Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

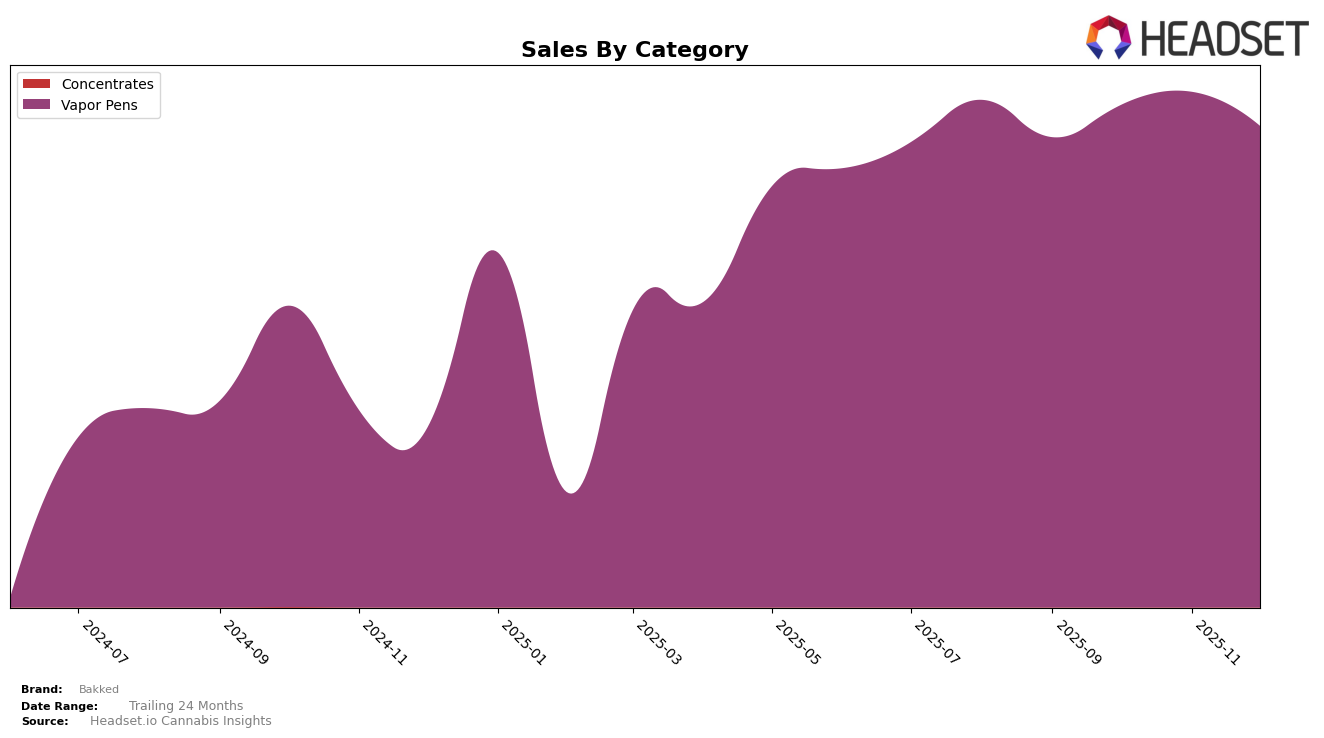

Bakked's performance in the Vapor Pens category within Colorado has shown a steady presence, albeit with some fluctuations in ranking. From September to December 2025, the brand maintained its position within the top 30, starting at rank 28 and holding onto rank 30 by December. This consistency in ranking, despite slight sales variations, indicates a stable consumer base and suggests that Bakked has managed to retain its market share in a competitive category. However, the brand's position at the lower end of the top 30 could imply challenges in elevating its market standing unless strategic changes are made.

Interestingly, Bakked's sales figures in Colorado show an upward trend from September to November, with a peak in November before a slight decline in December. This pattern might reflect seasonal purchasing behaviors or promotional efforts during the fall months. The fact that the brand did not break into the top 20 or improve its ranking significantly could be seen as a limitation in its growth strategy or market penetration efforts. The absence of Bakked from the top 30 in other states or categories suggests that its influence might be concentrated in specific regions, which could be an area for potential expansion or diversification.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Colorado, Bakked has maintained a relatively stable position, ranking 28th in September 2025 and slightly dropping to 30th by December 2025. Despite this minor decline in rank, Bakked's sales have shown resilience, with a peak in November 2025. In contrast, Orbital has demonstrated a notable upward trajectory, climbing from 34th to 29th place over the same period, with sales surpassing Bakked's in November and December. Meanwhile, Revel (CO) has experienced a significant improvement in rank, moving from 35th to 28th, indicating a strong sales performance in December. Sunshine Extracts and Lazercat Cannabis have faced challenges, with both brands ranking lower than Bakked, despite their fluctuating sales figures. These dynamics suggest that while Bakked remains a steady player, competitors like Orbital and Revel (CO) are gaining momentum, potentially impacting Bakked's market share in the near future.

Notable Products

In December 2025, Bakked's top-performing product was the Son of a Peach Distillate Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 4173 units. The Blueberry Muffin Distillate Cartridge (1g) climbed to the second position, improving from fifth in November with sales increasing to 3070 units. The Maui Wowie Distillate Cartridge (1g), despite leading in September and November, dropped to third place in December. Grape Galaxy Distillate Cartridge (1g) maintained a consistent performance, ranking fourth in December, similar to its ranking in October. Lemon Cherry Gelato Distillate Cartridge (1g) rounded out the top five, experiencing a slight decline from its fourth position in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.