Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

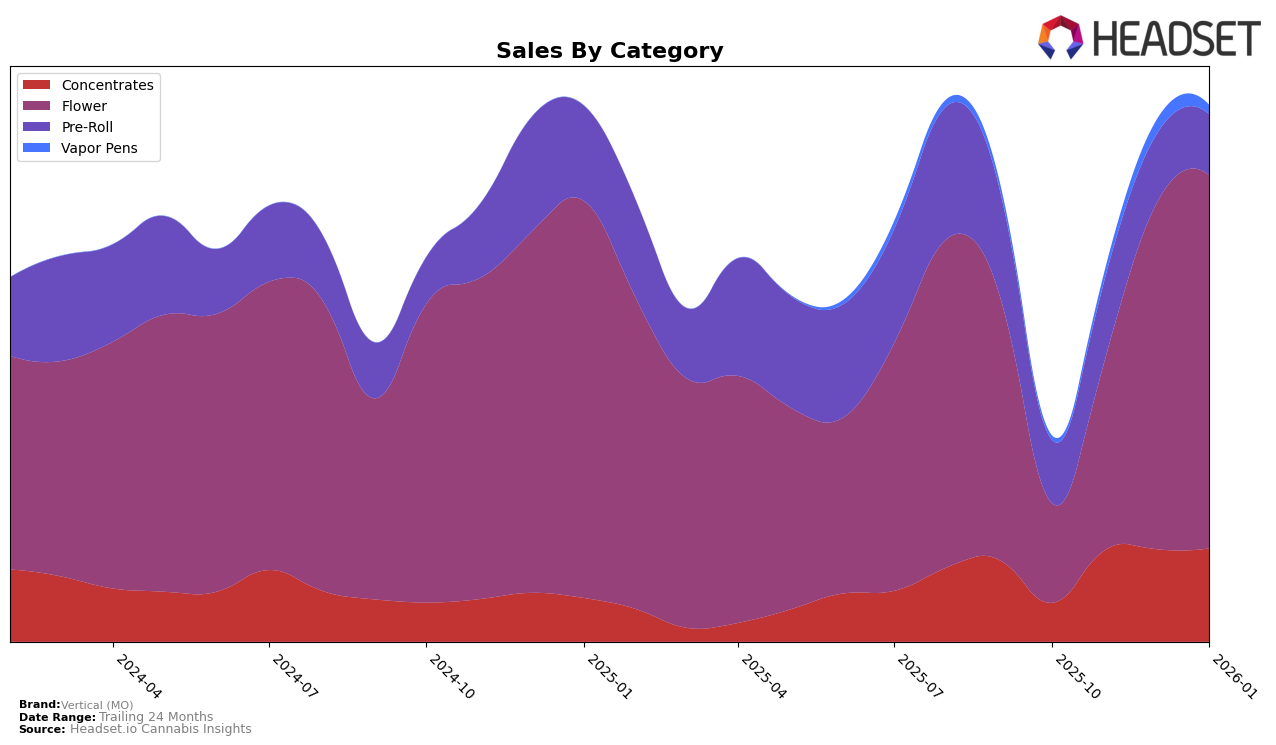

Vertical (MO) has shown varied performance across different product categories in Missouri. In the Concentrates category, the brand has maintained a strong presence, improving its rank from 23rd in October 2025 to 15th by January 2026. This consistent ranking within the top 15 indicates a stable demand and potentially effective market strategies. The Flower category also saw significant improvement, with the brand moving up from 43rd to 23rd over the same period. This upward trajectory in Flower sales suggests that Vertical (MO) is gaining traction and possibly increasing its market share in this category.

However, the performance in the Pre-Roll category tells a different story, with the brand fluctuating between ranks 27 and 40, and ultimately ending at 36th in January 2026. This inconsistency may point to challenges in maintaining consumer interest or competition from other brands. In the Vapor Pens category, Vertical (MO) was initially outside the top 30 in October 2025, but managed to climb to 77th by December, before slightly dropping to 81st in January. This indicates some progress in penetrating the market, but the brand still faces significant hurdles in achieving a top-tier position. Overall, while there are positive movements in certain categories, the brand's performance remains mixed, highlighting areas for potential growth and improvement.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Vertical (MO) has demonstrated a significant upward trajectory in rank and sales over the observed period. Starting from a rank of 43 in October 2025, Vertical (MO) made impressive strides to reach the 23rd position by January 2026. This surge is indicative of a robust growth strategy, as evidenced by the substantial increase in sales during this period. In contrast, Elevate, which started at rank 20 in October 2025, experienced fluctuations, ending slightly lower at rank 21 in January 2026. Meanwhile, Sublime showed a consistent presence, moving from rank 26 to 22, suggesting steady performance. Atta faced a decline from rank 16 to 25, indicating potential challenges in maintaining market share. These dynamics highlight Vertical (MO)'s ability to capitalize on market opportunities and improve its competitive position, making it a brand to watch in Missouri's Flower market.

Notable Products

In January 2026, Vertical (MO) saw Wild OG (7g) as its top-performing product, maintaining its position as the number one ranked product from December 2025 with sales reaching 3318 units. Wild Cherry Raspberry (3.5g) emerged as the second highest-selling product, making its debut in the rankings with notable sales of 999 units. Blue Andeze (3.5g) also entered the rankings in January, securing the third position. Souffle (14g) followed closely in fourth place, while Lemon Cherry Sherbert (3.5g) experienced a slight drop from fourth in December 2025 to fifth in January 2026. Overall, January saw new entries in the rankings, with Wild OG (7g) consistently leading the sales for Vertical (MO).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.