Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

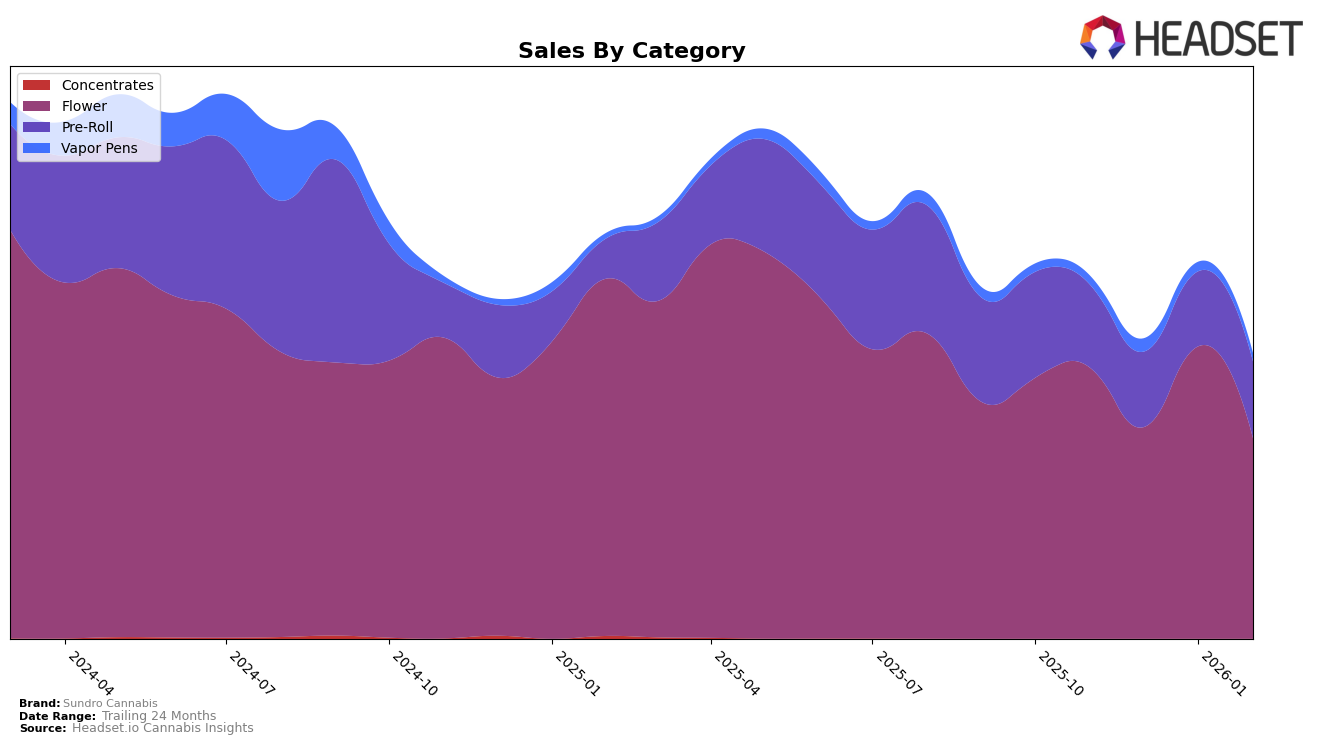

Sundro Cannabis has shown varied performance across different product categories in Missouri. In the Flower category, the brand experienced fluctuations in its rankings, starting at 26th in November 2025, dropping out of the top 30 in December, and then recovering to 28th in January 2026 before slipping again to 33rd in February. This inconsistent performance suggests challenges in maintaining a strong presence in a competitive market. On the other hand, the Pre-Roll category saw a steadier performance, with Sundro Cannabis managing to stay within the top 30, peaking at 26th in November and ending at 29th in February. This indicates a relatively stable demand for their Pre-Roll products compared to their Flower offerings.

In the Vapor Pens category, Sundro Cannabis did not manage to break into the top 30 rankings in any of the months from November 2025 to February 2026, with its highest position being 78th in December. This suggests a significant gap in performance compared to their other categories and highlights an area for potential improvement. The sales data reflects a similar trend, with Vapor Pens contributing less to the overall sales figures, indicating a need for strategic adjustments to enhance market penetration in this category. The varying performance across categories in Missouri points to the importance of targeted strategies to bolster Sundro Cannabis’s standing in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Sundro Cannabis has experienced notable fluctuations in its ranking and sales performance. From November 2025 to February 2026, Sundro Cannabis saw its rank shift from 26th to 33rd, indicating a competitive pressure from other brands. Notably, Scout & Seed demonstrated a significant upward trajectory, moving from 44th to 30th, with sales increasing substantially, which could have contributed to Sundro's declining rank. Meanwhile, Buoyant Bob maintained a relatively stable position, only slightly dropping from 29th to 35th, while The Standard showed resilience, ending February 2026 with an improved rank of 32nd. Despite these challenges, Sundro Cannabis achieved a peak in sales in January 2026, suggesting potential for recovery and growth amidst the competitive dynamics.

Notable Products

In February 2026, Bitter Sweet (3.5g) emerged as the top-performing product from Sundro Cannabis, securing the number one rank with sales of 1309 units. Puppy Breath (3.5g) maintained its strong position at rank 2, consistent with its performance in January 2026. Dirty Banana (3.5g) rose to rank 3, showing a slight improvement from its fourth position in January. Wow Si Wow (3.5g) held steady at rank 4, mirroring its previous month's performance. Animal Iccee (3.5g) made its debut in the rankings at position 5, indicating a new entry among the top sellers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.