Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

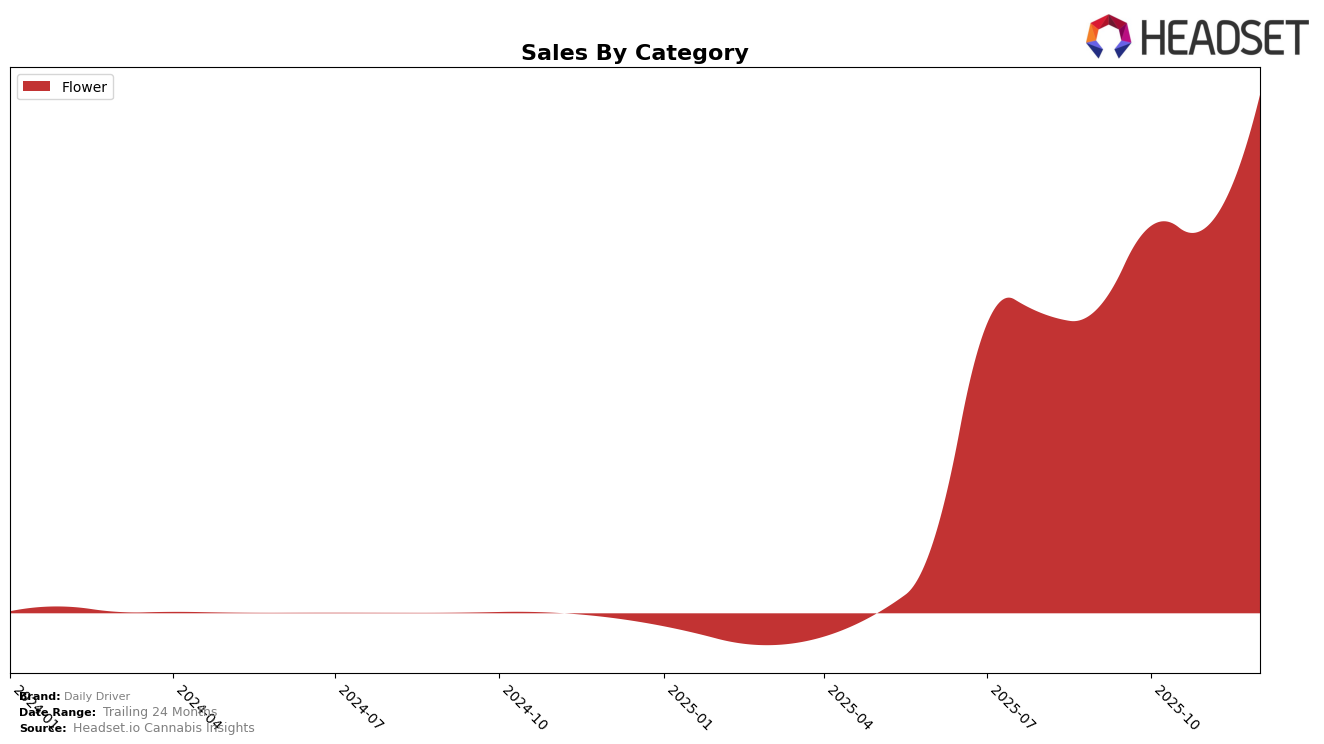

In the past few months, Daily Driver has shown noteworthy progress in the Missouri market, particularly in the Flower category. After not ranking in the top 30 brands in September 2025, Daily Driver made a significant leap to secure the 29th position in October and November, and further improved to the 24th position by December. This upward trajectory in rankings is indicative of a strong performance and growing consumer acceptance. The brand's sales in Missouri have also reflected this positive trend, with December 2025 sales reaching a notable $607,049, marking a substantial increase from the previous months.

While the performance in Missouri is encouraging, it's important to note that Daily Driver did not appear in the top 30 rankings for any other states or categories during this period. This absence highlights potential areas for growth and expansion that the brand could explore. The focus on Missouri's Flower category seems to be paying off, but diversification across other states and categories could provide additional growth opportunities. The brand's ability to maintain its momentum in Missouri while potentially expanding its reach could be a key factor in its future success.

