Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

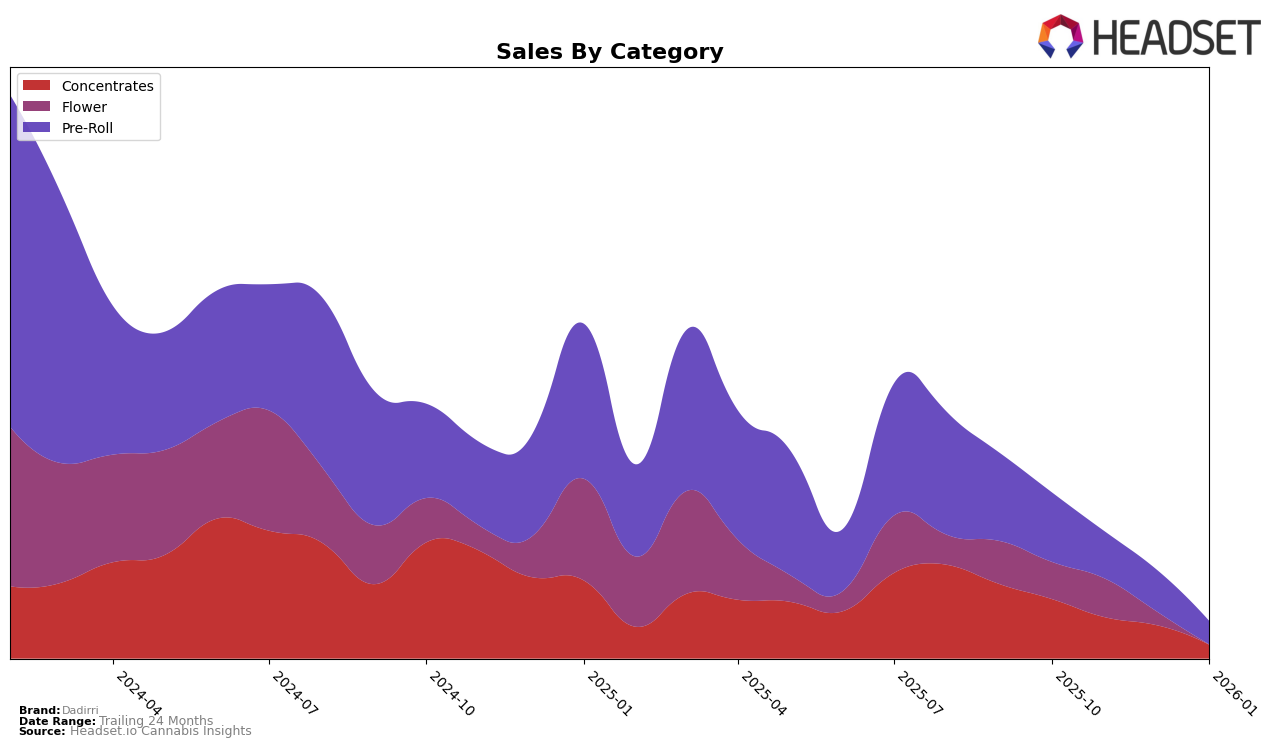

In the Colorado market, Dadirri has shown fluctuating performance across different categories. In the Concentrates category, Dadirri has consistently remained outside the top 30, with rankings hovering around the 40s, indicating a struggle to capture a significant market share. The Flower category presents a different challenge, as Dadirri only broke into the top 100 in November 2025, peaking at 85th in December, before falling out of the top rankings again by January 2026. This inconsistency highlights potential volatility in consumer preferences or competitive pressures. The Pre-Roll category, however, shows a slight improvement, with rankings oscillating between the 50s and 60s, suggesting a moderate but not dominant presence in this segment.

In Nevada, Dadirri's performance presents a mixed bag. The Concentrates category saw Dadirri dropping out of the top 30 after November 2025, which could indicate increased competition or shifting consumer tastes. In the Flower category, Dadirri's performance was inconsistent, with a brief re-entry into the rankings in January 2026 at 95th, suggesting challenges in maintaining a stable market position. However, in the Pre-Roll category, the brand managed to maintain a relatively stable ranking in the high 50s to low 60s, which could point to a more loyal customer base or effective product differentiation in this category. This stability in Pre-Rolls could provide a foundation for growth if leveraged effectively.

