Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

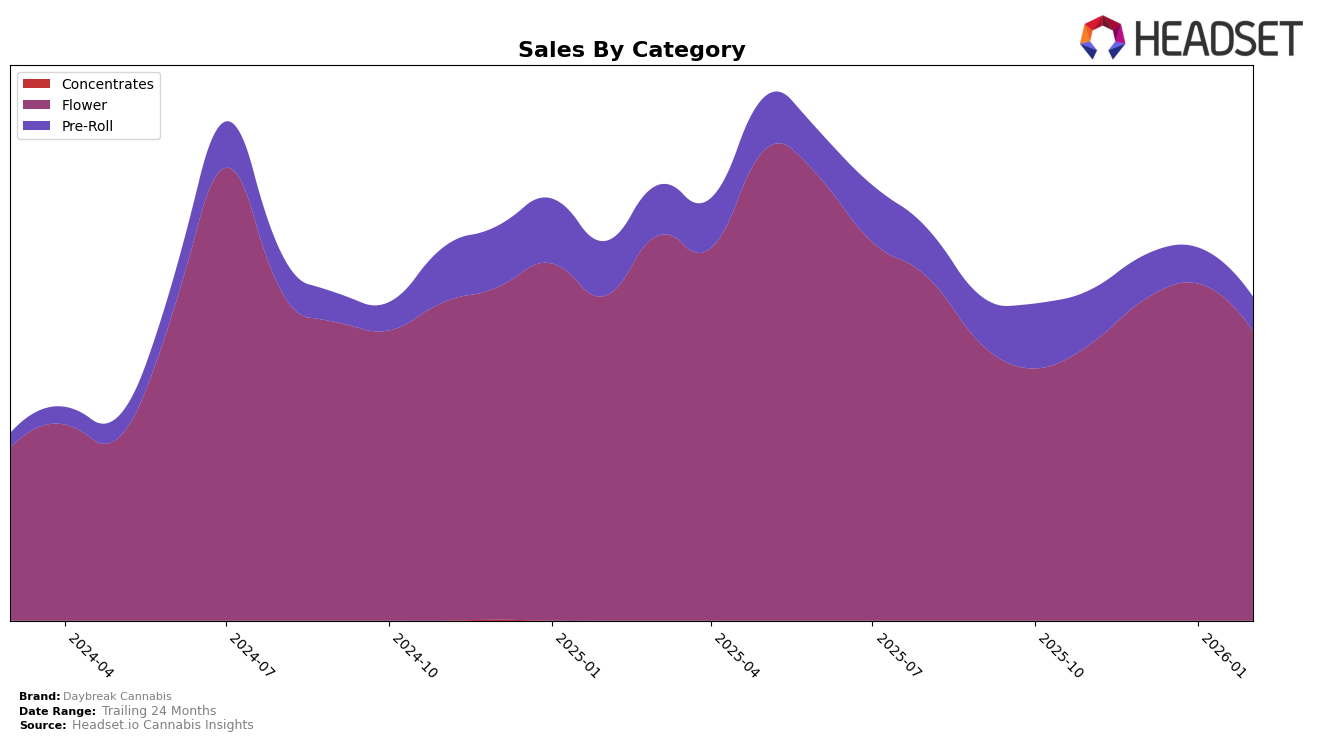

Daybreak Cannabis has shown a notable performance in the Missouri market, particularly in the Flower category. Over the months from November 2025 to February 2026, the brand consistently maintained a position within the top 11, peaking at rank 9 in both December 2025 and January 2026. This stability in the top 10 is indicative of strong brand loyalty and effective market strategies in the Flower category. However, there was a slight dip to rank 10 in February 2026, which might suggest emerging competition or seasonal fluctuations in consumer preferences. The sales figures for this category have seen a general upward trend, with a peak in January 2026, reflecting a robust demand for Daybreak Cannabis's Flower products.

In contrast, the performance in the Pre-Roll category in Missouri has been less consistent, with rankings fluctuating between 19 and 26 from November 2025 to February 2026. The brand's ranking fell to 26 in January 2026, which could be a point of concern, as it indicates a struggle to maintain a competitive edge within the top 30. Despite a slight recovery to rank 23 in February 2026, the sales figures have shown a downward trend over these months, suggesting potential challenges in product positioning or consumer demand within this category. This variability highlights the need for strategic adjustments to capture a larger share of the Pre-Roll market in Missouri.

Competitive Landscape

In the Missouri flower category, Daybreak Cannabis has experienced notable fluctuations in rank and sales, indicating a dynamic competitive landscape. From November 2025 to February 2026, Daybreak Cannabis improved its rank from 11th to 9th, before slightly dropping back to 10th in February. This movement reflects a competitive tussle with brands like Local Cannabis Co., which consistently maintained a higher rank, and Vibe Cannabis (MO), which saw a rank drop in December but rebounded by February. Despite these shifts, Daybreak Cannabis managed to increase its sales notably in December and January, surpassing Curio Wellness consistently. Meanwhile, Farmer G showed a steady climb in rank, suggesting a potential emerging threat. These insights highlight the importance for Daybreak Cannabis to strategize effectively to maintain and improve its market position amidst strong competition.

Notable Products

In February 2026, the top-performing product for Daybreak Cannabis was Detroit Cookie Pre-Roll 1g, which climbed to the number one spot with sales of 3676 units. Garlic Fusion Popcorn Bulk emerged as the second top product, marking its debut in the rankings. Garlic Fusion Pre-Roll 2-Pack 1g secured the third position, also making its first appearance in the top ranks. Hawaiian Fanta Popcorn Bulk and Red Runtz Popcorn Bulk followed in fourth and fifth places respectively, both also new to the rankings. Notably, Detroit Cookie Pre-Roll 1g improved significantly from its previous position in November 2025, where it was ranked third.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.