Labs faces stiff competition from brands like Sano Gardens, which maintained a strong presence in the top 20 for most of the period, and Natty Rems, which, despite fluctuations, consistently ranked higher than Dabs Labs. The entry of Bakked into the top 30 in January 2025, after being outside the top 40 in previous months, indicates a dynamic market where new strategies or products can quickly alter competitive standings. For Dabs Labs, maintaining and improving their rank will likely require strategic marketing and product innovation to capture a larger share of the market from these well-performing competitors.

Notable Products

In January 2025, Versa Choice - Sleep Distillate Cartridge (1g) maintained its top position in the Vapor Pens category for Dabs Labs, with sales reaching 2525 units. Chill - Hybrid Distillate Cartridge (1g) climbed from the third position in December to second place, showing a consistent improvement over the previous months. Versa Uplift Cartridge (1g) was introduced and secured the third rank, indicating strong initial sales performance. Versa Energize Cartridge (1g) held steady at fourth place, while Energize - Sativa Distillate Cartridge (1g) dropped to fifth, showing a decline in sales compared to earlier months. The overall rankings highlight a strong preference for distillate cartridges, with minor shifts in consumer demand among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.