Competitive Landscape

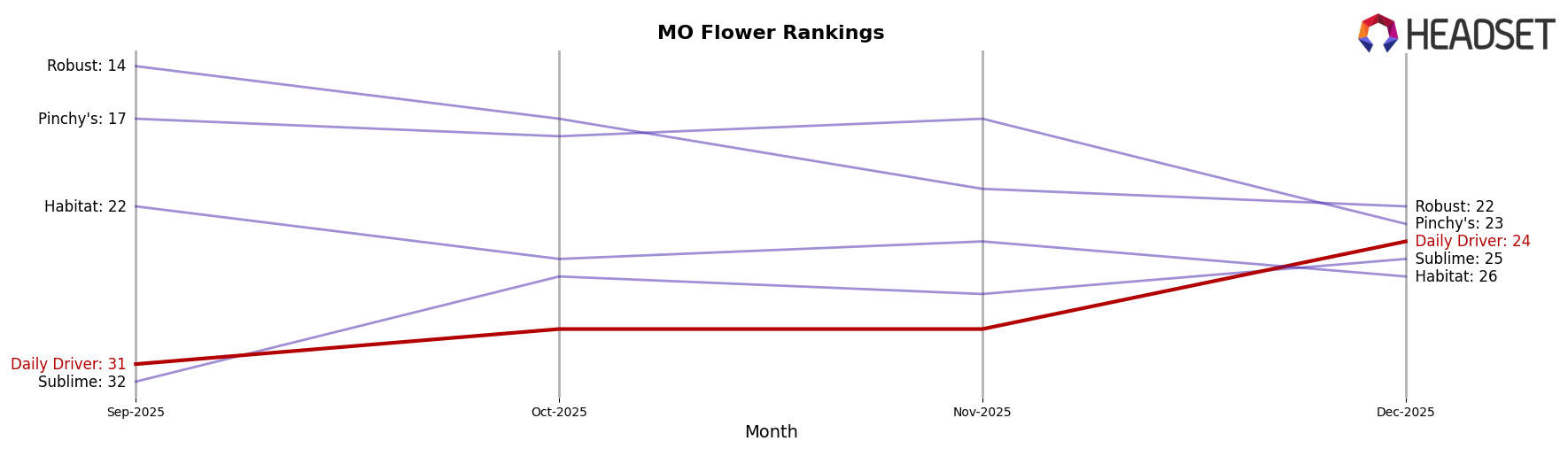

In the competitive landscape of the Missouri flower category, Daily Driver has shown a promising upward trajectory in recent months. From September to December 2025, Daily Driver improved its rank from 31st to 24th, indicating a positive shift in market positioning. This rise is particularly noteworthy when compared to competitors like Sublime, which also improved its rank but remained slightly behind at 25th in December. Meanwhile, Robust and Pinchy's experienced a decline in their rankings, with Robust dropping from 14th to 22nd and Pinchy's from 17th to 23rd, highlighting a potential opportunity for Daily Driver to capture more market share. Additionally, Daily Driver's sales figures have shown a consistent increase, culminating in a peak in December, which suggests strong consumer demand and effective market strategies. This competitive analysis underscores Daily Driver's potential to further ascend in the rankings and capitalize on the shifting dynamics within the Missouri flower market.

Notable Products

In December 2025, Daily Driver's top-performing product was Sticky Grapes #11 (3.5g) in the Flower category, maintaining its number one rank from October with a notable sales figure of 1430 units. Dulce De Uva (3.5g) rose to the second position, showing a strong comeback from being unranked in the previous months. Fugu (3.5g) debuted impressively at the third rank, indicating a successful market entry. High Fructose Corn Syrup (3.5g) secured the fourth spot, marking its first appearance in the rankings. Mango Haze (3.5g), although it dropped from its second position in September, remained in the top five at fifth place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.