Competitive Landscape

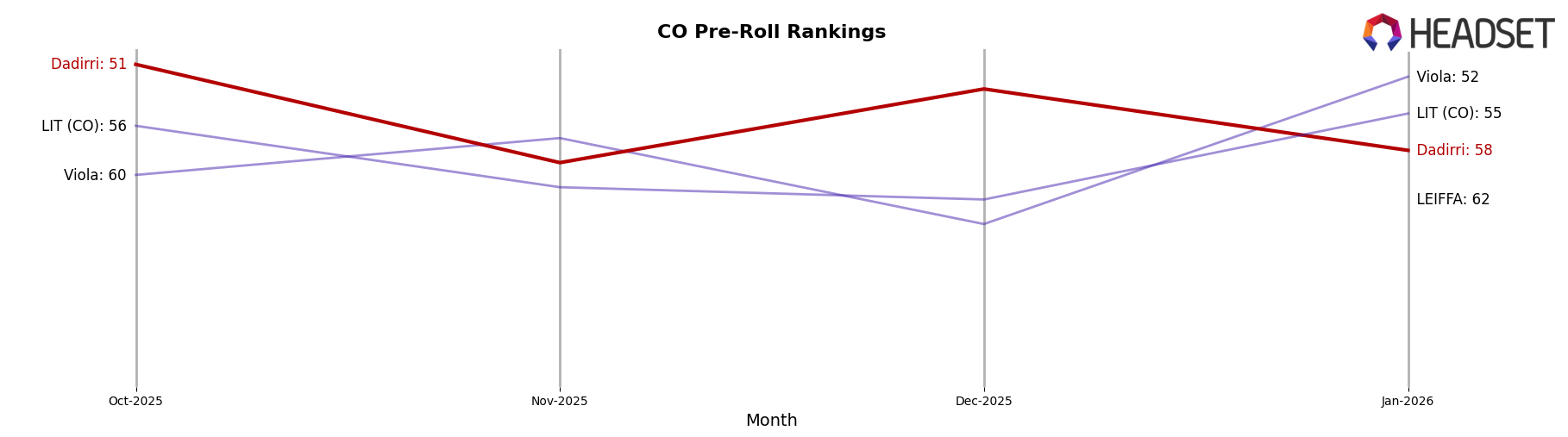

In the competitive landscape of the Pre-Roll category in Colorado, Dadirri has experienced fluctuations in its rank over the past few months, which could be indicative of shifting consumer preferences or competitive pressures. Dadirri's ranking dropped from 51st in October 2025 to 59th in November 2025, before slightly recovering to 53rd in December 2025, and then slipping again to 58th in January 2026. This volatility contrasts with competitors like Viola, which showed a more consistent upward trend, moving from 60th in October 2025 to 52nd by January 2026, suggesting a potential increase in market share. Meanwhile, LIT (CO) maintained a relatively stable position, ending January 2026 at 55th. Notably, LEIFFA re-entered the rankings in January 2026 at 62nd, indicating a resurgence that could pose a challenge to Dadirri if this trend continues. These dynamics highlight the importance for Dadirri to analyze these competitive movements and strategize accordingly to maintain and potentially improve its market position.

```

Notable Products

In January 2026, Purple Haze Sunrock (1g) emerged as the top-performing product for Dadirri, showcasing its dominance in the Flower category with a notable sales figure of 275 units. The Dadirri x Bloom County - Dime - Blue Razz Lemonade Infused Pre-Roll 2-Pack (1g) maintained a strong position, ranking second after previously holding the top rank in December 2025. The Dadirri x Bloom County - Dime - Grape Purp Slushy Infused Pre-Roll 2-Pack (1g) consistently ranked third, showing stable performance over the past months. Strawberries 'N Cream Infused Pre-Roll 2-Pack (1g), which was the top product in October 2025, ranked third in January, indicating a slight decline in its standing. Meanwhile, Governmint Oasis Caviar Infused (1g) entered the rankings at fourth place, showcasing potential growth in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.