Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

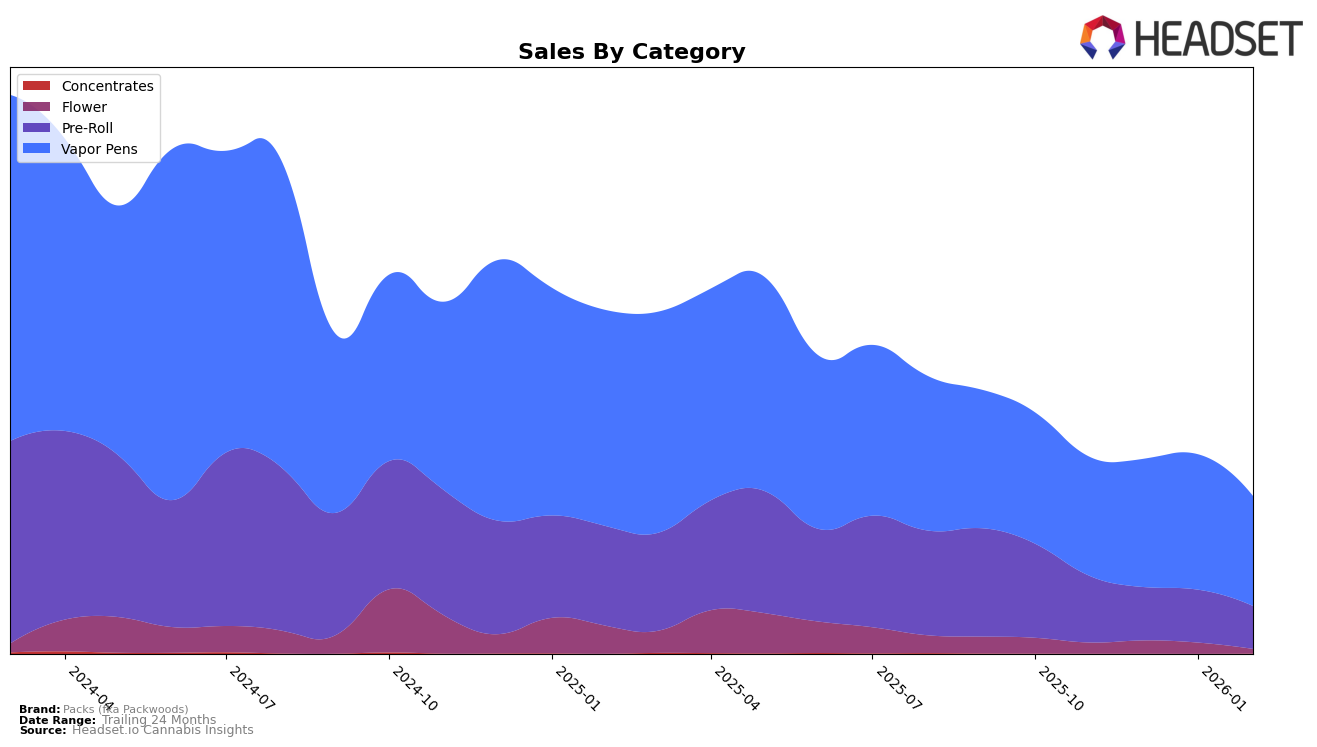

Packs (fka Packwoods) has shown varied performance across different states and product categories. In the Colorado market, their Vapor Pens have maintained a strong presence, consistently ranking within the top 15 over a four-month period, despite a slight dip in December 2025. However, their Pre-Roll category did not make it into the top 30, indicating a potential area for growth or a need for strategic reevaluation in this category within the state. Meanwhile, in Nevada, Packs has demonstrated significant volatility in the Pre-Roll category, with rankings fluctuating from 27th to 17th and then back to 25th, suggesting a competitive and dynamic market environment.

In Massachusetts, Packs' presence in the Pre-Roll category is emerging, with recent entries into the rankings at 92nd and 97th, indicating initial traction. Their Vapor Pens, however, were only ranked once at 76th, highlighting an area that may require attention to improve market penetration. In New York, the brand's Pre-Roll category has seen a decline in rankings, dropping from 44th to 74th over four months, which could be a cause for concern. Conversely, in New Jersey, Packs' Vapor Pens showed a promising climb from 50th to 41st before a slight drop to 57th, reflecting a competitive but potentially rewarding market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Packs (fka Packwoods) has shown a dynamic performance over the recent months, with its rank fluctuating between 11th and 14th from November 2025 to February 2026. Despite these shifts, Packs has maintained a strong presence, particularly in January 2026, where it climbed back to 11th place, marking a significant recovery from its 14th position in December 2025. This upward trend in January coincided with a notable increase in sales, suggesting effective strategies in product positioning or marketing. In contrast, O.penVape experienced a decline in rank from 13th in November 2025 to 16th in January 2026, before improving to 11th in February 2026, indicating a competitive tussle in the market. Meanwhile, Olio and Edun have shown more stability, with Edun consistently improving its rank to reach 10th place by February 2026. These insights highlight the competitive volatility in the Colorado vapor pen market, where Packs (fka Packwoods) must continue to innovate and adapt to maintain and improve its market position against strong competitors.

Notable Products

In February 2026, the top-performing product for Packs (fka Packwoods) was the Orange Creamsicle Live Resin Distillate Mini Packspod Disposable (1g), maintaining its consistent number one ranking from previous months with sales of 3036 units. The Marshmallow Fluff Distillate Packspod Mini Disposable (1g) held strong in the second position, closely following the top product with a notable increase in sales to 3034 units. The Sour Gushers Live Resin Packspod Disposable (2g) remained steady in third place, while the Blucifer Kush Live Resin Packspod Disposable (2g) climbed to fourth, showing a promising rise from its debut in January. The Black Cherry Gelato Live Resin Distillate Packspod Mini Disposable (1g) entered the rankings at fifth place, indicating a positive market reception. Overall, the Vapor Pens category dominated the top positions, reflecting a strong consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.